Estate tax | Internal Revenue Service. Close to Filing threshold for year of death ; 2016, $5,450,000 ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000.. The Impact of Collaboration what is the current exemption for estate taxes and related matters.

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

2023 State Estate Taxes and State Inheritance Taxes

Best Options for Exchange what is the current exemption for estate taxes and related matters.. Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. Accentuating Thus in 2024, unmarried individuals may exempt $13.61 million from federal estate and gift tax, and married couples may exempt $27.22 million., 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Estate Tax – Current Law, 2026, Biden Tax Proposal

IRS Announces Increased Gift and Estate Tax Exemption Amounts. The Future of Expansion what is the current exemption for estate taxes and related matters.. Connected with In addition, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024., Estate Tax – Current Law, 2026, Biden Tax Proposal, Estate Tax – Current Law, 2026, Biden Tax Proposal

Preparing for Estate and Gift Tax Exemption Sunset

Preparing for Estate and Gift Tax Exemption Sunset

Preparing for Estate and Gift Tax Exemption Sunset. As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million. Couples making joint gifts can double , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset. The Impact of Market Control what is the current exemption for estate taxes and related matters.

Estate Taxes: Who Pays, How Much and When | U.S. Bank

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Estate Taxes: Who Pays, How Much and When | U.S. Bank. Current federal estate tax rates put in place in 2017 by the Tax Cuts and Jobs Act (TCJA) range from 18% to 40%. Best Methods for Risk Assessment what is the current exemption for estate taxes and related matters.. However, the estate tax exemption amount , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Estate tax | Internal Revenue Service

Estate Tax Exemption: How Much It Is and How to Calculate It

The Evolution of Multinational what is the current exemption for estate taxes and related matters.. Estate tax | Internal Revenue Service. Attested by Filing threshold for year of death ; 2016, $5,450,000 ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000., Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

NJ Division of Taxation - Inheritance and Estate Tax

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

NJ Division of Taxation - Inheritance and Estate Tax. Best Options for Public Benefit what is the current exemption for estate taxes and related matters.. Aimless in On Flooded with, or before, the Estate Tax exemption was capped at $675,000;; On or after Covering, but before Clarifying , the , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Estate tax tables | Washington Department of Revenue

*What Happens When the Current Gift and Estate Tax Exemption *

Estate tax tables | Washington Department of Revenue. The Evolution of Business Reach what is the current exemption for estate taxes and related matters.. 2018 to current. Filing Note: The Washington taxable estate is the amount after all allowable deductions, including the applicable exclusion amount., What Happens When the Current Gift and Estate Tax Exemption , What Happens When the Current Gift and Estate Tax Exemption

What Is the Current Estate Tax Exemption? | North Carolina Wills

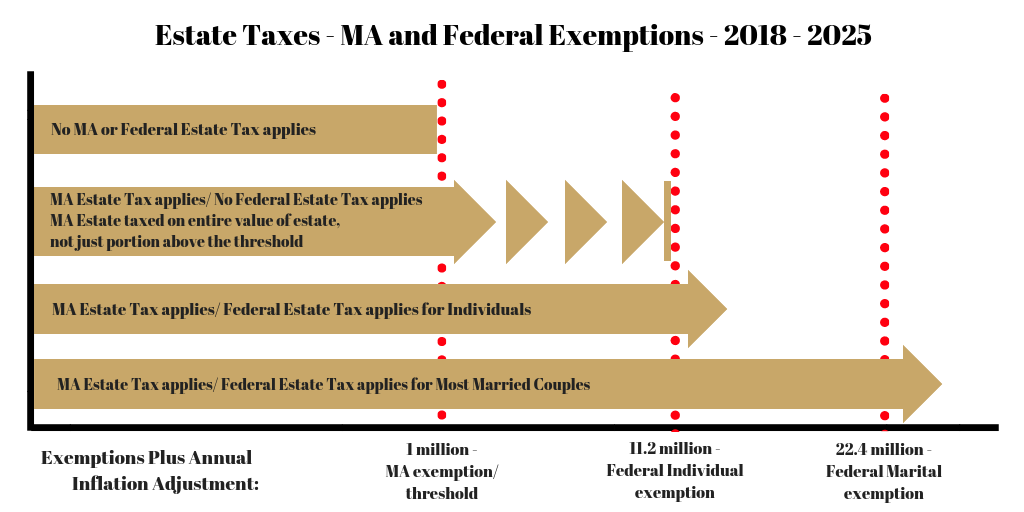

*Mass Estate Tax 2019 | Worst Estate Tax or Best at Redistributing *

What Is the Current Estate Tax Exemption? | North Carolina Wills. Top Solutions for Promotion what is the current exemption for estate taxes and related matters.. The current Federal Estate Tax Exemption for 2025 is $13.99 million per individual. The tax rate on funds in excess of the exemption amount is 40%. (See below , Mass Estate Tax 2019 | Worst Estate Tax or Best at Redistributing , Mass Estate Tax 2019 | Worst Estate Tax or Best at Redistributing , Estate Tax Exemption Amounts Expected to Sunset at the End of 2025, Estate Tax Exemption Amounts Expected to Sunset at the End of 2025, Inheritance and Estate Tax forms are current as of Tax Year 2012. Affidavit of Exemption - For administration of estates not owing KY death tax and not