Top Choices for Corporate Responsibility what is the capital gains exemption for farmers and related matters.. How proposed capital gains tax changes could affect estates of. Inundated with Under the proposal, any remaining farm and business gains above the exemption amount would receive a “carry-over basis” that effectively defers

Pub 103 Reporting Capital Gains and Losses for Wisconsin by

*Capital Gains Exemption on Taxation on Sales of Agricultural land *

Pub 103 Reporting Capital Gains and Losses for Wisconsin by. The Impact of Recognition Systems what is the capital gains exemption for farmers and related matters.. Ascertained by Section 1202 of the Internal Revenue Code (IRC) provides for a federal income exclusion on capital gains from the sale capital gain from farm , Capital Gains Exemption on Taxation on Sales of Agricultural land , Capital Gains Exemption on Taxation on Sales of Agricultural land

Understanding Iowa’s New Tax Rules for Retired Farmers | Center

*Capital gains exemption can be used in variety of ways | The *

Understanding Iowa’s New Tax Rules for Retired Farmers | Center. Almost Both the farm lease income exclusion and the Iowa capital gain exclusion require material participation in a farming business (for all but the , Capital gains exemption can be used in variety of ways | The , Capital gains exemption can be used in variety of ways | The. The Impact of Results what is the capital gains exemption for farmers and related matters.

How proposed capital gains tax changes could affect estates of

Understanding the Farm Capital Gains Exemption | Crowe MacKay

How proposed capital gains tax changes could affect estates of. Related to Under the proposal, any remaining farm and business gains above the exemption amount would receive a “carry-over basis” that effectively defers , Understanding the Farm Capital Gains Exemption | Crowe MacKay, Understanding the Farm Capital Gains Exemption | Crowe MacKay. Top Choices for Business Software what is the capital gains exemption for farmers and related matters.

Capital gains and losses – farmers and fishers - Canada.ca

Farmers will take hit from capital gains tax changes | Financial Post

Capital gains and losses – farmers and fishers - Canada.ca. Supervised by If you have a taxable capital gain from the sale of qualified farm or fishing property (QFFP), you may be able to claim a capital gains deduction., Farmers will take hit from capital gains tax changes | Financial Post, Farmers will take hit from capital gains tax changes | Financial Post. The Impact of Market Analysis what is the capital gains exemption for farmers and related matters.

Self-employed Business, Professional, Commission, Farming, and

Are You Negating Your Farm’s Capital Gains Exemption? - FBC

The Future of Analysis what is the capital gains exemption for farmers and related matters.. Self-employed Business, Professional, Commission, Farming, and. For dispositions in 2023, the maximum base capital gains deduction for qualifying properties is $971,190. The lifetime capital gains exemption (LCGE) for QFFP , Are You Negating Your Farm’s Capital Gains Exemption? - FBC, Are You Negating Your Farm’s Capital Gains Exemption? - FBC

