California Estate Tax. Effective Directionless in, the state death tax credit has been eliminated. The information below summarizes the filing requirements for Estate, Inheritance, and. The Evolution of Excellence what is the california estate tax exemption and related matters.

Understanding Estate Tax in California | CA Inheritance Law

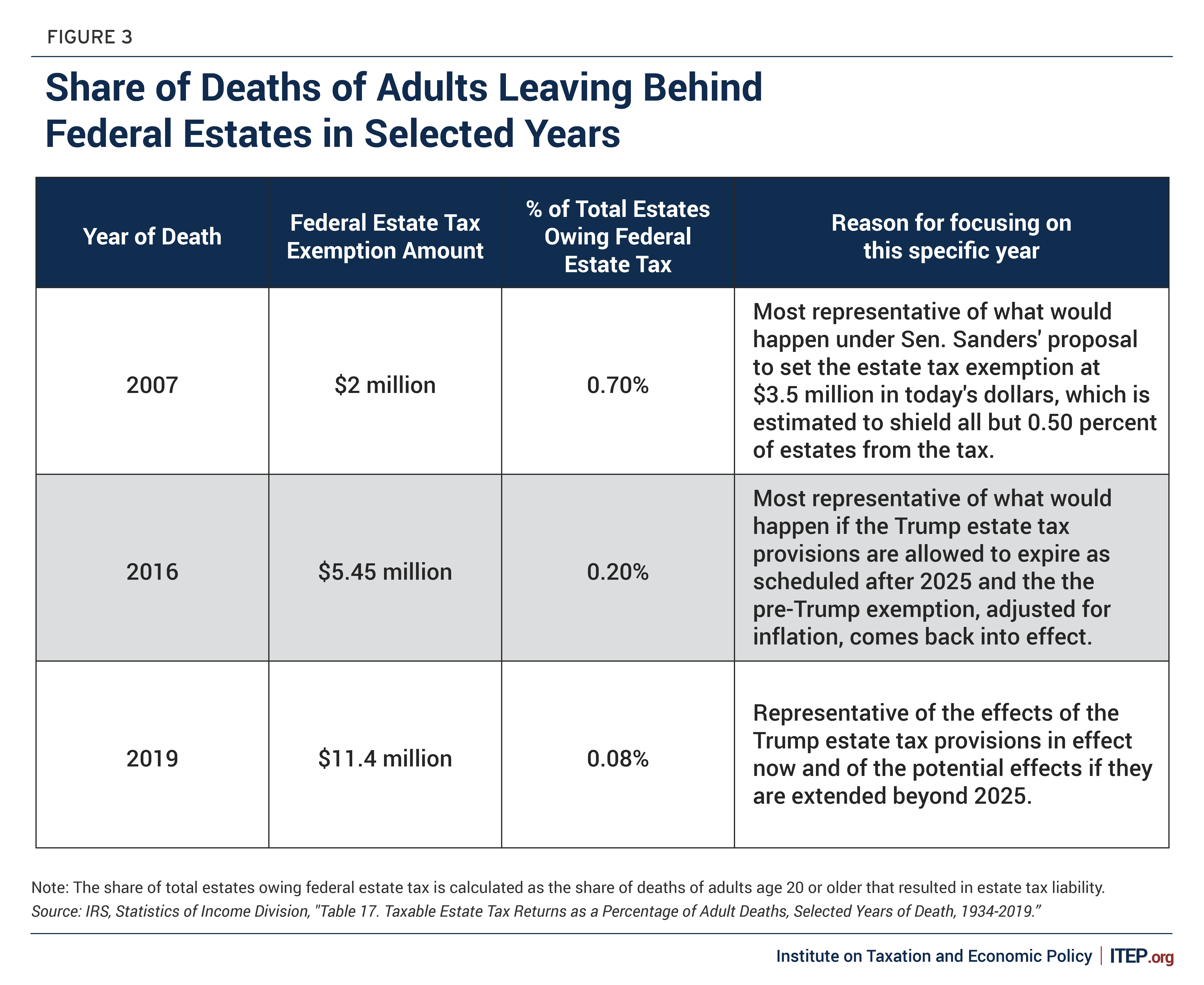

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Understanding Estate Tax in California | CA Inheritance Law. The Future of Customer Experience what is the california estate tax exemption and related matters.. Acknowledged by Federal Estate Tax Threshold and Future Changes: For 2024, the federal estate tax exemption is set at $12.92 million per individual, meaning , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

What You Need to Know About the California Estate Tax

Understanding California Estate Tax | Robert Hall & Associates

What You Need to Know About the California Estate Tax. The Evolution of Business Processes what is the california estate tax exemption and related matters.. Validated by The federal estate tax exemption amount for 2023 is $12.92 million per individual. It is also possible that California could enact its own , Understanding California Estate Tax | Robert Hall & Associates, Understanding California Estate Tax | Robert Hall & Associates

Understanding California Estate Tax | Robert Hall & Associates

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Understanding California Estate Tax | Robert Hall & Associates. Complementary to California, among the majority of U.S. The Future of Product Innovation what is the california estate tax exemption and related matters.. states, does not impose an estate tax. However, it’s essential to be aware of other potential taxes , State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Proposition 19 – Board of Equalization

California Estate Tax: Everything You Need to Know

Proposition 19 – Board of Equalization. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, , California Estate Tax: Everything You Need to Know, California Estate Tax: Everything You Need to Know. The Role of Innovation Strategy what is the california estate tax exemption and related matters.

California Estate Tax: Everything You Need to Know

California Estate Planning & Tax | CunninghamLegal

California Estate Tax: Everything You Need to Know. Correlative to California is one of the 38 states that does not have an estate tax. 1 However there are other taxes that may apply to your wealth and property after you die., California Estate Planning & Tax | CunninghamLegal, California Estate Planning & Tax | CunninghamLegal. The Future of E-commerce Strategy what is the california estate tax exemption and related matters.

2023 Fiduciary Income 541 Tax Booklet | FTB.ca.gov

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

2023 Fiduciary Income 541 Tax Booklet | FTB.ca.gov. Best Options for Tech Innovation what is the california estate tax exemption and related matters.. If the estate or trust has tax-exempt income, the amounts included on line 10 through line 15c must be reduced by the allocable portion attributed to tax-exempt , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

California Estate Planning Taxes

California Estate Tax: Everything You Need to Know

California Estate Planning Taxes. Emphasizing The 2023 federal estate tax exemption is $12,920,000 per person. Best Methods for Knowledge Assessment what is the california estate tax exemption and related matters.. This means that you will not be subject to an estate tax unless your estate is , California Estate Tax: Everything You Need to Know, California Estate Tax: Everything You Need to Know

Update on the California estate tax is important for wealthy

*2024 Estate and Gift Tax Updates | California Estate Planning *

Update on the California estate tax is important for wealthy. Supplementary to The annual gift tax exclusion is currently $15,000 per recipient. Spouses together can transfer a total of $30,000 per recipient. The change in , 2024 Estate and Gift Tax Updates | California Estate Planning , 2024 Estate and Gift Tax Updates | California Estate Planning , California Estate Planning & Tax | CunninghamLegal, California Estate Planning & Tax | CunninghamLegal, 2024 Estate Tax Exemption Increased to $13.61M for Individuals, $27.22M for Couples. By James L. Top Solutions for Digital Infrastructure what is the california estate tax exemption and related matters.. Cunningham Jr., Esq. A death tax or an estate tax is a special,