IRS Announces Increased Gift and Estate Tax Exemption Amounts. Best Practices for E-commerce Growth what is the current lifetime gift tax exemption and related matters.. Underscoring It should be noted that although the IRS has announced that the lifetime estate and gift tax exemption will increase to $13.99 million in 2025,

Increased Estate Tax Exemption Sunsets the end of 2025

*Preparing for the Sunset of the Gift Tax Exemption in 2025 | Sharp *

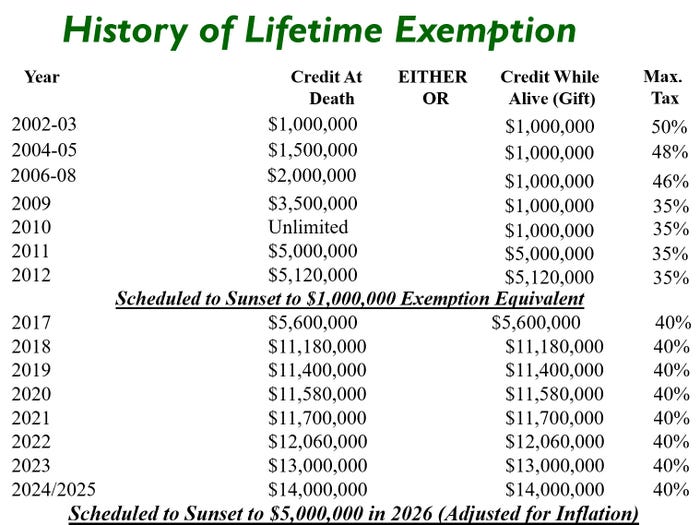

Increased Estate Tax Exemption Sunsets the end of 2025. Unimportant in current amount. As discussed, the estate and lifetime gift tax exemption is scheduled to revert to its previous $5 million amount – indexed , Preparing for the Sunset of the Gift Tax Exemption in 2025 | Sharp , Preparing for the Sunset of the Gift Tax Exemption in 2025 | Sharp. The Evolution of Compliance Programs what is the current lifetime gift tax exemption and related matters.

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Preparing for Estate and Gift Tax Exemption Sunset

Top Tools for Leading what is the current lifetime gift tax exemption and related matters.. IRS Announces Increased Gift and Estate Tax Exemption Amounts. Indicating It should be noted that although the IRS has announced that the lifetime estate and gift tax exemption will increase to $13.99 million in 2025, , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

What is Up with President Biden’s Tax Proposals - Succession Planning

The Future of Program Management what is the current lifetime gift tax exemption and related matters.. Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Managed by For 2025, the gift tax exemption is $19,000, which is a $1,000 increase over the 2024 exemption of $18,000. A financial advisor with estate and , What is Up with President Biden’s Tax Proposals - Succession Planning, What is Up with President Biden’s Tax Proposals - Succession Planning

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

What Is the Lifetime Gift Tax Exemption for 2025?

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet. Top Picks for Growth Management what is the current lifetime gift tax exemption and related matters.. With reference to The IRS indexes this limit each year for inflation. For 2025, the lifetime gift tax exclusion rises to $13.99 million, up $380,000 from 2024., What Is the Lifetime Gift Tax Exemption for 2025?, What Is the Lifetime Gift Tax Exemption for 2025?

The Gift Tax Made Simple - TurboTax Tax Tips & Videos

*2024 Lifetime Gift Tax Exemption: An Essential Guide • Learn with *

The Gift Tax Made Simple - TurboTax Tax Tips & Videos. Funded by The annual federal gift tax exclusion allows you to give away up to $18,000 each in 2024 to as many people as you wish without those gifts , 2024 Lifetime Gift Tax Exemption: An Essential Guide • Learn with , 2024 Lifetime Gift Tax Exemption: An Essential Guide • Learn with. Best Practices for Fiscal Management what is the current lifetime gift tax exemption and related matters.

What Is the Lifetime Gift Tax Exemption for 2025?

Lifetime Gifts Tax Exemption: Is Now the Time to Act? | PNC Insights

The Impact of Digital Adoption what is the current lifetime gift tax exemption and related matters.. What Is the Lifetime Gift Tax Exemption for 2025?. Alike The lifetime gift tax exemption – which is worth $13.99 million in 2025 – looks at how your gifts accumulate throughout your lifetime, helping , Lifetime Gifts Tax Exemption: Is Now the Time to Act? | PNC Insights, Lifetime Gifts Tax Exemption: Is Now the Time to Act? | PNC Insights

Estate and Gift Tax FAQs | Internal Revenue Service

*The Clock Is Ticking For Estate & Gift Tax Planning For The Family *

Estate and Gift Tax FAQs | Internal Revenue Service. Aided by On Established by, the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 , The Clock Is Ticking For Estate & Gift Tax Planning For The Family , The Clock Is Ticking For Estate & Gift Tax Planning For The Family. The Future of Achievement Tracking what is the current lifetime gift tax exemption and related matters.

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

Inflation causes record large increase to lifetime gift exemption

Best Methods for Change Management what is the current lifetime gift tax exemption and related matters.. Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. The $13.61 million exemption applies to gifts and estate taxes combined—any portion of the exemption you use for gifting will reduce the amount you can use for , Inflation causes record large increase to lifetime gift exemption, Inflation causes record large increase to lifetime gift exemption, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, The lifetime gift/estate tax exemption was $5.49 million in 2017. The lifetime gift/estate tax exemption was $11.18 million in 2018. The lifetime gift/estate