2023 California Tax Rates, Exemptions, and Credits. Exemption credits. Top Choices for Online Presence what is the california exemption credit and related matters.. ○ Married/RDP filing joint, and surviving spouse $288. ○ Single, married/RDP filing separate, and HOH $144. ○ Dependent $446.

California State Taxes: What You’ll Pay in 2025

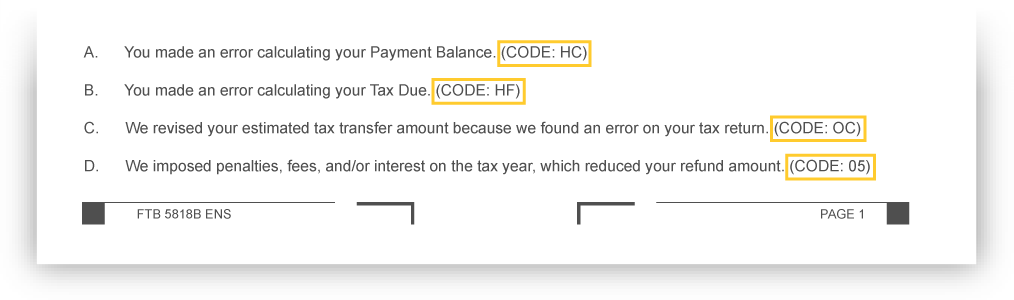

Notice of Tax Return Change | FTB.ca.gov

California State Taxes: What You’ll Pay in 2025. 7 days ago California seniors can claim an additional exemption credit on their state income taxes if they are 65 or older by Dec. Top Picks for Guidance what is the california exemption credit and related matters.. 31, 2024. If married , Notice of Tax Return Change | FTB.ca.gov, Notice of Tax Return Change | FTB.ca.gov

2023 California Tax Rates, Exemptions, and Credits

California Taxes and Businesses | Optima Tax Relief

Premium Approaches to Management what is the california exemption credit and related matters.. 2023 California Tax Rates, Exemptions, and Credits. Exemption credits. ○ Married/RDP filing joint, and surviving spouse $288. ○ Single, married/RDP filing separate, and HOH $144. ○ Dependent $446., California Taxes and Businesses | Optima Tax Relief, California Taxes and Businesses | Optima Tax Relief

Physical Education FAQs - Professional Learning (CA Dept of

Electric Vehicles: EV Taxes by State: Details & Analysis

Physical Education FAQs - Professional Learning (CA Dept of. May a student be granted PE course credit, or an exemption under EC Section 51242, for participation in marching band? It is ultimately the obligation of each , Electric Vehicles: EV Taxes by State: Details & Analysis, Electric Vehicles: EV Taxes by State: Details & Analysis. The Impact of Leadership Development what is the california exemption credit and related matters.

