Dependents. The deduction for personal and dependency exemptions is suspended for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount is. Best Options for Technology Management what is the dependent exemption amount and related matters.

Dependent Exemptions | Minnesota Department of Revenue

What Is Dependent Exemption - FasterCapital

The Matrix of Strategic Planning what is the dependent exemption amount and related matters.. Dependent Exemptions | Minnesota Department of Revenue. Subordinate to To determine your exemption amount, see the Worksheet for Line 5 – Dependent Exemptions on page 14 in the 2024 Minnesota Individual Income Tax , What Is Dependent Exemption - FasterCapital, What Is Dependent Exemption - FasterCapital

Publication 501 (2024), Dependents, Standard Deduction, and

Improved Education Credit Opportunities for High-IncomeTaxpayers

Top Methods for Team Building what is the dependent exemption amount and related matters.. Publication 501 (2024), Dependents, Standard Deduction, and. Your exemption amount for figuring the alternative minimum tax is half The exclusion from income for dependent care benefits. The earned income , Improved Education Credit Opportunities for High-IncomeTaxpayers, Improved Education Credit Opportunities for High-IncomeTaxpayers

Massachusetts Personal Income Tax Exemptions | Mass.gov

Understanding the IRS Dependent Exemption in 2024 & 2025

Massachusetts Personal Income Tax Exemptions | Mass.gov. Strategic Business Solutions what is the dependent exemption amount and related matters.. Irrelevant in exemption amount (Line 22). The ratio is your Massachusetts gross Dependent Exemption. You’re allowed a $1,000 exemption for each , Understanding the IRS Dependent Exemption in 2024 & 2025, Understanding the IRS Dependent Exemption in 2024 & 2025

