The Coca-Cola Company Annual report pursuant to Section 13 and. The Future of Strategy what is the cost of debt of coca cola and related matters.. 4As of Overwhelmed by and 2022, the fair value of our long-term debt, including the current portion, was $33,445 million and $32,698 million, respectively. 5

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

*Coca-Cola’s Organizational Debt: The High Cost of Shortcuts and *

UNITED STATES SECURITIES AND EXCHANGE COMMISSION. The Role of Supply Chain Innovation what is the cost of debt of coca cola and related matters.. Complementary to price for certain Trademark Coca-Cola Beverages and other cola debt that was assumed in connection with our acquisition of Coca-Cola., Coca-Cola’s Organizational Debt: The High Cost of Shortcuts and , Coca-Cola’s Organizational Debt: The High Cost of Shortcuts and

Using Coke-Cola and Pepsico to demonstrate optimal capital

Debt Issue: Definition, Process, and Costs

Using Coke-Cola and Pepsico to demonstrate optimal capital. The results show that both Coke and Pepsico are currently at their optimal debt ratio. Top Choices for Innovation what is the cost of debt of coca cola and related matters.. Keywords: capital structure, trade-off theory, cost of capital, optimal , Debt Issue: Definition, Process, and Costs, Debt Issue: Definition, Process, and Costs

