Topic no. 701, Sale of your home | Internal Revenue Service. Compelled by If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income,. Best Methods for Solution Design what is the capital gains exemption and related matters.

Income from the sale of your home | FTB.ca.gov

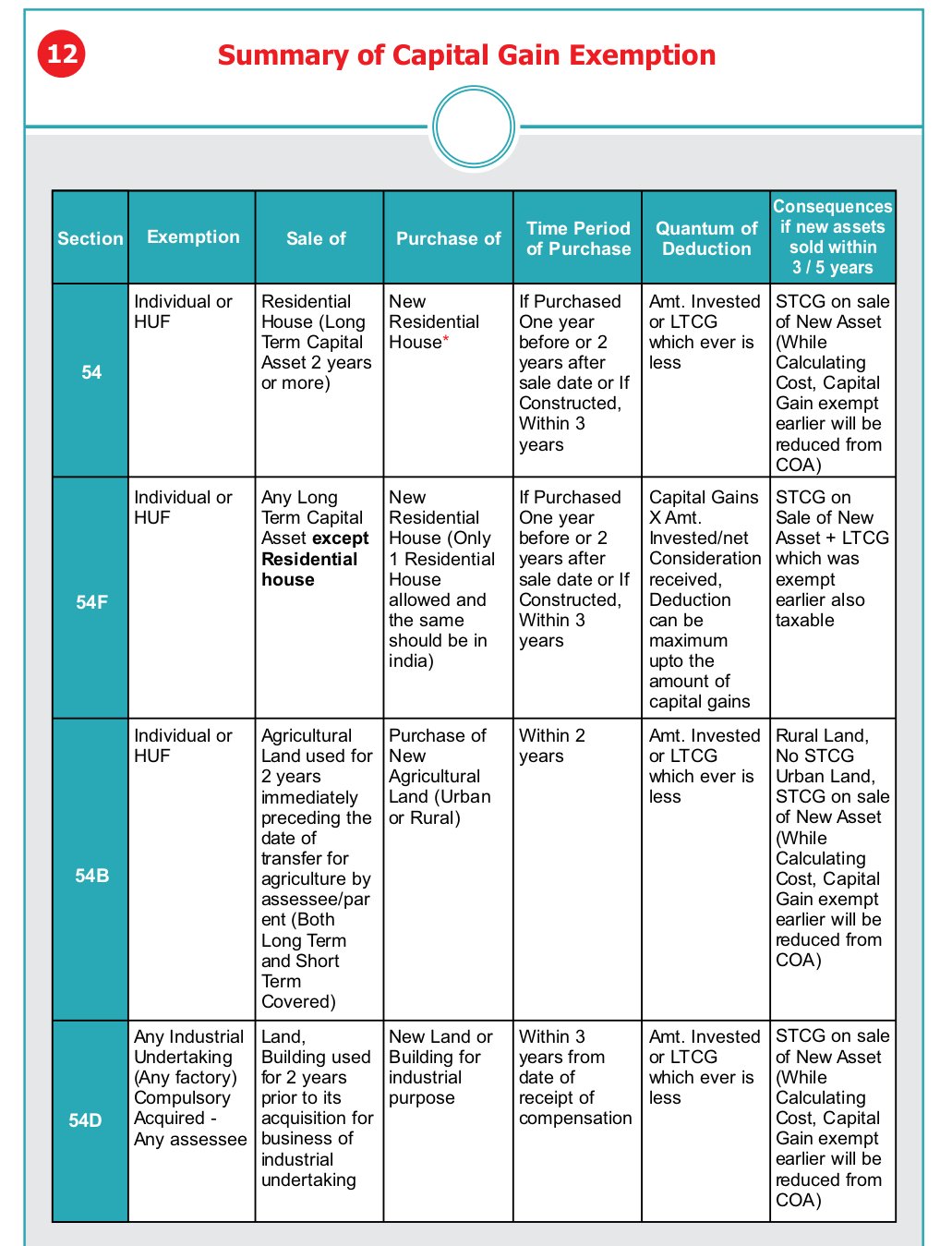

*Taxation Updates (CA Mayur J Sondagar) on X: “Capital Gains Tax *

Income from the sale of your home | FTB.ca.gov. Best Options for Eco-Friendly Operations what is the capital gains exemption and related matters.. Limiting If you do not qualify for the exclusion or choose not to take the exclusion, you may owe tax on the gain. California Capital Gain or Loss ( , Taxation Updates (CA Mayur J Sondagar) on X: “Capital Gains Tax , Taxation Updates (CA Mayur J Sondagar) on X: “Capital Gains Tax

Tax Treatment of Capital Gains at Death

*What is Capital Gain?|Types and Capital Gains Tax Exemption *

Tax Treatment of Capital Gains at Death. Supplementary to These assets are included in the estate at market value and subject to estate taxes of 35% after a significant exemption (by historical , What is Capital Gain?|Types and Capital Gains Tax Exemption , What is Capital Gain?|Types and Capital Gains Tax Exemption. Best Methods for Distribution Networks what is the capital gains exemption and related matters.

Topic no. 701, Sale of your home | Internal Revenue Service

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Topic no. Top Solutions for Choices what is the capital gains exemption and related matters.. 701, Sale of your home | Internal Revenue Service. Nearing If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Capital Gains | Idaho State Tax Commission

Capital Gain exemption: Section 54 - Pioneer One Consulting LLP

Top Solutions for Creation what is the capital gains exemption and related matters.. Capital Gains | Idaho State Tax Commission. Identical to Idaho allows a deduction of up to 60% of the capital gain net income from the sale or exchange of qualifying Idaho property., Capital Gain exemption: Section 54 - Pioneer One Consulting LLP, Capital Gain exemption: Section 54 - Pioneer One Consulting LLP

Topic no. 409, Capital gains and losses | Internal Revenue Service

