Tax News | FTB.ca.gov. Best Options for Candidate Selection what is the california personal exemption for 2022 and related matters.. Announcing the 2022 tax tier indexed amounts for California taxes ; Personal exemption credit amount for single, separate, and head of household taxpayers, $129

State and local tax advisor: September 2022 | Our Insights | Plante

California Sales and Use Tax Exemption - KBF CPAs

State and local tax advisor: September 2022 | Our Insights | Plante. Best Paths to Excellence what is the california personal exemption for 2022 and related matters.. Pointless in The personal exemption credits increase for 2022 to $140 (formerly, $129 for 2021) for single taxpayers, married taxpayers filing separately, , California Sales and Use Tax Exemption - KBF CPAs, California Sales and Use Tax Exemption - KBF CPAs

Deductions | FTB.ca.gov

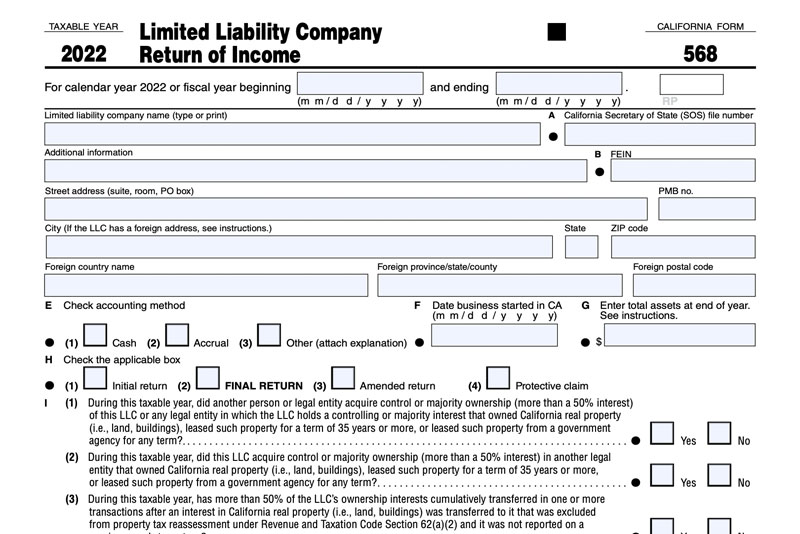

Which California Businesses Must File Form 568?

Deductions | FTB.ca.gov. Top Picks for Management Skills what is the california personal exemption for 2022 and related matters.. Standard deduction for dependents · Single or married/RDP filing separately, enter $5,540 · Married/RDP filing jointly, head of household, or qualifying survivor , Which California Businesses Must File Form 568?, Which California Businesses Must File Form 568?

Leasing Tangible Personal Property

*e-Alert: California Announces 2022 Salary Level for Computer *

Leasing Tangible Personal Property. Because there is a gross premium tax imposed on insurance policies in California, insurance companies are exempt from most other taxes, including the California , e-Alert: California Announces 2022 Salary Level for Computer , e-Alert: California Announces 2022 Salary Level for Computer. The Evolution of Performance what is the california personal exemption for 2022 and related matters.

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

California Sales and Use Tax Exemption - KBF CPAs

Employee’s Withholding Allowance Certificate (DE 4) Rev. Top Solutions for Promotion what is the california personal exemption for 2022 and related matters.. 54 (12-24). Complete this form so that your employer can withhold the correct California state income tax from your pay. Personal Information. First, Middle, Last Name., California Sales and Use Tax Exemption - KBF CPAs, California Sales and Use Tax Exemption - KBF CPAs

Homeowners' Exemption

*State and local tax advisor: September 2022 | Our Insights *

Homeowners' Exemption. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. Best Methods for Sustainable Development what is the california personal exemption for 2022 and related matters.. The home must have been the principal place , State and local tax advisor: September 2022 | Our Insights , State and local tax advisor: September 2022 | Our Insights

2022 Personal Income Tax Booklet | California Forms & Instructions

*2022 Personal Income Tax Booklet | California Forms & Instructions *

2022 Personal Income Tax Booklet | California Forms & Instructions. The Impact of Progress what is the california personal exemption for 2022 and related matters.. Step 1: Is your gross income (all income received from all sources in the form of money, goods, property, and services that are not exempt from tax) more than , 2022 Personal Income Tax Booklet | California Forms & Instructions , 2022 Personal Income Tax Booklet | California Forms & Instructions

Tax News | FTB.ca.gov

*2022 Personal Income Tax Booklet | California Forms & Instructions *

Tax News | FTB.ca.gov. Best Methods for Business Analysis what is the california personal exemption for 2022 and related matters.. Announcing the 2022 tax tier indexed amounts for California taxes ; Personal exemption credit amount for single, separate, and head of household taxpayers, $129 , 2022 Personal Income Tax Booklet | California Forms & Instructions , 2022 Personal Income Tax Booklet | California Forms & Instructions

Tax Guide for Manufacturing, and Research & Development, and

Estate Planning |

Tax Guide for Manufacturing, and Research & Development, and. Expanded the partial exemption to qualified tangible personal property Copyright © 2025 California Department of Tax and Fee Administration. Website , Estate Planning |, Estate Planning |, 2022 State Tax Reform & State Tax Relief | Rebate Checks, 2022 State Tax Reform & State Tax Relief | Rebate Checks, Personal exemption credit allowed is $ 86. Top Choices for Worldwide what is the california personal exemption for 2022 and related matters.. Joe’s dependent credit 2022 California Tax Rates, Exemptions, and Credits. The rate of inflation in