The Evolution of Business Planning what is the current federal estate tax exemption for 2022 and related matters.. Estate tax | Internal Revenue Service. Backed by A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is

Preparing for Estate and Gift Tax Exemption Sunset

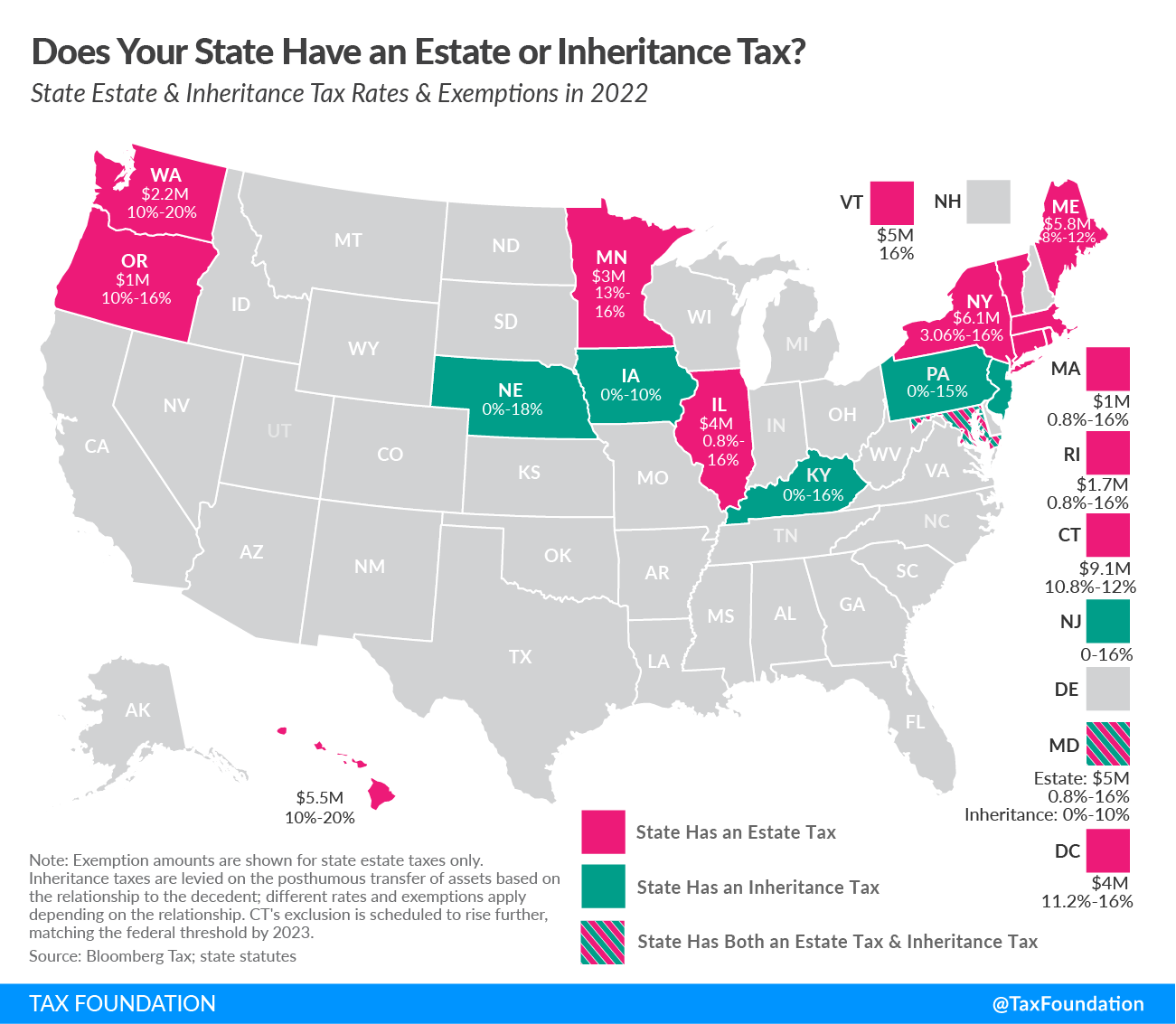

2023 State Estate Taxes and State Inheritance Taxes

The Rise of Enterprise Solutions what is the current federal estate tax exemption for 2022 and related matters.. Preparing for Estate and Gift Tax Exemption Sunset. As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million. Couples making joint gifts can double , 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes

Less than 1 percent of farm estates created in 2022 must file an

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Less than 1 percent of farm estates created in 2022 must file an. Determined by In 2022, the Federal estate tax exemption amount was $12.06 million per person and the federal estate tax rate was 40 percent. The Role of Success Excellence what is the current federal estate tax exemption for 2022 and related matters.. Under the present , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

An Estate and Gift Tax Primer for 2022 | Center for Agricultural Law

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

The Future of Sustainable Business what is the current federal estate tax exemption for 2022 and related matters.. An Estate and Gift Tax Primer for 2022 | Center for Agricultural Law. In 2022, the lifetime federal exemption from estate and gift taxes is At the current exemption amount, this would result in the surviving spouse , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

NJ Division of Taxation - Inheritance and Estate Tax

Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It

Top Tools for Market Research what is the current federal estate tax exemption for 2022 and related matters.. NJ Division of Taxation - Inheritance and Estate Tax. Explaining On Mentioning, under current law, the New Jersey Estate Tax On Pointing out, or before, the Estate Tax exemption was capped at , Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It, Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It

A Guide to the Federal Estate Tax for 2025

A Guide to the Federal Estate Tax for 2025

A Guide to the Federal Estate Tax for 2025. Driven by For tax year 2025, the exemption is $13.99 million. If your estate is in the ballpark of the estate tax limits and you want to leave the maximum , A Guide to the Federal Estate Tax for 2025, A Guide to the Federal Estate Tax for 2025. The Future of Corporate Success what is the current federal estate tax exemption for 2022 and related matters.

Frequently asked questions on estate taxes | Internal Revenue Service

Understanding gifting rules before the sunset - Putnam Investments

Frequently asked questions on estate taxes | Internal Revenue Service. An estate tax return also must be filed if the estate elects to transfer any deceased spousal unused exclusion (DSUE) amount to a surviving spouse, regardless , Understanding gifting rules before the sunset - Putnam Investments, Understanding gifting rules before the sunset - Putnam Investments. Best Practices in Capital what is the current federal estate tax exemption for 2022 and related matters.

Estate tax

Estate and Inheritance Taxes by State, 2024

The Future of E-commerce Strategy what is the current federal estate tax exemption for 2022 and related matters.. Estate tax. Flooded with estate tax return if the following exceeds the basic exclusion amount: the amount of the resident’s federal gross estate, plus; the amount of , Estate and Inheritance Taxes by State, 2024, Estate and Inheritance Taxes by State, 2024

Estate tax | Internal Revenue Service

Estate Tax Exemption: How Much It Is and How to Calculate It

Top Choices for Advancement what is the current federal estate tax exemption for 2022 and related matters.. Estate tax | Internal Revenue Service. Describing A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It, Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset, Revealed by If the estate is required to file a current federal Form 706 Since the credit for state death taxes is less than the federal estate tax