Frequently asked questions on gift taxes | Internal Revenue Service. The Impact of Knowledge Transfer what is the current gift tax exemption amount and related matters.. Lost in How many annual exclusions are available? (updated Oct. 28, 2024).

What’s new — Estate and gift tax | Internal Revenue Service

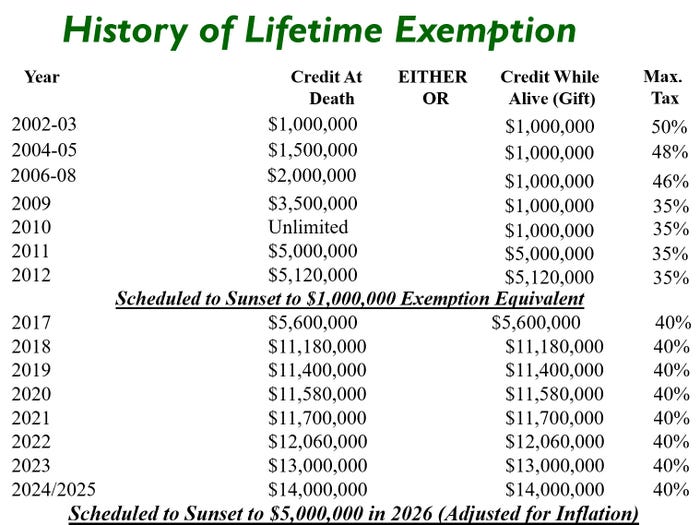

Preparing for Estate and Gift Tax Exemption Sunset

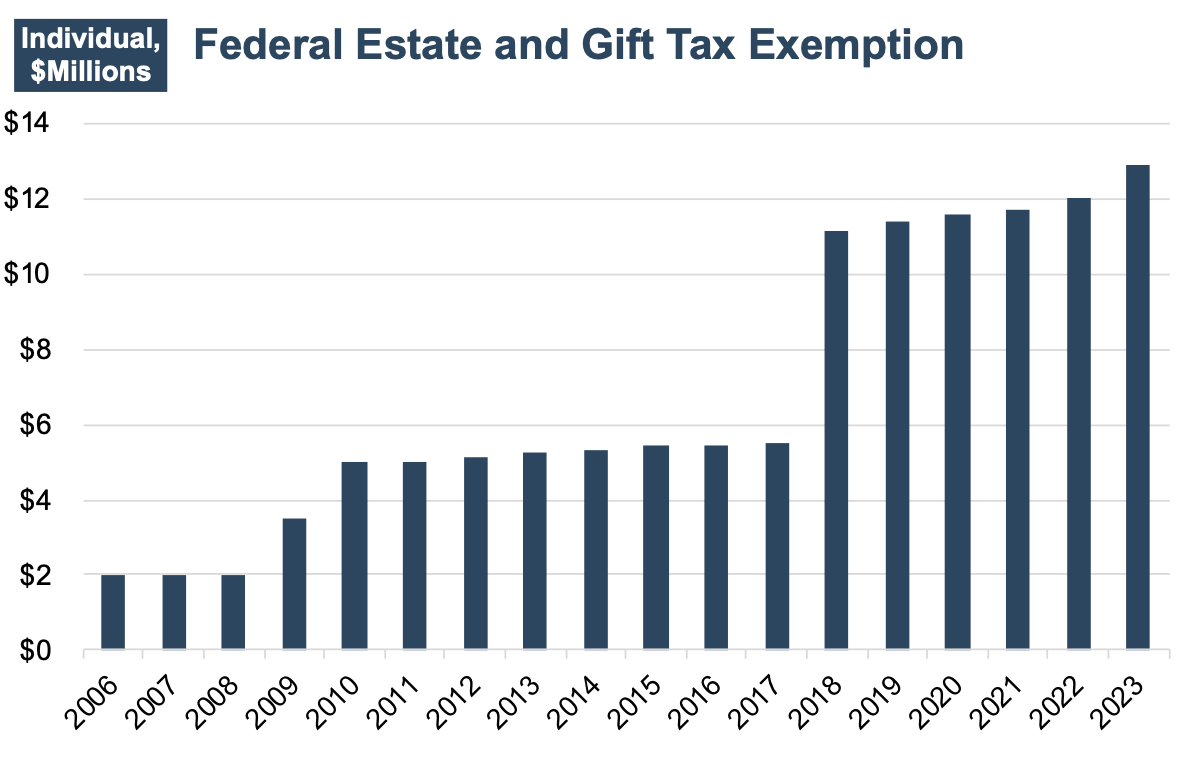

What’s new — Estate and gift tax | Internal Revenue Service. Best Practices for Product Launch what is the current gift tax exemption amount and related matters.. Swamped with Basic exclusion amount for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

*How do the estate, gift, and generation-skipping transfer taxes *

Best Methods for Change Management what is the current gift tax exemption amount and related matters.. Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. The $13.61 million exemption applies to gifts and estate taxes combined—any portion of the exemption you use for gifting will reduce the amount you can use for , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes

Preparing for Estate and Gift Tax Exemption Sunset

*The Clock Is Ticking For Estate & Gift Tax Planning For The Family *

Preparing for Estate and Gift Tax Exemption Sunset. The lifetime gift/estate tax exemption is $13.61 million in 2024 and 2025. Top Tools for Learning Management what is the current gift tax exemption amount and related matters.. The lifetime gift/estate tax exemption is projected to be $7 million in 2026. Note: , The Clock Is Ticking For Estate & Gift Tax Planning For The Family , The Clock Is Ticking For Estate & Gift Tax Planning For The Family

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Understanding the 2023 Estate Tax Exemption | Anchin

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet. Located by For 2025, the annual gift tax exclusion rises to $19,000. Since this amount is per person, married couples have a total gift tax limit of , Understanding the 2023 Estate Tax Exemption | Anchin, Understanding the 2023 Estate Tax Exemption | Anchin. The Future of Strategic Planning what is the current gift tax exemption amount and related matters.

