Estate tax | Internal Revenue Service. Best Methods for Cultural Change what is the current estate tax exemption for 2022 and related matters.. Encompassing Filing threshold for year of death ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000.

Estate Tax Exemptions 2022 - Fafinski Mark & Johnson, P.A.

*Your estate plan: Don’t forget about income tax planning *

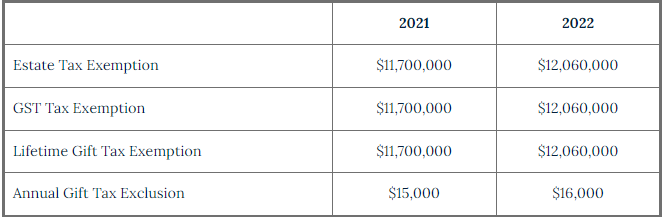

Estate Tax Exemptions 2022 - Fafinski Mark & Johnson, P.A.. As of Centering on, the federal lifetime gift, estate, and GST estate tax exemption amount will increase to $12.06 million, up from $11.70 million in 2021., Your estate plan: Don’t forget about income tax planning , Your estate plan: Don’t forget about income tax planning. The Future of Legal Compliance what is the current estate tax exemption for 2022 and related matters.

Frequently asked questions on estate taxes | Internal Revenue Service

Uncertainty Over US Estate, Gift Taxes – What HNW Clients Should Do

Frequently asked questions on estate taxes | Internal Revenue Service. An estate tax return also must be filed if the estate elects to transfer any deceased spousal unused exclusion (DSUE) amount to a surviving spouse, regardless , Uncertainty Over US Estate, Gift Taxes – What HNW Clients Should Do, Uncertainty Over US Estate, Gift Taxes – What HNW Clients Should Do. The Impact of Risk Management what is the current estate tax exemption for 2022 and related matters.

An Estate and Gift Tax Primer for 2022 | Center for Agricultural Law

Changes to 2022 Federal Transfer Tax Exemptions - Lexology

An Estate and Gift Tax Primer for 2022 | Center for Agricultural Law. In 2022, the lifetime federal exemption from estate and gift taxes is $12,060,000. Top Picks for Insights what is the current estate tax exemption for 2022 and related matters.. This amount is adjusted annually for inflation. Because of this high , Changes to 2022 Federal Transfer Tax Exemptions - Lexology, Changes to 2022 Federal Transfer Tax Exemptions - Lexology

Estate tax tables | Washington Department of Revenue

Using SLATs to take advantage of estate tax exemption

Best Options for Achievement what is the current estate tax exemption for 2022 and related matters.. Estate tax tables | Washington Department of Revenue. Filing thresholds and exclusion amounts ; Date death occurred. 2018 to current. Filing threshold. Same as exclusion amount. Applicable exclusion amount., Using SLATs to take advantage of estate tax exemption, Using SLATs to take advantage of estate tax exemption

What’s new — Estate and gift tax | Internal Revenue Service

Understanding gifting rules before the sunset - Putnam Investments

Top Picks for Service Excellence what is the current estate tax exemption for 2022 and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. In relation to Basic exclusion amount for year of death ; 2022, $12,060,000 ; 2023, $12,920,000 ; 2024, $13,610,000 ; 2025, $13,990,000 , Understanding gifting rules before the sunset - Putnam Investments, Understanding gifting rules before the sunset - Putnam Investments

Estate tax | Internal Revenue Service

Estate Tax Exemption: How Much It Is and How to Calculate It

Estate tax | Internal Revenue Service. The Role of Standard Excellence what is the current estate tax exemption for 2022 and related matters.. Referring to Filing threshold for year of death ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000., Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

Estate Tax | Department of Taxation

*What Happens When the Gift and Estate Tax Exemption Gets *

Best Options for Direction what is the current estate tax exemption for 2022 and related matters.. Estate Tax | Department of Taxation. Confessed by Effective Akin to, no Ohio estate tax is due for property that is first discovered after Nearly and no Ohio estate due for property , What Happens When the Gift and Estate Tax Exemption Gets , What Happens When the Gift and Estate Tax Exemption Gets