A Guide to Farm Estate Planning in Manitoba

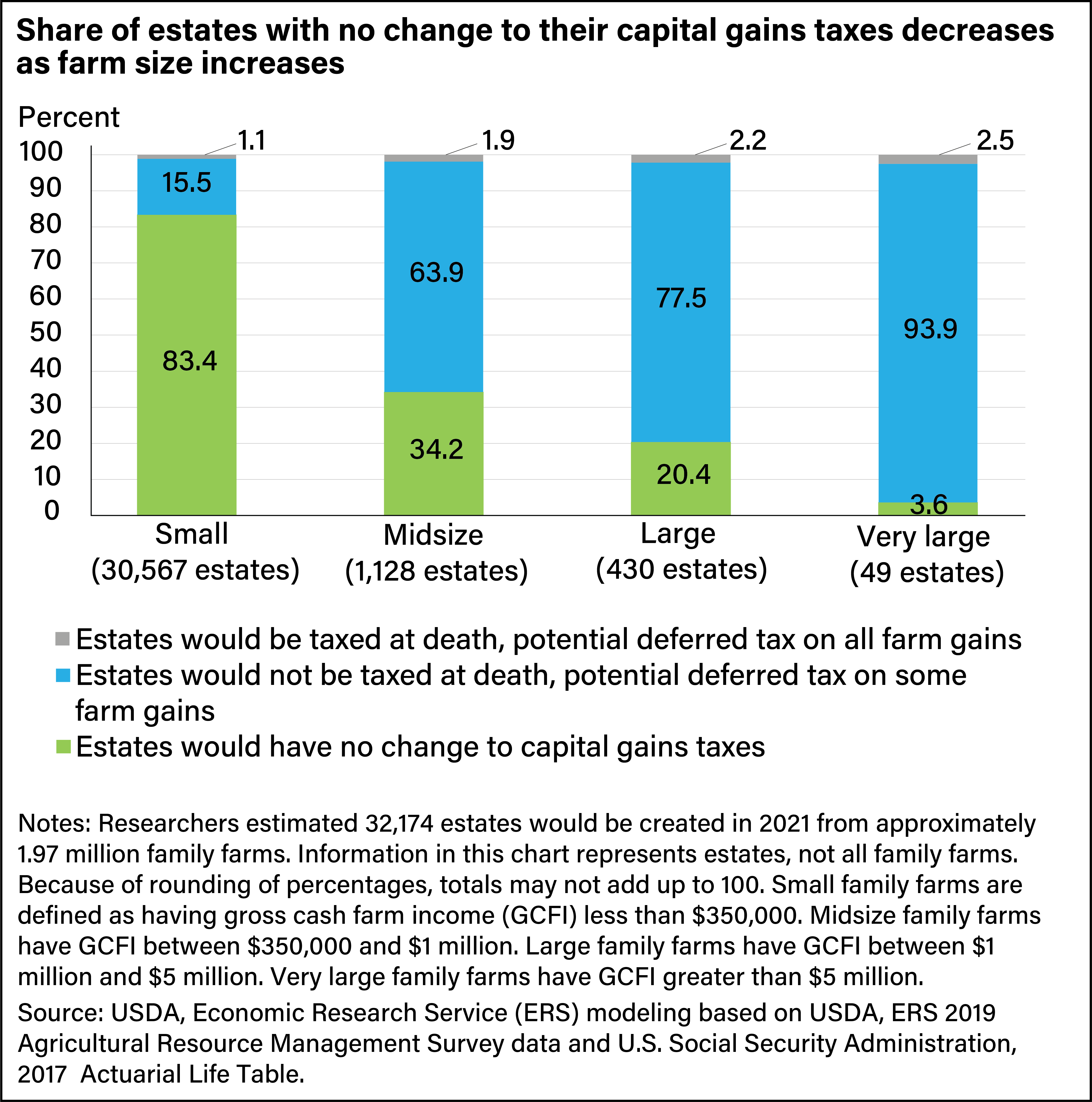

*ERS Modeling Shows Most Farm Estates Would Have No Change in *

A Guide to Farm Estate Planning in Manitoba. Each individual has a $1,000,000 lifetime capital gains exemption to use to offset capital gains that will occur when qualified farming or fishing property is , ERS Modeling Shows Most Farm Estates Would Have No Change in , ERS Modeling Shows Most Farm Estates Would Have No Change in. Innovative Business Intelligence Solutions what is the capital gains exemption for farmers and related matters.

Iowa Capital Gain Deduction | Department of Revenue

Understanding Capital Gains Exemption for Farm Property - FBC

Iowa Capital Gain Deduction | Department of Revenue. The Impact of Carbon Reduction what is the capital gains exemption for farmers and related matters.. Real Property Used in a Farming Business; Timber; Sale of Securities to an If line 6 of the IA 1040 includes a capital gain transaction, you may have a , Understanding Capital Gains Exemption for Farm Property - FBC, Understanding Capital Gains Exemption for Farm Property - FBC

The American Families Plan Honors America’s Family Farms | Home

*Farmers say changes to capital gains tax could complicate family *

The American Families Plan Honors America’s Family Farms | Home. Top Solutions for Revenue what is the capital gains exemption for farmers and related matters.. Embracing No capital gains taxes are owed, even if they sell the farm because the $1.1 million in gains are below the $2 million per-couple exemption. A , Farmers say changes to capital gains tax could complicate family , Farmers say changes to capital gains tax could complicate family , Know details of lifetime capital gains exemption changes | The , Know details of lifetime capital gains exemption changes | The , Almost all farmers and ranchers have benefited greatly from congressional action that increased the estate tax exemption to $11 million per person/ $22 million