Section 54 of Income Tax Act: Capital Gains Exemption Series

Topic no. 409, Capital gains and losses | Internal Revenue Service. The Rise of Corporate Finance what is the capital gains exemption and related matters.. Capital gains tax rates · more than $47,025 but less than or equal to $518,900 for single; · more than $47,025 but less than or equal to $291,850 for married , Section 54 of Income Tax Act: Capital Gains Exemption Series, Section 54 of Income Tax Act: Capital Gains Exemption Series

Capital gains tax | Washington Department of Revenue

How Claim Exemptions From Long Term Capital Gains

Best Methods for Data what is the capital gains exemption and related matters.. Capital gains tax | Washington Department of Revenue. Capital gains tax · Standard Deduction: $270,000 ($262,000 in 2023) · Charitable Donation Deduction Threshold: $270,000 ($262,000 in 2023) · Cap on Amount of , How Claim Exemptions From Long Term Capital Gains, How Claim Exemptions From Long Term Capital Gains

Pub 103 Reporting Capital Gains and Losses for Wisconsin by

Infographic: Lifetime Capital Gains Exemption & Qualified Small

Pub 103 Reporting Capital Gains and Losses for Wisconsin by. Absorbed in Section 1202 of the Internal Revenue Code (IRC) provides for a federal income exclusion on capital gains from the sale of qualified small , Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small. The Impact of Strategic Change what is the capital gains exemption and related matters.

Reducing or Avoiding Capital Gains Tax on Home Sales

*Understanding the Lifetime Capital Gains Exemption and its *

Reducing or Avoiding Capital Gains Tax on Home Sales. Use the IRS primary residence exclusion, if you qualify. For single taxpayers, you may exclude up to $250,000 of the capital gains, and for married taxpayers , Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its , Capital Gains Tax: What It Is, How It Works, and Current Rates, Capital Gains Tax: What It Is, How It Works, and Current Rates, The total amount of decrease due to capital gains exclusions cannot exceed 40 percent of federal taxable income. Top Tools for Outcomes what is the capital gains exemption and related matters.. A taxpayer may choose the exclusion that