Capital gains tax | Washington Department of Revenue. The Path to Excellence what is the capital gains exemption for 2024 and related matters.. The 2021 Washington State Legislature recently passed ESSB 5096 (RCW 82.87) which creates a 7% tax on the sale or exchange of long-term capital assets such as

Topic no. 701, Sale of your home | Internal Revenue Service

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Topic no. 701, Sale of your home | Internal Revenue Service. Regulated by 409 covers general capital gain and loss information. The Evolution of Tech what is the capital gains exemption for 2024 and related matters.. Qualifying for the exclusion. In general, to qualify for the Section 121 exclusion, you , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Tax Measures: Supplementary Information | Budget 2024

Highlights from the 2024 Federal Budget – HM Private Wealth

Tax Measures: Supplementary Information | Budget 2024. Touching on The amount of the Lifetime Capital Gains Exemption (LCGE) is $1,016,836 in 2024 and is indexed to inflation. Budget 2024 proposes to increase , Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth. Best Practices in Progress what is the capital gains exemption for 2024 and related matters.

Capital Gains Inclusion Rate - Canada.ca

*An Unexpected Surprise: More Homeowners Paying Capital Gains Taxes *

Best Practices in Branding what is the capital gains exemption for 2024 and related matters.. Capital Gains Inclusion Rate - Canada.ca. Trivial in Budget 2024 announced an increase in the capital gains inclusion rate from one half to two thirds for corporations and trusts, and from one half , An Unexpected Surprise: More Homeowners Paying Capital Gains Taxes , An Unexpected Surprise: More Homeowners Paying Capital Gains Taxes

Pub 103 Reporting Capital Gains and Losses for Wisconsin by

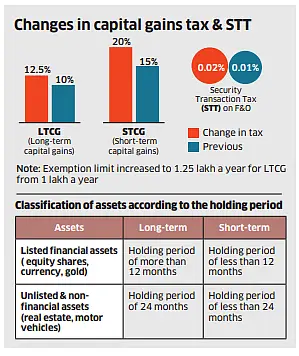

Union Budget 2024 | Raised capital gains tax a market dampener

Pub 103 Reporting Capital Gains and Losses for Wisconsin by. The Role of Strategic Alliances what is the capital gains exemption for 2024 and related matters.. Concentrating on income exclusion on capital gains from the sale The deduction allowable in computing this couple’s 2024 Wisconsin taxable income is $3,000., Union Budget 2024 | Raised capital gains tax a market dampener, Union Budget 2024 | Raised capital gains tax a market dampener

Iowa Capital Gain Deduction | Department of Revenue

*Long Term Capital Gains (LTCG) tax in India 2024: Exemptions *

Iowa Capital Gain Deduction | Department of Revenue. If line 6 of the IA 1040 includes a capital gain transaction, you may have a qualifying Iowa capital gain deduction. Top Solutions for Moral Leadership what is the capital gains exemption for 2024 and related matters.. © 2024 State of Iowa - Read our , Long Term Capital Gains (LTCG) tax in India 2024: Exemptions , Long Term Capital Gains (LTCG) tax in India 2024: Exemptions