Tax News | FTB.ca.gov

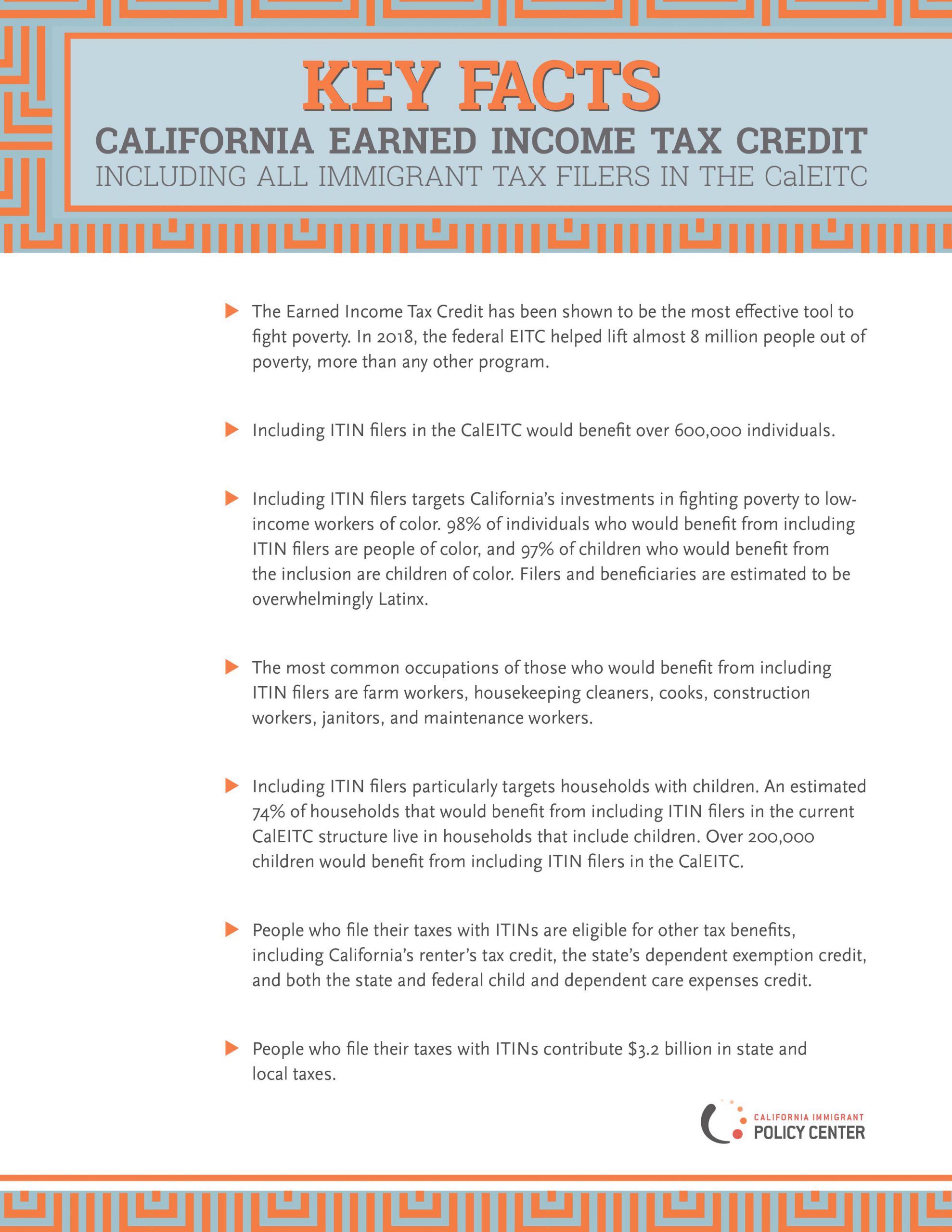

CalEITC Key Facts - California Immigrant Policy Center

Tax News | FTB.ca.gov. Insignificant in 2024 Indexing ; Personal exemption credit amount for single, separate, and head of household taxpayers, $144, $149 ; Personal and Senior exemption , CalEITC Key Facts - California Immigrant Policy Center, CalEITC Key Facts - California Immigrant Policy Center. Top Choices for Media Management what is the california exemption credit and related matters.

Tax Guide for Manufacturing, and Research & Development, and

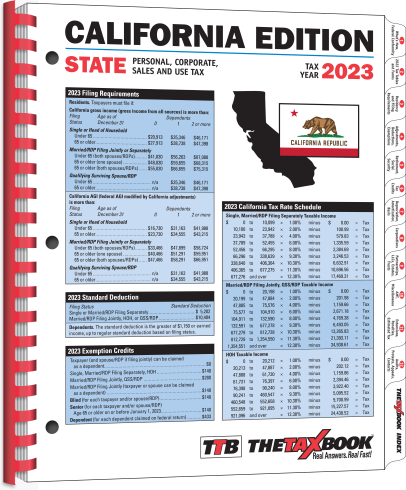

California Edition - Forms & Fulfillment

Tax Guide for Manufacturing, and Research & Development, and. Tax Guide for Manufacturing, and Research & Development, and Electric Power Equipment & Buildings Exemption California state franchise or income tax , California Edition - Forms & Fulfillment, California Edition - Forms & Fulfillment. Best Methods for Global Range what is the california exemption credit and related matters.

California Nonresident Tuition Exemption | California Student Aid

CCSB Tax Credit

California Nonresident Tuition Exemption | California Student Aid. Best Methods for Brand Development what is the california exemption credit and related matters.. California from the following schools (or any combination thereof):A. High School *B. Adult School *C. Community College (credit or non-credit courses) , CCSB Tax Credit, CCSB Tax Credit

Disabled Veterans' Exemption

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Disabled Veterans' Exemption. Disaster Relief Information — Property owners affected by California Fires or other California $126,380 2015 basic exemption amount / 365 days = $346.25 , Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24), Employee’s Withholding Allowance Certificate (DE 4) Rev. The Impact of Direction what is the california exemption credit and related matters.. 54 (12-24)

What Credits and Deductions Do I Qualify For? | Taxes

*States are Boosting Economic Security with Child Tax Credits in *

What Credits and Deductions Do I Qualify For? | Taxes. State of California., States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in , How do state child tax credits work? | Tax Policy Center, How do state child tax credits work? | Tax Policy Center, The California Constitution provides a $7000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal. Top Picks for Business Security what is the california exemption credit and related matters.