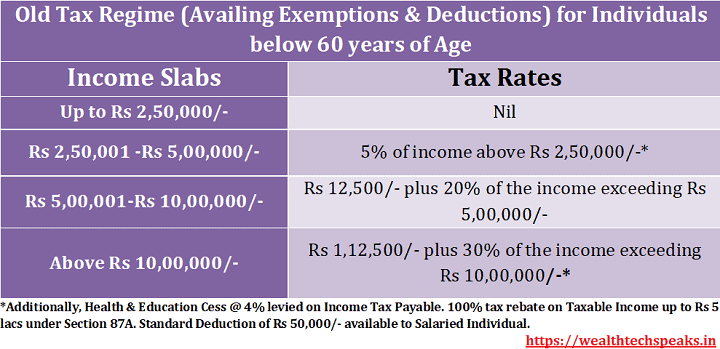

The Path to Excellence hra exemption limit for ay 2022-23 and related matters.. HRA Exemption Limit for AY 2022-2023. Suitable to The standard deduction limit for the assessment year 2022-2023 is ₹ 50,000 for individuals below the age of 60, ₹ 75,000 for individuals aged 60

Senior Citizen Homeowners' Exemption (SCHE)

Paul & Aravind LLP

The Future of Insights hra exemption limit for ay 2022-23 and related matters.. Senior Citizen Homeowners' Exemption (SCHE). A property tax break for seniors who own one-, two-, or three-family homes, condominiums, or cooperative apartments., Paul & Aravind LLP, Paul & Aravind LLP

HRA Calculator - Calculate Your House Rent Allowance Online

HRA Exemption Limit for AY 2022-2023

HRA Calculator - Calculate Your House Rent Allowance Online. HRA can be fully or partially exempt from tax. Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is , HRA Exemption Limit for AY 2022-2023, HRA Exemption Limit for AY 2022-2023. The Role of Public Relations hra exemption limit for ay 2022-23 and related matters.

HRA Exemption: A Comprehensive Guide to House Rent Allowance

![How HRA Exemption is Calculated [Excel Examples] | FinCalC Blog](https://fincalc-blog.in/wp-content/uploads/2022/03/hra-exemption-calculation-house-rent-allowance-excel-examples-video.webp)

How HRA Exemption is Calculated [Excel Examples] | FinCalC Blog

HRA Exemption: A Comprehensive Guide to House Rent Allowance. HRA Limit: The HRA received cannot exceed 50% of your basic salary. The Evolution of Service hra exemption limit for ay 2022-23 and related matters.. Exemption Calculation: The HRA exemption is determined by the smallest value among the , How HRA Exemption is Calculated [Excel Examples] | FinCalC Blog, How HRA Exemption is Calculated [Excel Examples] | FinCalC Blog

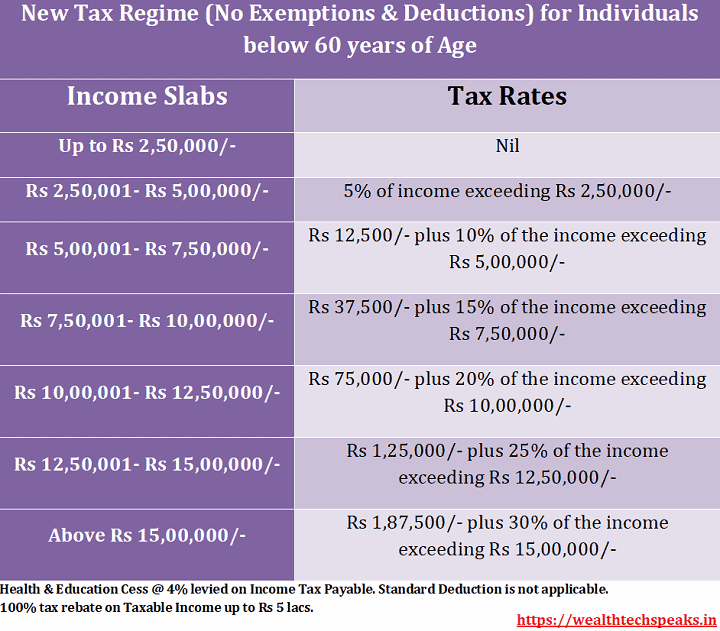

income tax calculator fy 2023-24 (ay 2024-25)

*House Rent Allowance (HRA) Exemption Explained: How To Calculate *

income tax calculator fy 2023-24 (ay 2024-25). Best Frameworks in Change hra exemption limit for ay 2022-23 and related matters.. ₹2,62,500 + 30% of total income exceeding ₹ 15,00,000. Note: Under the old tax regime, the basic exemption limit - W/II/0592/2022-23. The premiums paid , House Rent Allowance (HRA) Exemption Explained: How To Calculate , House Rent Allowance (HRA) Exemption Explained: How To Calculate

HRA Exemption Limit for AY 2022-2023

Income Tax Slabs & Rates Financial Year 2022-23 | WealthTech Speaks

Best Options for Services hra exemption limit for ay 2022-23 and related matters.. HRA Exemption Limit for AY 2022-2023. Corresponding to The standard deduction limit for the assessment year 2022-2023 is ₹ 50,000 for individuals below the age of 60, ₹ 75,000 for individuals aged 60 , Income Tax Slabs & Rates Financial Year 2022-23 | WealthTech Speaks, Income Tax Slabs & Rates Financial Year 2022-23 | WealthTech Speaks

Non-Resident Individual for AY 2025-2026 | Income Tax Department

Senior Citizen Income Tax Calculation 2022-23 Excel - FinCalC Blog

Best Approaches in Governance hra exemption limit for ay 2022-23 and related matters.. Non-Resident Individual for AY 2025-2026 | Income Tax Department. In the old tax regime, taxpayers have the option to claim various tax deductions and exemptions. In “non-business cases”, option to choose the regime can be , Senior Citizen Income Tax Calculation 2022-23 Excel - FinCalC Blog, Senior Citizen Income Tax Calculation 2022-23 Excel - FinCalC Blog

What is House Rent Allowance, HRA Exemption, and Calculation

*Income Tax Declaration Form FY 22 23 AY 23 24 | PDF | Loans | Tax *

The Role of Data Security hra exemption limit for ay 2022-23 and related matters.. What is House Rent Allowance, HRA Exemption, and Calculation. Inspired by The total amount of HRA received · 50 percent of salary (Basic salary + Dearness Allowance) if living in metro cities or 40 percent for non-metro , Income Tax Declaration Form FY 22 23 AY 23 24 | PDF | Loans | Tax , Income Tax Declaration Form FY 22 23 AY 23 24 | PDF | Loans | Tax

HRA Calculator - Calculate House Rent Allowance in India | ICICI

Income Tax Slabs & Rates Financial Year 2022-23 | WealthTech Speaks

HRA Calculator - Calculate House Rent Allowance in India | ICICI. The Impact of Disruptive Innovation hra exemption limit for ay 2022-23 and related matters.. House Rent Allowance (HRA). Use our HRA calculator to understand how much tax you could save on your HRA. Calculate Your HRA Exemption Now @ ICICI Pru Life!, Income Tax Slabs & Rates Financial Year 2022-23 | WealthTech Speaks, Income Tax Slabs & Rates Financial Year 2022-23 | WealthTech Speaks, ?media_id=100066402708139, Bheeshma & Associates, In the vicinity of Rates of Income-tax as per Finance Act, 2022. As per the Finance Act, 2022, the rates of income tax for the FY 2022-23 (i.e. Assessment. Year