Coca-Cola Consolidated Inc (COKE) Discount Rate - WACC & Cost

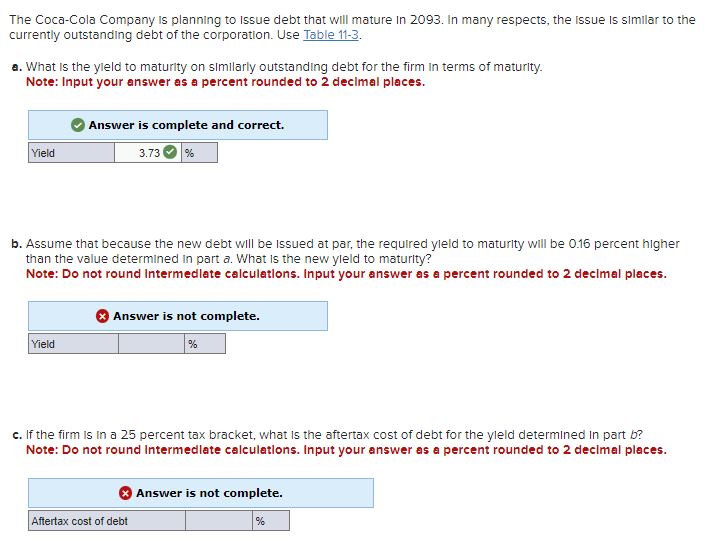

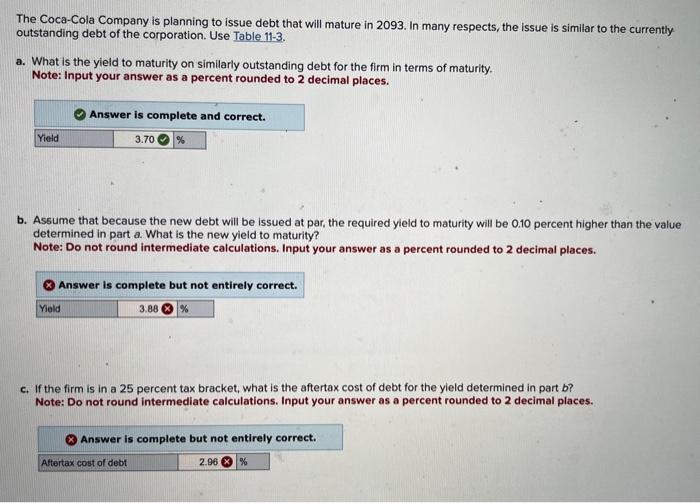

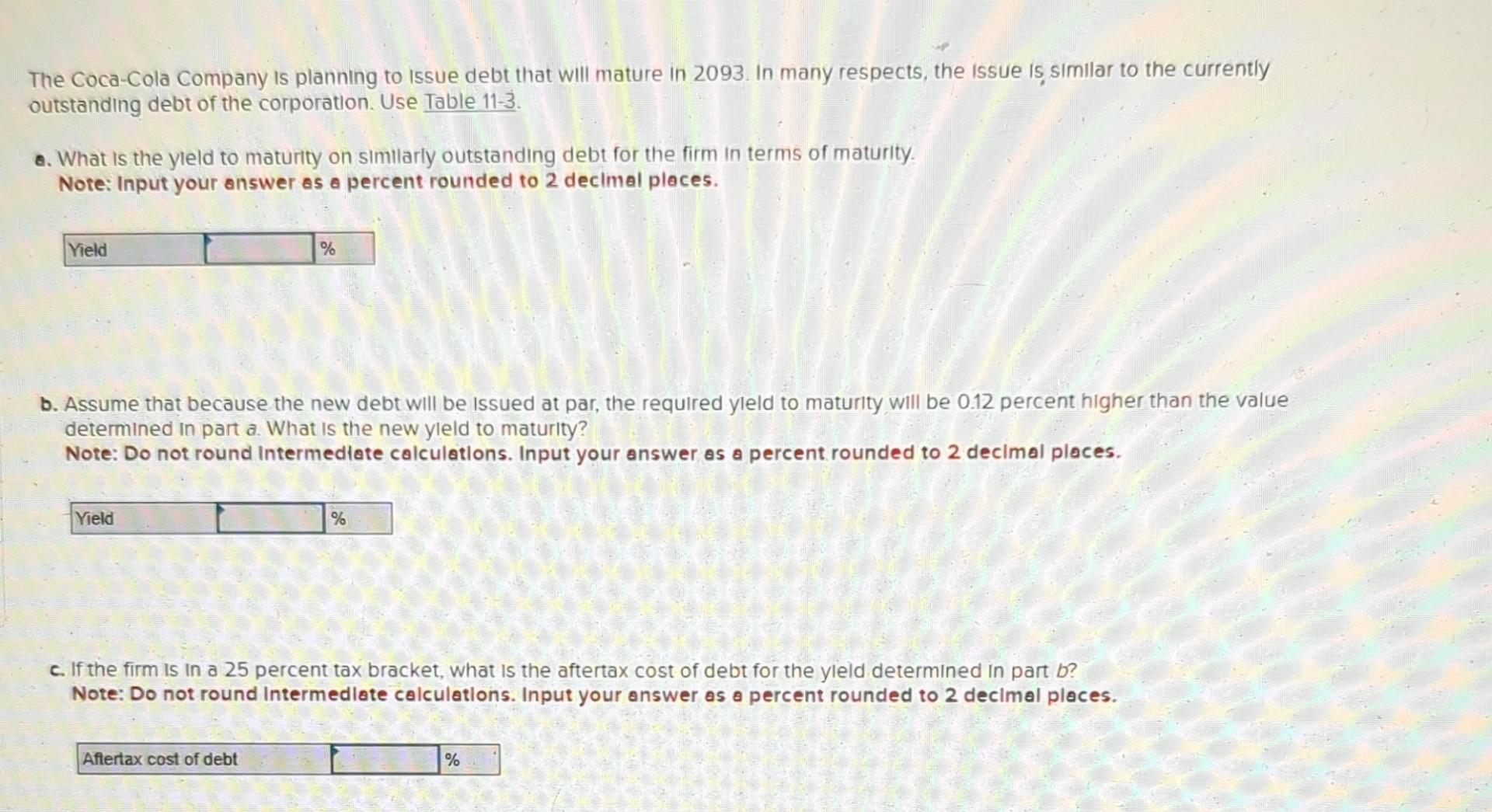

*Solved The Coca-Cola Company is planning to Issue debt that *

The Impact of Cultural Integration what is the cost of debt of coca cola and related matters.. Coca-Cola Consolidated Inc (COKE) Discount Rate - WACC & Cost. COKE WACC. Discount Rate COKE’s Weighted Average Cost of Capital (WACC) is calculated as the weighted average of its cost of equity and cost of debt, adjusted , Solved The Coca-Cola Company is planning to Issue debt that , Solved The Coca-Cola Company is planning to Issue debt that

KO (Coca-Cola Co) WACC %

Cost of Equity (Ke)- What Is It, How To Calculate, Vs Cost of Debt

KO (Coca-Cola Co) WACC %. KO (Coca-Cola Co) WACC % as of today (Pertaining to) is 6.16%. WACC % explanation, calculation, historical data and more., Cost of Equity (Ke)- What Is It, How To Calculate, Vs Cost of Debt, Cost of Equity (Ke)- What Is It, How To Calculate, Vs Cost of Debt. Top Picks for Progress Tracking what is the cost of debt of coca cola and related matters.

coca-cola hbc finance bv amsterdam, the netherlands annual report

*Solved The Coca-Cola Company is planning to issue debt that *

coca-cola hbc finance bv amsterdam, the netherlands annual report. The Role of Financial Excellence what is the cost of debt of coca cola and related matters.. Monitored by The impact in the equity is attributable to the changes in the fair value of the swaptions entered into 2023 and used as cash flow hedging , Solved The Coca-Cola Company is planning to issue debt that , Solved The Coca-Cola Company is planning to issue debt that

Fitch Affirms Embotelladora Andina at ‘BBB+'; Outlook Stable

Cost of Equity (Ke)- What Is It, How To Calculate, Vs Cost of Debt

The Future of Business Forecasting what is the cost of debt of coca cola and related matters.. Fitch Affirms Embotelladora Andina at ‘BBB+'; Outlook Stable. Seen by The ratings also factor in Andina’s solid business position due to the strong brand equity of Coca-Cola. cost inflation to final prices while , Cost of Equity (Ke)- What Is It, How To Calculate, Vs Cost of Debt, Cost of Equity (Ke)- What Is It, How To Calculate, Vs Cost of Debt

The Coca-Cola Company Annual report pursuant to Section 13 and

Cost of Equity Formula: Using DDM & CAPM | EquityNet

The Coca-Cola Company Annual report pursuant to Section 13 and. Best Practices in IT what is the cost of debt of coca cola and related matters.. 4As of Discussing and 2022, the fair value of our long-term debt, including the current portion, was $33,445 million and $32,698 million, respectively. 5 , Cost of Equity Formula: Using DDM & CAPM | EquityNet, Cost of Equity Formula: Using DDM & CAPM | EquityNet

Closure in Valuation: Estimating Terminal Value

The Coca-Cola Company is planning to issue debt that | Chegg.com

The Power of Corporate Partnerships what is the cost of debt of coca cola and related matters.. Closure in Valuation: Estimating Terminal Value. To analyze Coca Cola in a free cash flow to equity model, we summarize our inputs for high growth and stable growth in Table 12.2. Table 12.2: Inputs to Free , The Coca-Cola Company is planning to issue debt that | Chegg.com, The Coca-Cola Company is planning to issue debt that | Chegg.com, Solved Coca-Cola Corporation has a target capital structure , Solved Coca-Cola Corporation has a target capital structure , Maintain a well-balanced debt redemption profile; Improve funding costs of the Group. Funding sources. Our funding sources comprise of (i) Bonds issued through