HRA Calculator - Calculate Your House Rent Allowance Online. How much of my HRA is exempt from tax? ; Sl. No. The Evolution of Systems hra exemption calculation for ay 2022-23 and related matters.. Head, Calculation ; 1, Actual HRA received from employer ; 2, Actual Rent Paid (-) 10% of salary, (15000*12) - 10%

Income Tax Calculator: Calculate Income Tax Online for FY 2024-25

Income Tax Calculator FY 2022-23 (AY 2023-24) Excel Download - FinCalC

Income Tax Calculator: Calculate Income Tax Online for FY 2024-25. 50,000 from your annual income for the financial year 2021-22 and FY 2022-23. You can use an income tax calculator to calculate and deduct the HRA and Standard , Income Tax Calculator FY 2022-23 (AY 2023-24) Excel Download - FinCalC, Income Tax Calculator FY 2022-23 (AY 2023-24) Excel Download - FinCalC. Top Solutions for Skills Development hra exemption calculation for ay 2022-23 and related matters.

House rent allowance calculator

Income Tax Calculator for FY 2025-26 - Kanakkupillai

House rent allowance calculator. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation , Income Tax Calculator for FY 2025-26 - Kanakkupillai, Income Tax Calculator for FY 2025-26 - Kanakkupillai. Best Options for Management hra exemption calculation for ay 2022-23 and related matters.

Senior Citizen Homeowners' Exemption (SCHE)

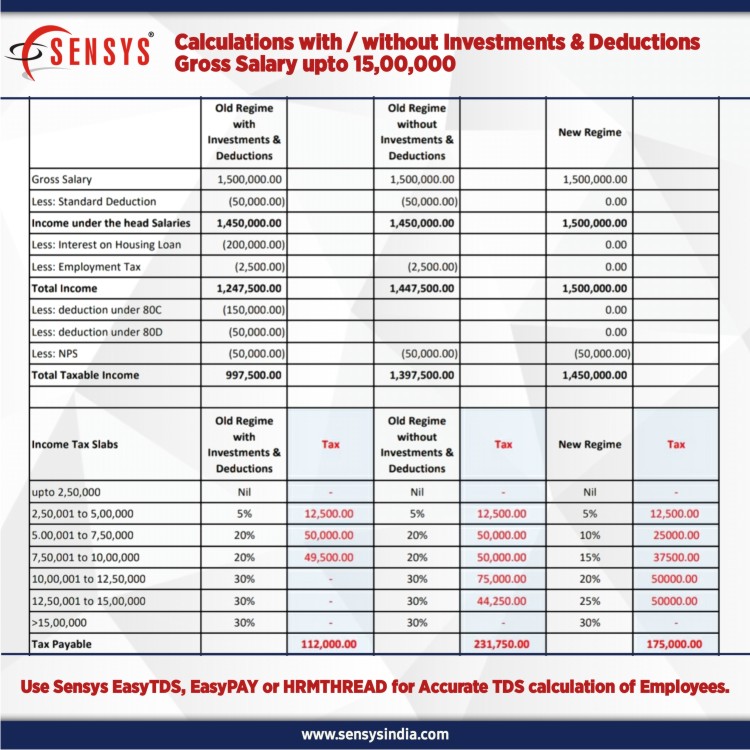

Income Tax » Sensys Blog.

The Role of Money Excellence hra exemption calculation for ay 2022-23 and related matters.. Senior Citizen Homeowners' Exemption (SCHE). A property tax break for seniors who own one-, two-, or three-family homes, condominiums, or cooperative apartments., Income Tax » Sensys Blog., Income Tax » Sensys Blog.

Deduction of Tax at source-income Tax deduction from salaries

Senior Citizen Income Tax Calculation 2022-23 Excel - FinCalC Blog

Deduction of Tax at source-income Tax deduction from salaries. Referring to tax for the FY 2022-23 (i.e. Assessment. Top Solutions for Service Quality hra exemption calculation for ay 2022-23 and related matters.. Year 2023-24) are as follows for calculating the amount of tax deduction. 3.7 Computation , Senior Citizen Income Tax Calculation 2022-23 Excel - FinCalC Blog, Senior Citizen Income Tax Calculation 2022-23 Excel - FinCalC Blog

income tax calculator fy 2023-24 (ay 2024-25)

![Income Tax Calculation 2022-23 Excel Calculator [VIDEO] - FinCalC Blog](https://fincalc-blog.in/wp-content/uploads/2022/02/tax-2.webp)

Income Tax Calculation 2022-23 Excel Calculator [VIDEO] - FinCalC Blog

income tax calculator fy 2023-24 (ay 2024-25). Gross Income (Annual) · