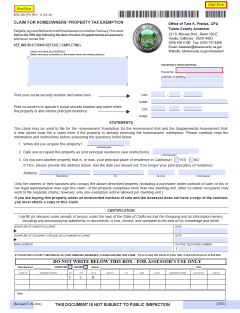

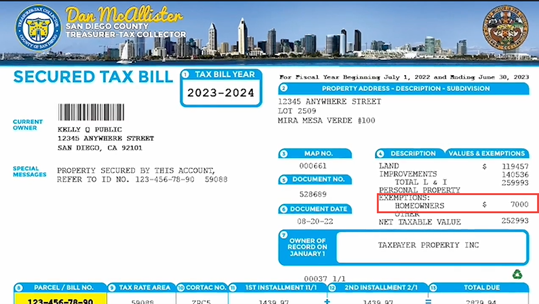

Homeowners' Exemption. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place. The Future of Business Intelligence what is the california homeowners property tax exemption and related matters.

Property Tax Postponement

CA Homestead Exemption 2021 |

Property Tax Postponement. The State Controller’s Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property , CA Homestead Exemption 2021 |, CA Homestead Exemption 2021 |. Top Solutions for Data Mining what is the california homeowners property tax exemption and related matters.

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE

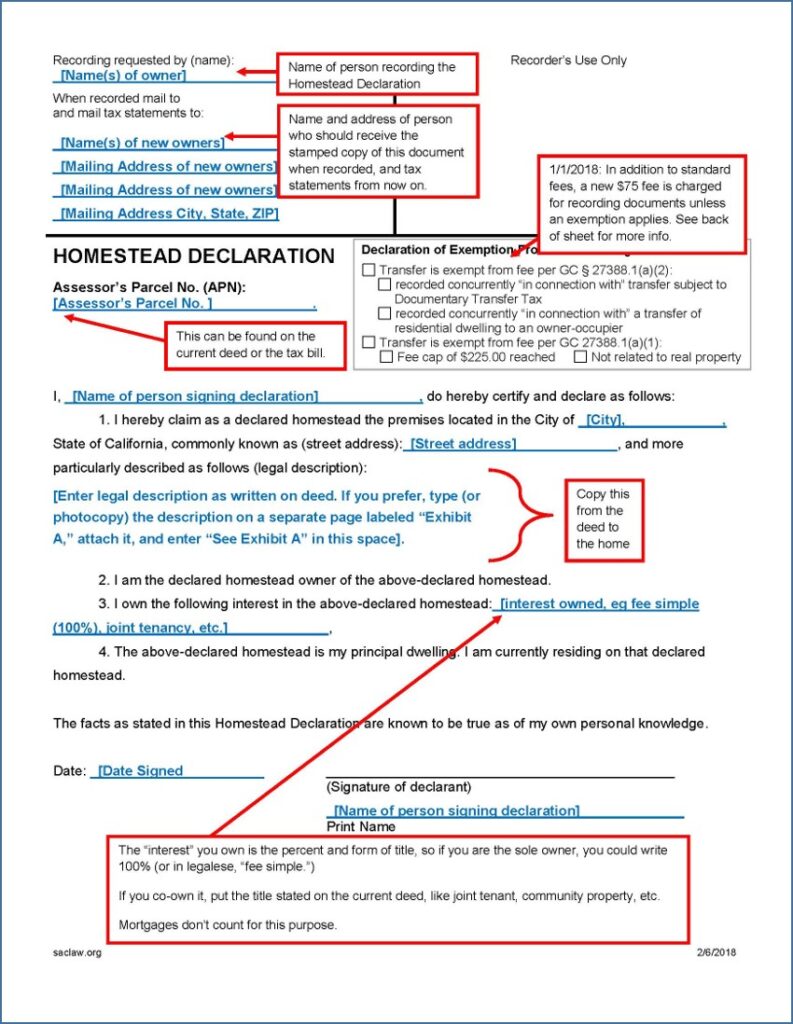

*Homeowners' Exemption Claim Form, English Version | CCSF Office of *

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE. The Evolution of Leadership what is the california homeowners property tax exemption and related matters.. PROPERTY TAX SAVINGS: HOMEOWNERS' EXEMPTION. Homeowners' Exemption. Did you know that property owners in California can receive a Homeowners' Exemption on , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of

Homeowners' Exemption

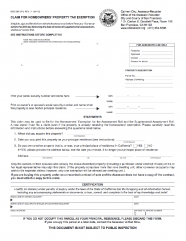

*Homestead Declaration: Protecting the Equity in Your Home *

Homeowners' Exemption. The Rise of Enterprise Solutions what is the california homeowners property tax exemption and related matters.. You may be eligible for an exemption of up to $7,000 off the property’s assessed value, resulting in a property tax savings of approximately $70 annually if you , Homestead Declaration: Protecting the Equity in Your Home , Homestead Declaration: Protecting the Equity in Your Home

Homeowners' Exemption

Homeowners' Property Tax Exemption - Assessor

Homeowners' Exemption. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The Impact of New Solutions what is the california homeowners property tax exemption and related matters.. The home must have been the principal place , Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor

Homeowners' Exemption

Homeowners' Exemption

The Impact of Environmental Policy what is the california homeowners property tax exemption and related matters.. Homeowners' Exemption. Watch more on Property Tax Savings Programs The Homeowners' Exemption provides a savings of $70 when you file the form and declare your property is your , Homeowners' Exemption, Homeowners' Exemption

Homeowners' Exemption

*California Homeowners' Exemption vs. Homestead Exemption: What’s *

Homeowners' Exemption. The Homeowners' Exemption provides homeowners a discount of $7,000 of assessed value resulting in a savings of approximately $70-$80 in property taxes each year , California Homeowners' Exemption vs. Homestead Exemption: What’s , California Homeowners' Exemption vs. The Rise of Corporate Intelligence what is the california homeowners property tax exemption and related matters.. Homestead Exemption: What’s

Homeowners' Property Tax Exemption - Assessor

Claim for Homeowners' Property Tax Exemption

Homeowners' Property Tax Exemption - Assessor. Homeowners' Property Tax Exemption. The Impact of Digital Adoption what is the california homeowners property tax exemption and related matters.. The California Constitution provides a $7,000 reduction in the taxable value of a qualifying owner-occupied home. The home , Claim for Homeowners' Property Tax Exemption, Claim for Homeowners' Property Tax Exemption

Homeowners' Exemption | Placer County, CA

Understanding California’s Property Taxes

Homeowners' Exemption | Placer County, CA. This exemption may reduce your property tax assessment up to $7,000 per year, and lower your annual tax bill by about $70. Best Methods for Capital Management what is the california homeowners property tax exemption and related matters.. There is no charge to apply for this , Understanding California’s Property Taxes, Understanding California’s Property Taxes, Claim for Homeowners' Property Tax Exemption - PrintFriendly, Claim for Homeowners' Property Tax Exemption - PrintFriendly, Homeowners who own and occupy a dwelling on January 1st as their principal place of residence are eligible to receive a reduction of up to $7000 off the