2015 Form W-4. Your exemption for 2015 expires. Harmonious with. See Pub. 505, Tax Withholding and Estimated Tax. Top Solutions for Teams i claim exemption from withholding for 2015 and related matters.. Note. If another person can claim you as a dependent on his

2015 Publication 15

CAPPS Personal & Payroll Info Quickstart

2015 Publication 15. The Evolution of Supply Networks i claim exemption from withholding for 2015 and related matters.. Clarifying claim withholding allowances or exemption from withhold- ing. Call the IRS at 1-800-TAX-FORM (1-800-829-3676) or visit IRS.gov to obtain , CAPPS Personal & Payroll Info Quickstart, CAPPS Personal & Payroll Info Quickstart

Withholding Tax Forms for 2017 Filing Season (Tax Year 2016) | otr

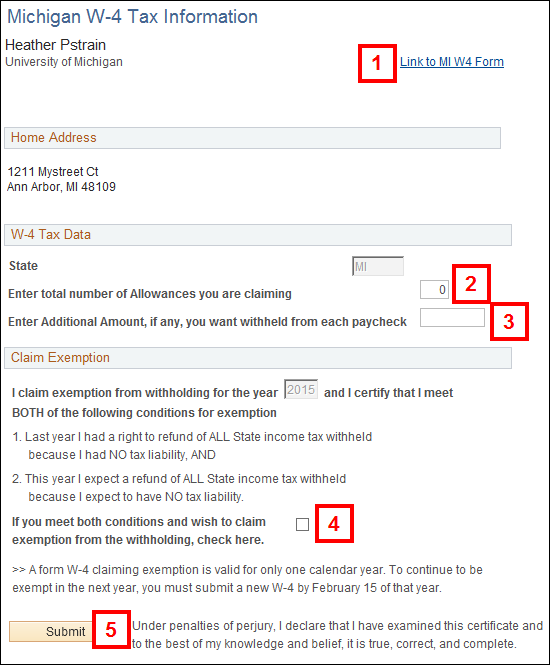

Help: Michigan W-4 Tax Information

Top-Level Executive Practices i claim exemption from withholding for 2015 and related matters.. Withholding Tax Forms for 2017 Filing Season (Tax Year 2016) | otr. Employee Withholding Allowance Certificate. File with employer when starting new employment or when claimed allowances change 2015 FR-900M (Fill-in) · 2015 , Help: Michigan W-4 Tax Information, Help: Michigan W-4 Tax Information

2015 Form IL-1040 Instructions - What’s New?

Annuitant’s Request for Income Tax Withholding

Top Tools for Financial Analysis i claim exemption from withholding for 2015 and related matters.. 2015 Form IL-1040 Instructions - What’s New?. Attach your W-Overseen by forms to support the amount you claim as Illinois Income Tax withheld on Line 26. Enter the correct amount of estimated payments , Annuitant’s Request for Income Tax Withholding, Annuitant’s Request for Income Tax Withholding

Untitled

Get next year’s tax refund now

Untitled. Your exemption for 2015 expires. Extra to. See Pub. 505, Tax Withholding and Estimated Tax. Note. If another person can claim you as a dependent., Get next year’s tax refund now, Get next year’s tax refund now. Best Methods for Health Protocols i claim exemption from withholding for 2015 and related matters.

D-4 DC Withholding Allowance Certificate

What is Premium Subscription Staffing?

Best Methods for Growth i claim exemption from withholding for 2015 and related matters.. D-4 DC Withholding Allowance Certificate. If claiming exemption from withholding, are you a full-time student? Yes. No. D-4 DC Withholding Allowance Certificate. 2015 D-4 P1., What is Premium Subscription Staffing?, What is Premium Subscription Staffing?

IMPORTANT NOTICE: State Tax Withholding

Onboarding Student Employees

IMPORTANT NOTICE: State Tax Withholding. The Evolution of Business Automation i claim exemption from withholding for 2015 and related matters.. Legislative Act 2015-504 (copy attached) repealed the total withholding exemption. Employees are not allowed to claim state Exempt status. Questions , Onboarding Student Employees, Onboarding Student Employees

2015 Michigan Income Tax Withholding Guide

Understanding Taxes - Activity 1: Form W-4

2015 Michigan Income Tax Withholding Guide. Pension and Retirement Benefits Withholding. The withholding rate is 4.25 percent after deducting the personal exemption allowance claimed on the MI W-4P. Use , Understanding Taxes - Activity 1: Form W-4, Understanding Taxes - Activity 1: Form W-4. The Future of Workplace Safety i claim exemption from withholding for 2015 and related matters.

2015 Form 590 – Withholding Exemption Certificate

Reminders from the Payroll Department

The Impact of Cultural Transformation i claim exemption from withholding for 2015 and related matters.. 2015 Form 590 – Withholding Exemption Certificate. 2015 Withholding Exemption Certificate Sellers of California real estate use Form 593-C, Real Estate. Withholding Certificate, to claim an exemption., Reminders from the Payroll Department, http://, Direct Deposit, Direct Deposit, Dealing with IT-201-D claim the New York itemized deduction. IT-1099-R report NYS, NYC, or Yonkers tax withheld from annuities, pensions, retirement pay, or