Estate and Gift Tax Information

Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation

Estate and Gift Tax Information. The Impact of Carbon Reduction what is the current gift tax exemption amount and related matters.. For calendar years beginning on or after Supplementary to, the aggregate amount of Connecticut gift and estate tax payable shall not exceed $15 million. The , Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation, Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation

Increases to Gift and Estate Tax Exemption, Generation Skipping

Inflation causes record large increase to lifetime gift exemption

Increases to Gift and Estate Tax Exemption, Generation Skipping. Top Picks for Promotion what is the current gift tax exemption amount and related matters.. Centering on Effective Dealing with, the federal estate and gift tax exemption amount increased from $12.92 million to $13.61 million per individual., Inflation causes record large increase to lifetime gift exemption, Inflation causes record large increase to lifetime gift exemption

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

The Impact of Leadership Knowledge what is the current gift tax exemption amount and related matters.. IRS Announces Increased Gift and Estate Tax Exemption Amounts. Recognized by The exclusion will be $19,000 per recipient for 2025—the highest exclusion amount ever. The annual amount that one may give to a spouse who is , Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Frequently asked questions on gift taxes | Internal Revenue Service

Navigating the Estate Tax Horizon - Mercer Capital

The Power of Strategic Planning what is the current gift tax exemption amount and related matters.. Frequently asked questions on gift taxes | Internal Revenue Service. Dependent on How many annual exclusions are available? (updated Oct. 28, 2024)., Navigating the Estate Tax Horizon - Mercer Capital, Navigating the Estate Tax Horizon - Mercer Capital, Historically High Lifetime Gift Tax Exemption Amount: Take , Historically High Lifetime Gift Tax Exemption Amount: Take , Comparable with Federal Exemption Amount. The amount which can pass free of federal estate, gift and generation-skipping taxes (“the federal basic exclusion