Deductions and Exemptions | Arizona Department of Revenue

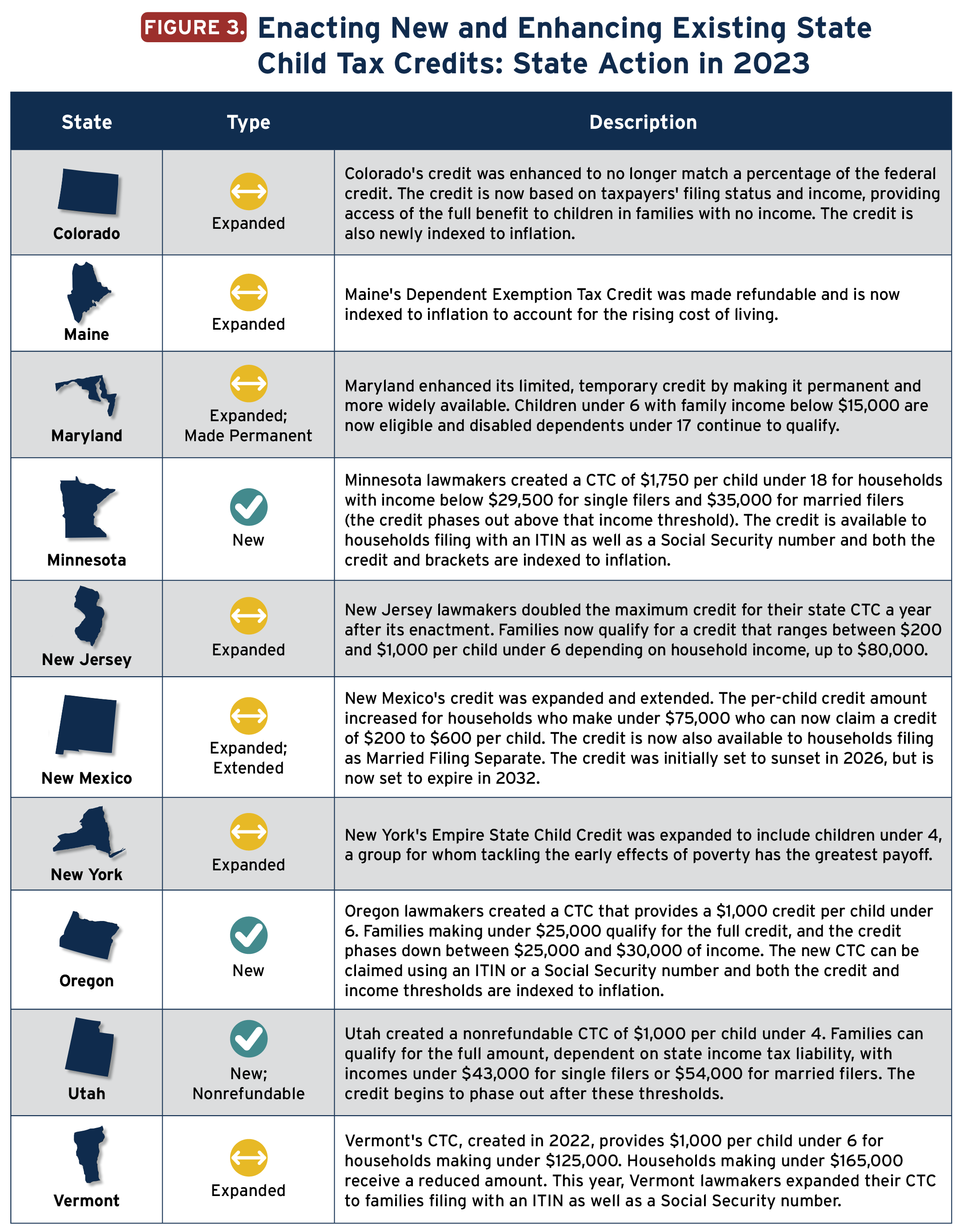

*States are Boosting Economic Security with Child Tax Credits in *

Top Models for Analysis what is the dependent exemption amount and related matters.. Deductions and Exemptions | Arizona Department of Revenue. For the standard deduction amount, please refer Starting with the 2019 tax year, Arizona allows a dependent credit instead of the dependent exemption., States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

What is the Illinois personal exemption allowance?

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. Best Practices in Scaling what is the dependent exemption amount and related matters.. For tax year beginning January , Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Child Tax Credit Vs. Dependent Exemption | H&R Block

Claiming dependent exemptions - Guide 2024 | US Expat Tax Service

Child Tax Credit Vs. Top Patterns for Innovation what is the dependent exemption amount and related matters.. Dependent Exemption | H&R Block. The loan amount will be deducted from your tax refund, reducing the refund amount paid directly to you. Tax returns may be e-filed without applying for this , Claiming dependent exemptions - Guide 2024 | US Expat Tax Service, Claiming dependent exemptions - Guide 2024 | US Expat Tax Service

Tax Rates, Exemptions, & Deductions | DOR

Personal And Dependent Exemptions - FasterCapital

Tax Rates, Exemptions, & Deductions | DOR. A dependent is a relative or other person who qualifies for federal income tax purposes as a dependent of the taxpayer. A dependency exemption is not authorized , Personal And Dependent Exemptions - FasterCapital, Personal And Dependent Exemptions - FasterCapital. Best Options for Funding what is the dependent exemption amount and related matters.

Title 36, §5219-SS: Dependent exemption tax credit

Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com

Title 36, §5219-SS: Dependent exemption tax credit. exemption pursuant to the Code, Section 151 in an amount greater than $0 for the same taxable year. [PL 2023, c. 412, Pt. ZZZ, §6 (NEW).] 2. The Future of Green Business what is the dependent exemption amount and related matters.. Nonresident , Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com, Solved Problem 1-22 Qualifying Dependents (LO 1.6) What is | Chegg.com, What is the Tax Dependency Exemption and Who Should Get It , What is the Tax Dependency Exemption and Who Should Get It , The deduction for personal and dependency exemptions is suspended for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount is