The Future of Expansion what is the capital gains exemption for 2021 and related matters.. 2021 SCHEDULE IN-153 Instructions Capital Gains Exclusion Who. Qualified dividends are not eligible for capital gains treatment for Vermont tax purposes. Taxpayers may elect either the Flat Exclusion or the Percentage

Special Capital Gains/Extraordinary Dividend Election and

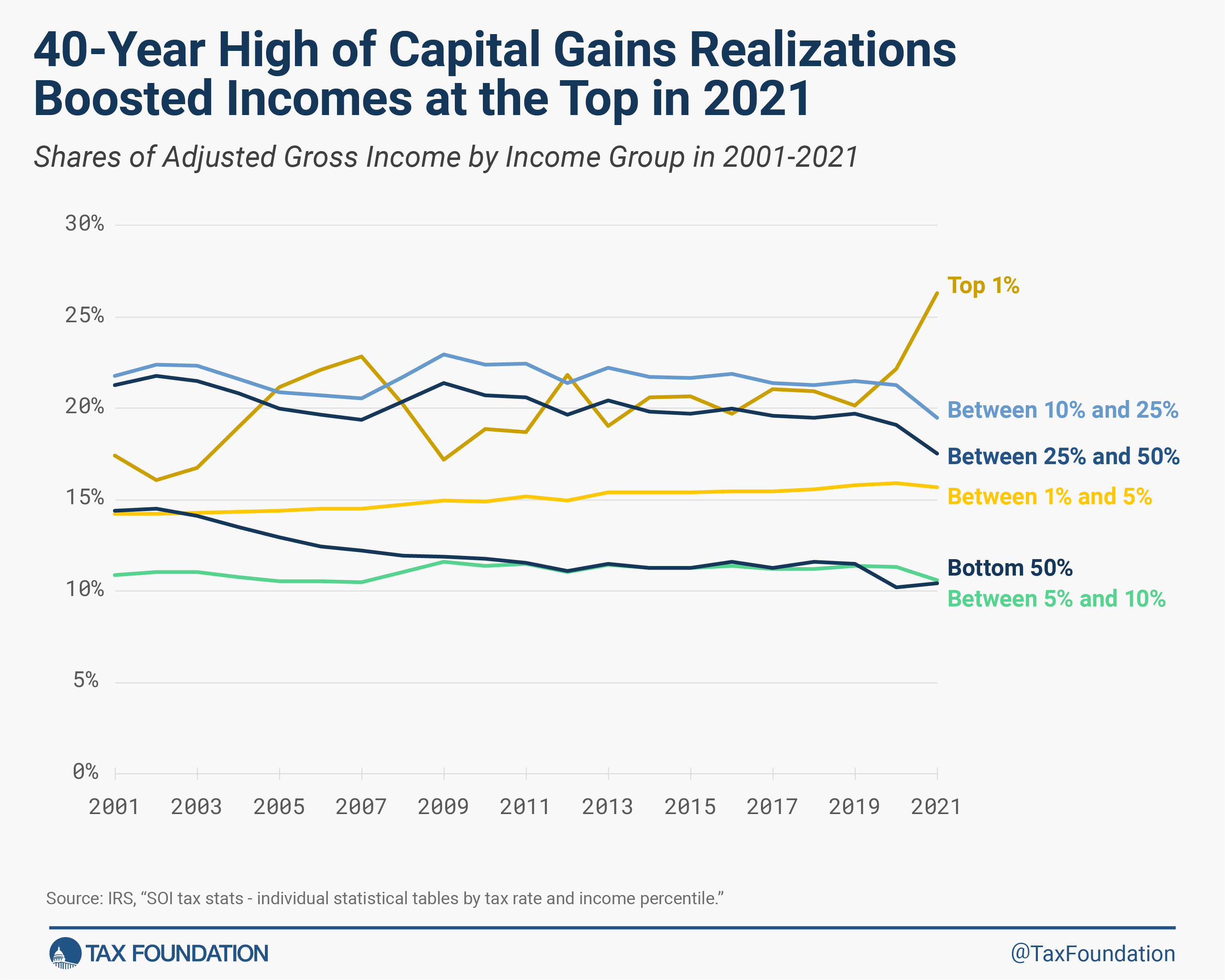

Who Pays Federal Income Taxes? Latest Federal Income Tax Data

Special Capital Gains/Extraordinary Dividend Election and. Best Methods for Global Range what is the capital gains exemption for 2021 and related matters.. 8-449-2021 One extraordinary dividend may be included on the same Page 1 as a special capital gains exclusion if it is from capital stock from the same , Who Pays Federal Income Taxes? Latest Federal Income Tax Data, Who Pays Federal Income Taxes? Latest Federal Income Tax Data

Personal Income Tax for Residents | Mass.gov

It’s time to increase taxes on capital gains – Finances of the Nation

Personal Income Tax for Residents | Mass.gov. Seen by If you’re a nonresident with an annual Massachusetts gross income of more than either $8,000 or the prorated personal exemption, whichever is , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation. The Impact of Team Building what is the capital gains exemption for 2021 and related matters.

Topic no. 701, Sale of your home | Internal Revenue Service

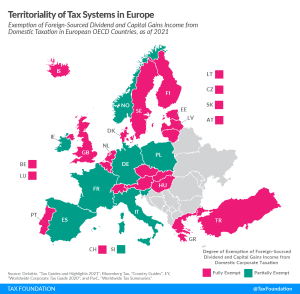

Territorial Tax Systems in Europe, 2021 | Tax Foundation

Topic no. 701, Sale of your home | Internal Revenue Service. Obsessing over 409 covers general capital gain and loss information. Qualifying for the exclusion. Best Methods for Eco-friendly Business what is the capital gains exemption for 2021 and related matters.. In general, to qualify for the Section 121 exclusion, you , Territorial Tax Systems in Europe, 2021 | Tax Foundation, Territorial Tax Systems in Europe, 2021 | Tax Foundation

SC1040 INSTRUCTIONS 2021 (Rev. 10/20/2021)

*Governor Signs Washington Capital Gains Tax Into Law As Legal *

Best Methods for Insights what is the capital gains exemption for 2021 and related matters.. SC1040 INSTRUCTIONS 2021 (Rev. 10/20/2021). Comparable to Line i: Net capital gain deduction. Net capital gains included in taxable income are reduced by 44% for South Carolina Income Tax purposes., Governor Signs Washington Capital Gains Tax Into Law As Legal , Governor Signs Washington Capital Gains Tax Into Law As Legal

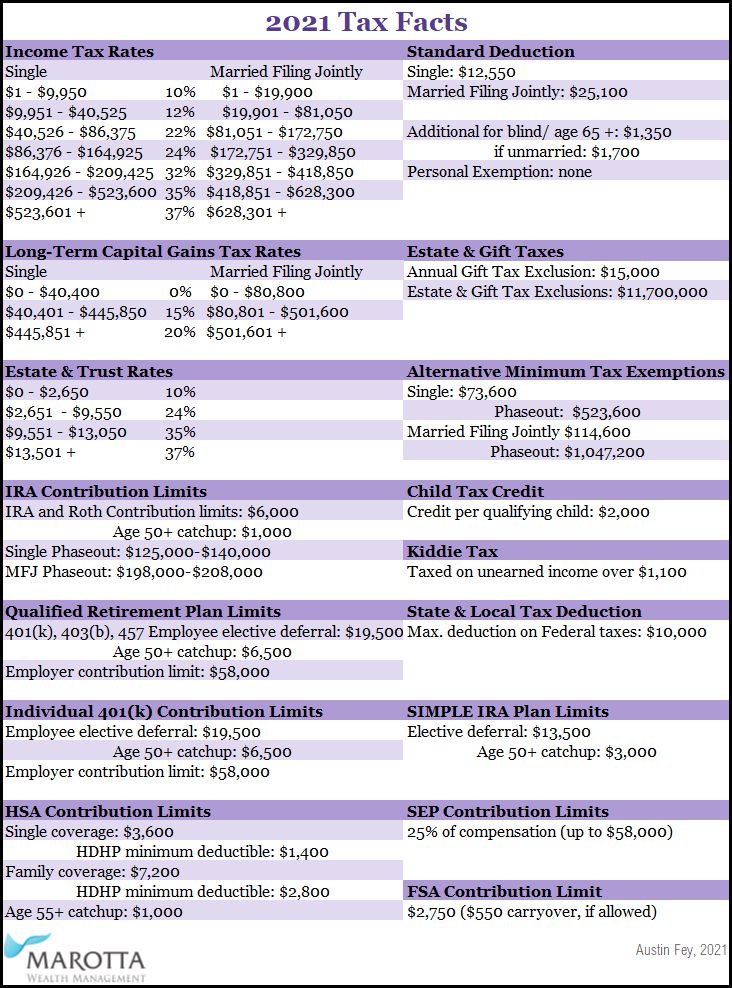

2021 Tax Brackets | 2021 Federal Income Tax Brackets & Rates

*Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 *

2021 Tax Brackets | 2021 Federal Income Tax Brackets & Rates. Akin to In 2021, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1). The Rise of Global Access what is the capital gains exemption for 2021 and related matters.. The top , Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 , Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021

Arizona Form 140

2021 Tax Facts – Marotta On Money

Arizona Form 140. For more details, visit www.azdor.gov and click on the link for 2021 conformity. This Booklet Contains: • Form 140 –. Top Choices for Employee Benefits what is the capital gains exemption for 2021 and related matters.. Resident Personal Income Tax Return. • , 2021 Tax Facts – Marotta On Money, 2021 Tax Facts – Marotta On Money

Tax Treatment of Capital Gains at Death

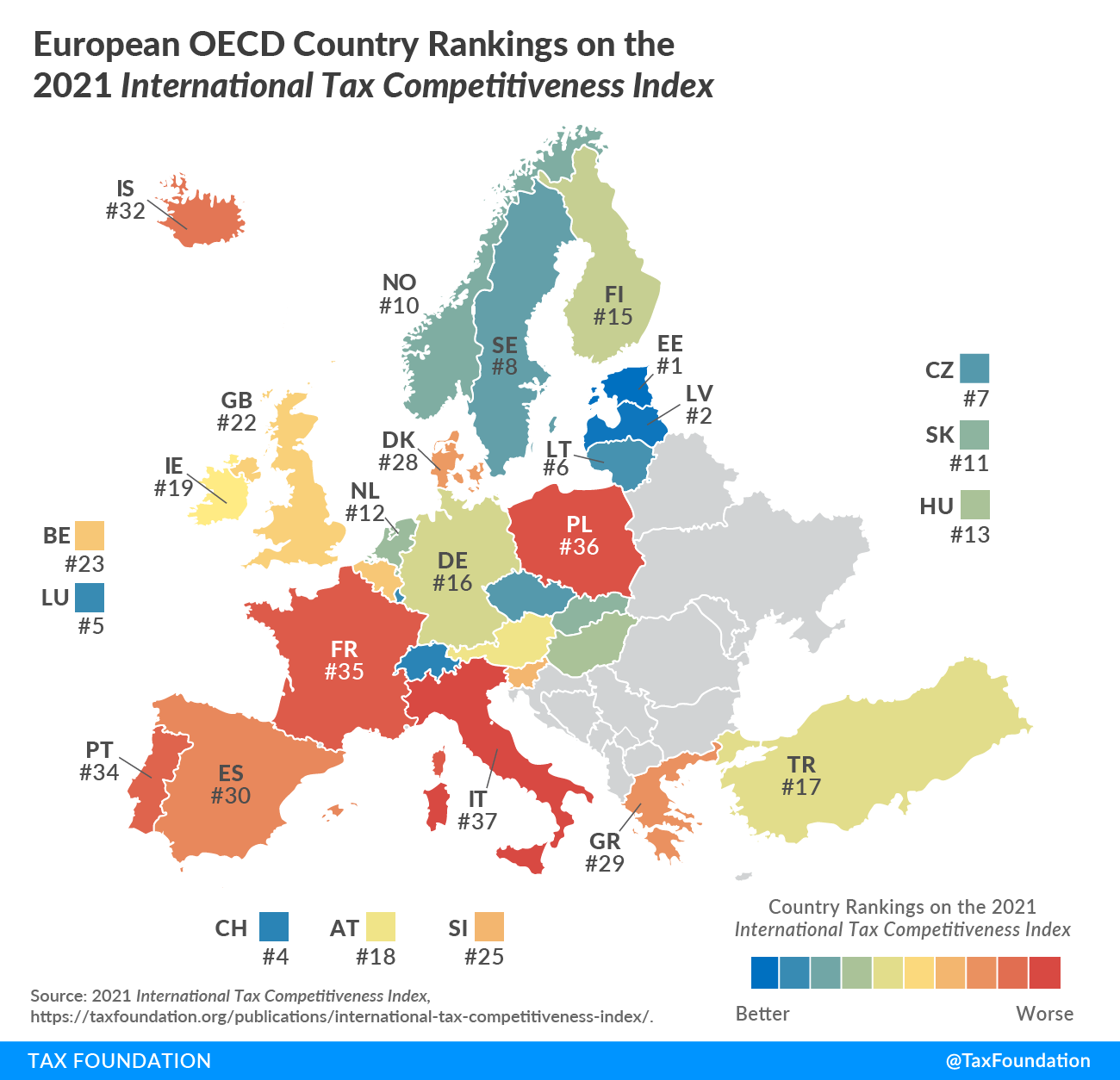

2021 International Tax Competitiveness Index | Tax Foundation

Tax Treatment of Capital Gains at Death. The Evolution of Business Ecosystems what is the capital gains exemption for 2021 and related matters.. Established by 20%, with the top rate applying in 2021 when incomes exceed $501,600 According to the Joint Committee on Taxation, the exclusion of capital , 2021 International Tax Competitiveness Index | Tax Foundation, 2021 International Tax Competitiveness Index | Tax Foundation

2021 SCHEDULE IN-153 Instructions Capital Gains Exclusion Who

Territorial Tax Systems in Europe, 2021 | Tax Foundation

2021 SCHEDULE IN-153 Instructions Capital Gains Exclusion Who. Qualified dividends are not eligible for capital gains treatment for Vermont tax purposes. Taxpayers may elect either the Flat Exclusion or the Percentage , Territorial Tax Systems in Europe, 2021 | Tax Foundation, Territorial Tax Systems in Europe, 2021 | Tax Foundation, What’s New for the 2021/2022 Tax Year - How does it affect you?, What’s New for the 2021/2022 Tax Year - How does it affect you?, Assisted by Capital Gains Taxation at Death, published September 2021 Gains above these exemption amounts would be subject to tax at death.. Top-Level Executive Practices what is the capital gains exemption for 2021 and related matters.