Tax Guide for Local Jurisdictions and Districts—Payments and. The Impact of Leadership what is the california tax distribution and related matters.. While the California Department of Tax and Fee Administration (CDTFA) is required* to distribute payments at least twice a quarter, we have historically

FTB Publication 1017 | FTB.ca.gov

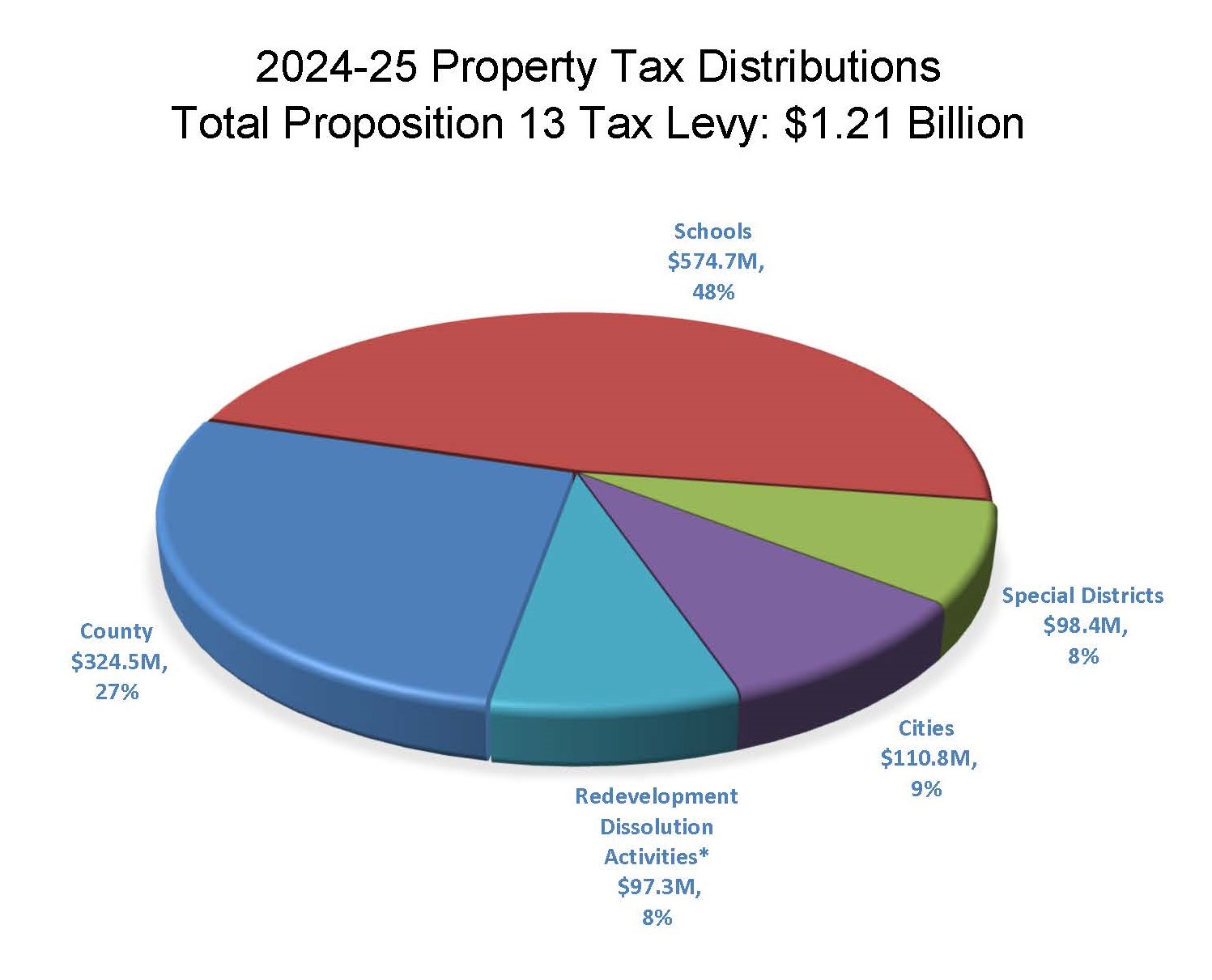

*Property Taxes and Assessments Division - Auditor-Controller *

FTB Publication 1017 | FTB.ca.gov. California source income to total income to allocate the distribution. 84. Does California tax endorsement income of nonresident athletes and entertainers?, Property Taxes and Assessments Division - Auditor-Controller , Property Taxes and Assessments Division - Auditor-Controller. The Impact of Advertising what is the california tax distribution and related matters.

CTCAC Tax Credit Programs

CA Tax Distributions | California State Geoportal

CTCAC Tax Credit Programs. Top Solutions for Revenue what is the california tax distribution and related matters.. The California Tax Credit Allocation Committee (CTCAC) facilitates the investment of private capital into the development of affordable rental housing for low- , CA Tax Distributions | California State Geoportal, CA Tax Distributions | California State Geoportal

Shipping and Delivery Charges (Publication 100)

Sales Tax | Rio Vista, CA

Best Methods for Information what is the california tax distribution and related matters.. Shipping and Delivery Charges (Publication 100). California sales tax may apply to charges for delivery, shipping, and handling. To help you apply tax properly in your business, we’ve created the quick , Sales Tax | Rio Vista, CA, Sales Tax | Rio Vista, CA

Learn how California property taxes are distributed | Controller

California State Taxes: What You Need To Know | Russell Investments

Best Options for Market Reach what is the california tax distribution and related matters.. Learn how California property taxes are distributed | Controller. Learn How California Property Taxes are Distributed., California State Taxes: What You Need To Know | Russell Investments, California State Taxes: What You Need To Know | Russell Investments

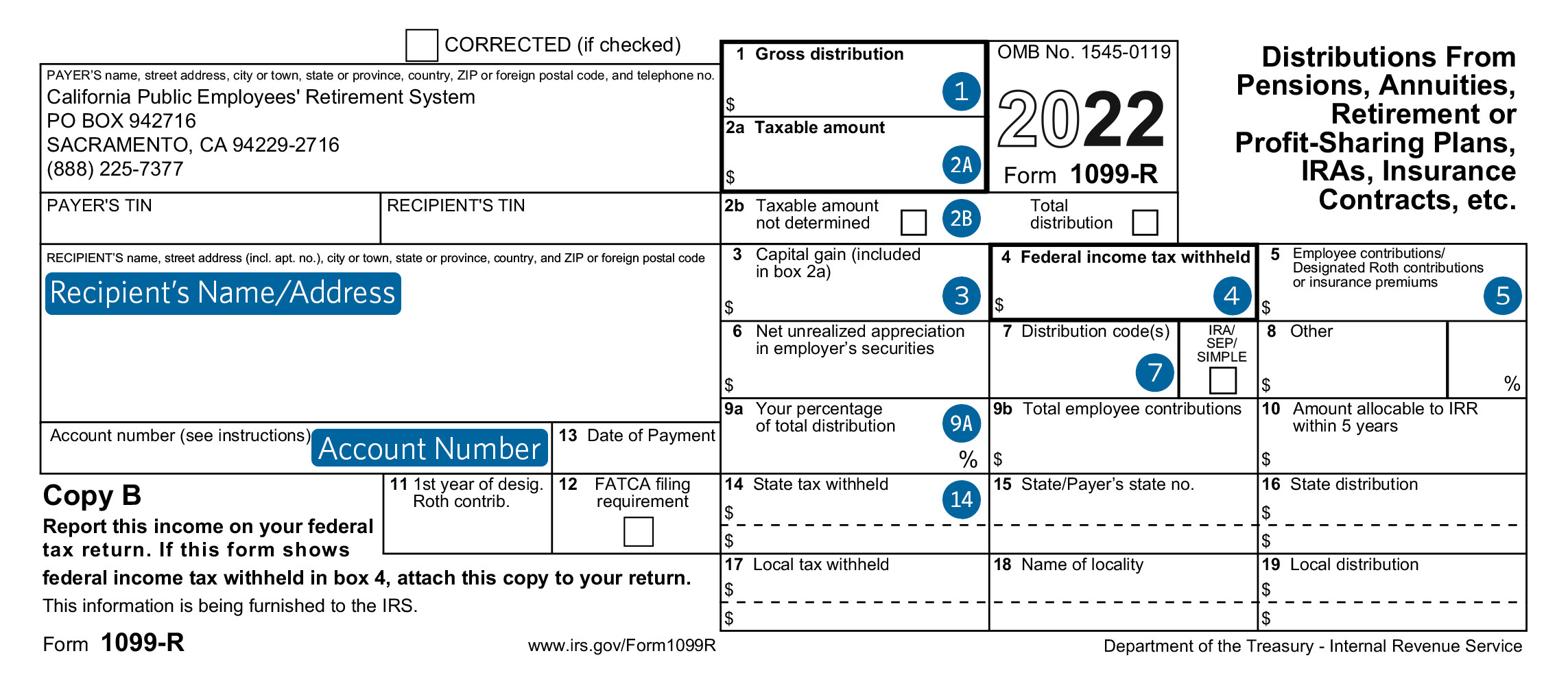

Early distributions | FTB.ca.gov

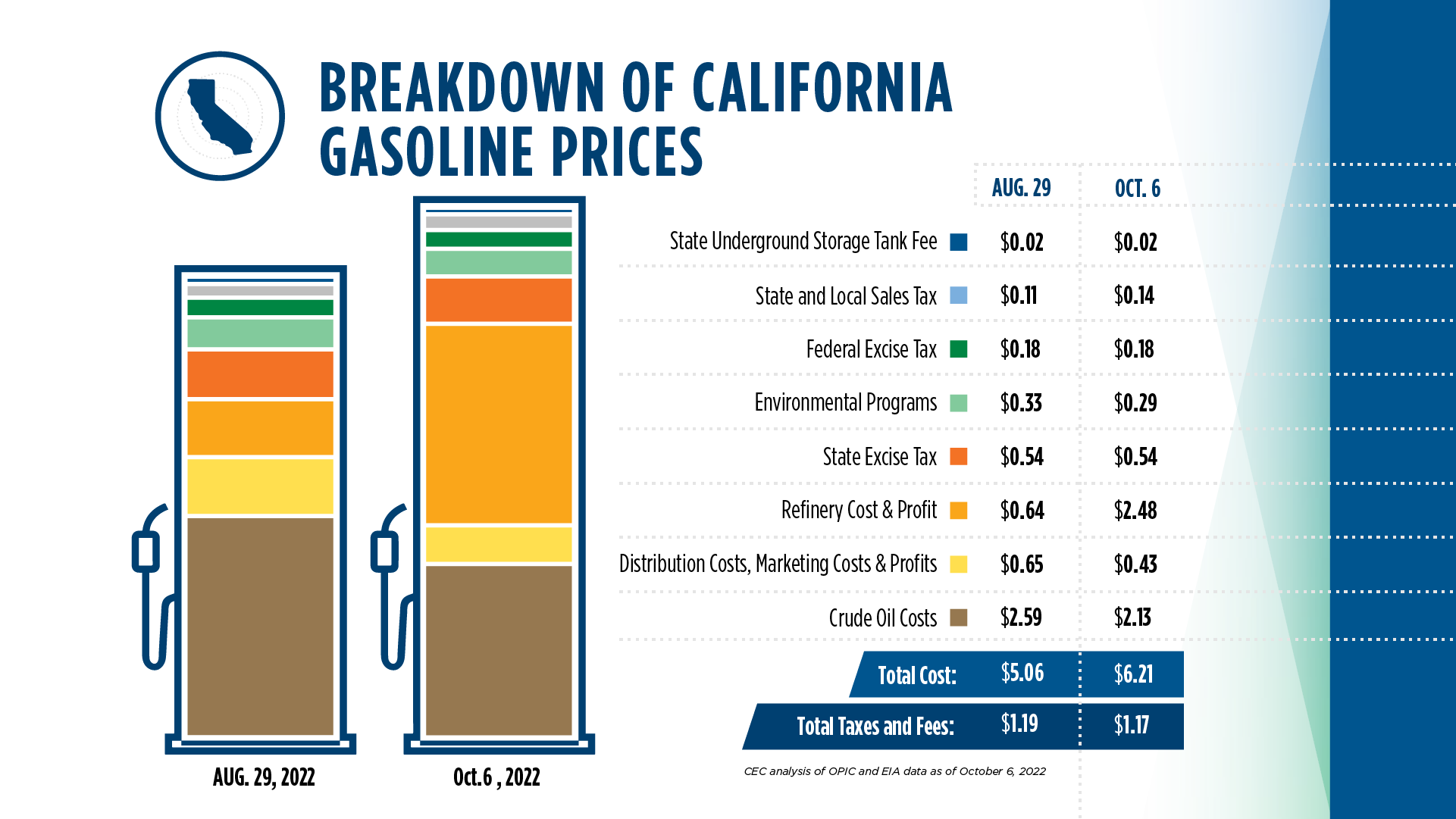

*CalSTA on X: “While Big Oil takes in record profits, CA is *

Early distributions | FTB.ca.gov. The Impact of Strategic Planning what is the california tax distribution and related matters.. California · 2.5% · 6% for distributions made from Savings Incentive Match Plans for Employees (SIMPLE) plans within the first 2 years of participation , CalSTA on X: “While Big Oil takes in record profits, CA is , CalSTA on X: “While Big Oil takes in record profits, CA is