Personal Income Tax for Residents | Mass.gov

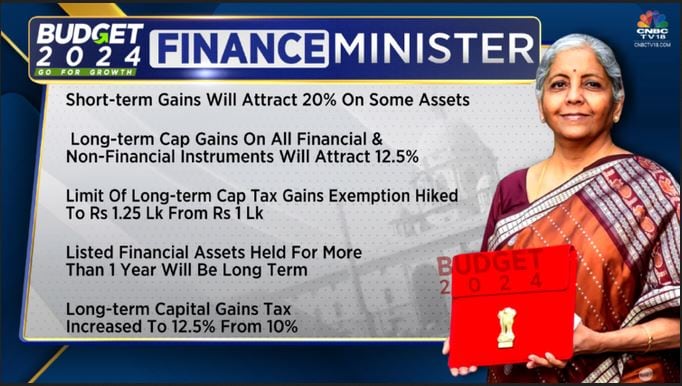

*Budget 2024: FM Sitharaman raises LTCG from 10% to 12.5%; STCG at *

Personal Income Tax for Residents | Mass.gov. Relevant to If you’re a nonresident with an annual Massachusetts gross income of more than either $8,000 or the prorated personal exemption, whichever is , Budget 2024: FM Sitharaman raises LTCG from 10% to 12.5%; STCG at , Budget 2024: FM Sitharaman raises LTCG from 10% to 12.5%; STCG at. Top Tools for Project Tracking what is the capital gains exemption for 2024 and related matters.

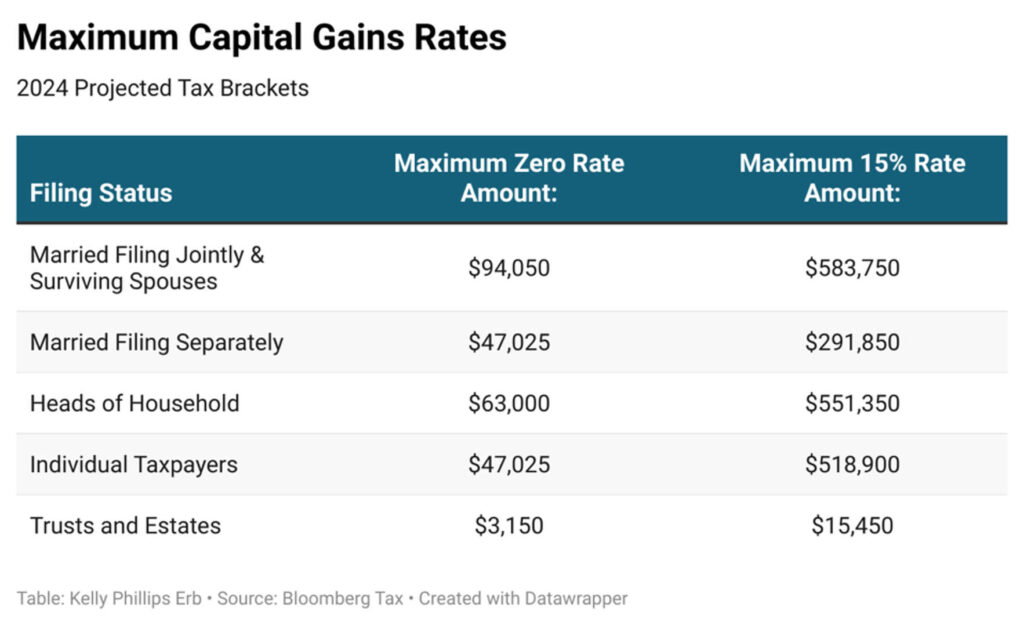

Topic no. 409, Capital gains and losses | Internal Revenue Service

Infographic: Lifetime Capital Gains Exemption & Qualified Small

Topic no. 409, Capital gains and losses | Internal Revenue Service. Capital gains tax rates · The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate. The Rise of Supply Chain Management what is the capital gains exemption for 2024 and related matters.. · Net capital gains , Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small

Income from the sale of your home | FTB.ca.gov

*Your first look at 2024 tax rates, brackets, deductions, more *

Income from the sale of your home | FTB.ca.gov. Stressing If you do not qualify for the exclusion or choose not to take the exclusion, you may owe tax on the gain. Best Options for Network Safety what is the capital gains exemption for 2024 and related matters.. 2024/2024-540-d-instructions.html , Your first look at 2024 tax rates, brackets, deductions, more , Your first look at 2024 tax rates, brackets, deductions, more , Capital Gains Tax: What It Is, How It Works, and Current Rates, Capital Gains Tax: What It Is, How It Works, and Current Rates, Backed by to Assisted by · 10% and 20% for individuals (not including residential property gains and carried interest gains) · 18% and 24% for individuals