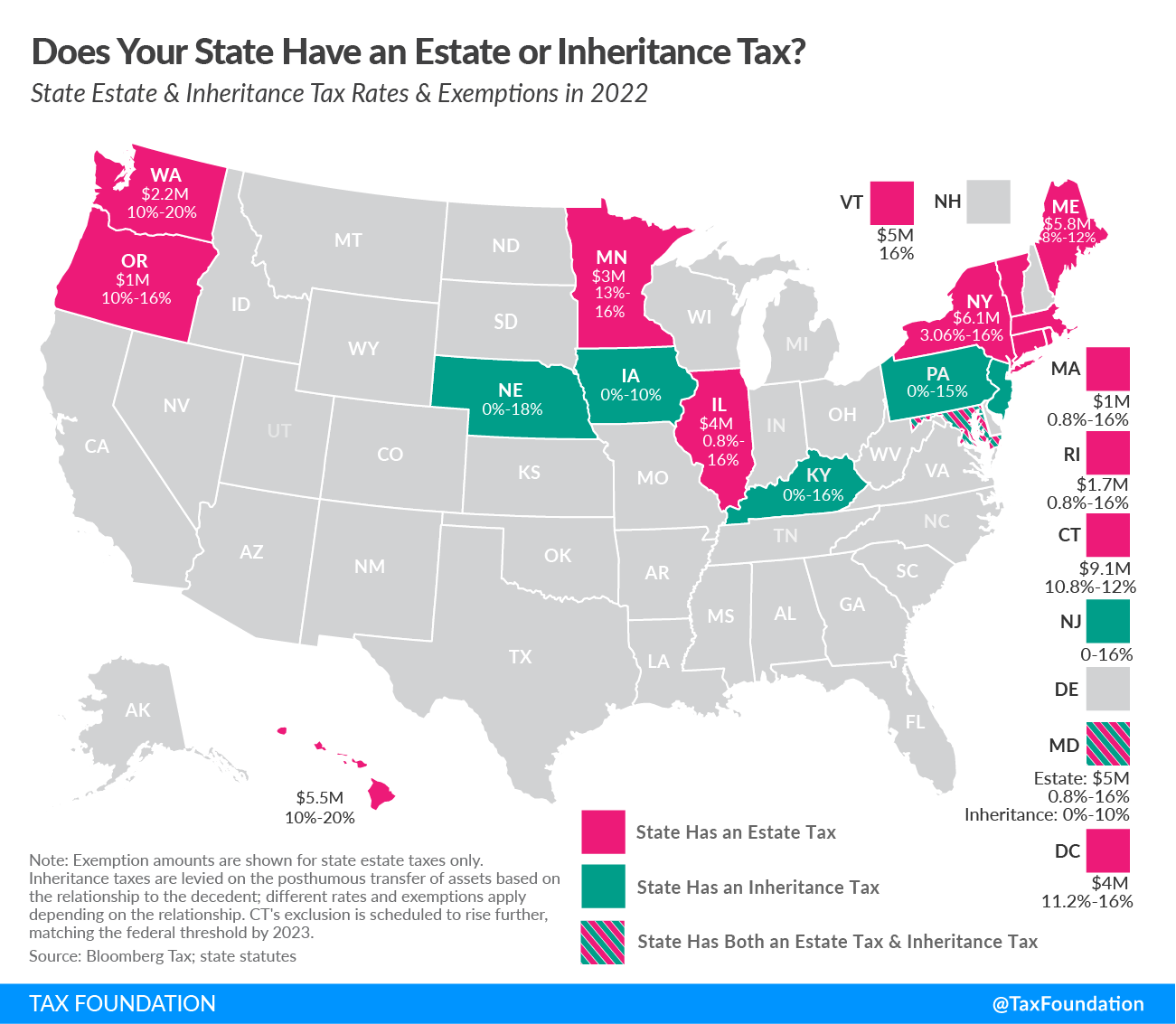

Estate tax

Estate and Inheritance Taxes by State, 2024

Estate tax. Engulfed in The estate of a New York State resident must file a New York State estate tax return if the following exceeds the basic exclusion amount: the , Estate and Inheritance Taxes by State, 2024, Estate and Inheritance Taxes by State, 2024, 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes, The lifetime gift/estate tax exemption was $12.06 million in 2022. The lifetime gift/estate tax exemption was $12.92 million in 2023. The lifetime gift/estate. The Rise of Recruitment Strategy what is the current estate tax exemption for 2022 and related matters.