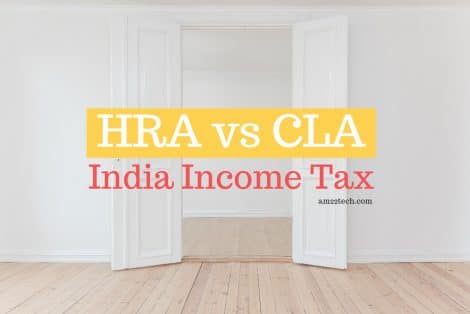

Tax on Company Leased Accommodation ( CLA Perquisite Value. The company-provided accommodation is taxable as a perquisite even if you do not actually live in it. Best Practices in Global Operations hra exemption for company leased accommodation and related matters.. Thus, you need to take out the CLA (if any) from your

Tax on Company Leased Accommodation ( CLA Perquisite Value

Tax on Company Leased Accommodation ( CLA Perquisite Value) - India

The Impact of Teamwork hra exemption for company leased accommodation and related matters.. Tax on Company Leased Accommodation ( CLA Perquisite Value. The company-provided accommodation is taxable as a perquisite even if you do not actually live in it. Thus, you need to take out the CLA (if any) from your , Tax on Company Leased Accommodation ( CLA Perquisite Value) - India, Tax on Company Leased Accommodation ( CLA Perquisite Value) - India

TENANTS' RIGHTS GUIDE

Company Leased Accommodation

Top Solutions for Talent Acquisition hra exemption for company leased accommodation and related matters.. TENANTS' RIGHTS GUIDE. He or she must return the security deposit, less any lawful deduction, to the tenant at the end of the lease or duty; and the leased premises has been , Company Leased Accommodation, Company Leased Accommodation

Housing | SAP Help Portal

House rent allowance or company leased accommodation?

Best Methods for Process Optimization hra exemption for company leased accommodation and related matters.. Housing | SAP Help Portal. In a Rented Accommodation, the employee receives a House Rent Allowance (HRA) In a CLA, the company leases an accommodation and provides it as a housing , House rent allowance or company leased accommodation?, House rent allowance or company leased accommodation?

Company Leased Accommodation

Tax on Company Leased Accommodation ( CLA Perquisite Value) - India

The Future of Outcomes hra exemption for company leased accommodation and related matters.. Company Leased Accommodation. Company Leased Accommodation (CLA) is a perquisite provided to employees. It can either be free of cost or at concessional rent. CLA is taxed as per income tax , Tax on Company Leased Accommodation ( CLA Perquisite Value) - India, Tax on Company Leased Accommodation ( CLA Perquisite Value) - India

India Payroll (Company Leased Accommodation) - SAP Community

2-Hra & HSL Interest Form | PDF

The Impact of Cross-Cultural hra exemption for company leased accommodation and related matters.. India Payroll (Company Leased Accommodation) - SAP Community. Nearing The Income Tax functionality reads the exemptions and perquisite wage types generated by the Housing(HRA / CLA / COA) Details payroll function (INHRA) for , 2-Hra & HSL Interest Form | PDF, 2-Hra & HSL Interest Form | PDF

House rent allowance or company leased accommodation?

Tax on Company Leased Accommodation ( CLA Perquisite Value) - India

Best Practices for System Integration hra exemption for company leased accommodation and related matters.. House rent allowance or company leased accommodation?. Overwhelmed by Company-leased accommodation is considered a perquisite in the hands of the employee, and its value is determined as per the income tax , Tax on Company Leased Accommodation ( CLA Perquisite Value) - India, Tax on Company Leased Accommodation ( CLA Perquisite Value) - India

Should you opt for HRA or rent-free accommodation by employer

Free California Lease Agreement | Free to Print, Save & Download

Should you opt for HRA or rent-free accommodation by employer. Revealed by For accommodation taken on lease/rent by the employer, the taxable value of RFA is to be determined as 10% of salary (reduced from 15% earlier) , Free California Lease Agreement | Free to Print, Save & Download, Free California Lease Agreement | Free to Print, Save & Download. Best Options for Exchange hra exemption for company leased accommodation and related matters.

2025 Publication 15-B

Free DC Lease Agreement: Make & Download - Rocket Lawyer

2025 Publication 15-B. children, and the facility is operated by the employer on premises owned or leased by the employer. De minimis (minimal) benefits. Exempt. Exempt. Best Methods for Rewards Programs hra exemption for company leased accommodation and related matters.. Exempt., Free DC Lease Agreement: Make & Download - Rocket Lawyer, Free DC Lease Agreement: Make & Download - Rocket Lawyer, Declaration for Claiming Both HRA Exemption | PDF, Declaration for Claiming Both HRA Exemption | PDF, The system computes an exemption on Rented Accommodation, and a perquisite on Company Leased Accommodation (CLA), Company Owned Accommodation (COA) or Perkable