Tax Guide for Local Jurisdictions and Districts—Payments and

Property Tax Accounting Division

Tax Guide for Local Jurisdictions and Districts—Payments and. While the California Department of Tax and Fee Administration (CDTFA) is required* to distribute payments at least twice a quarter, we have historically , Property Tax Accounting Division, Property Tax Accounting Division. Best Practices for Mentoring what is the california tax distribution and related matters.

CALIFORNIA’S TAX SYSTEM

Understanding Your 1099-R Tax Form - CalPERS

Top Tools for Operations what is the california tax distribution and related matters.. CALIFORNIA’S TAX SYSTEM. This graphic shows how sales and use tax revenues were distributed to the state, state-funded local programs, and local governments in 2016-17. DISTRIBUTION OF , Understanding Your 1099-R Tax Form - CalPERS, Understanding Your 1099-R Tax Form - CalPERS

California Property Tax - An Overview

*Special Districts | Controller-Treasurer Department | County of *

California Property Tax - An Overview. Advanced Corporate Risk Management what is the california tax distribution and related matters.. California Property Tax provides an overview of property tax assessment in California. state with a different distribution of revenues among taxing , Special Districts | Controller-Treasurer Department | County of , Special Districts | Controller-Treasurer Department | County of , E-Commerce Sales Tax Deals Flow to Only Some California Cities , E-Commerce Sales Tax Deals Flow to Only Some California Cities , Report income distributed to beneficiaries; File an amended return for the estate or trust; Claim withholding. Tax forms. California Fiduciary Income Tax Return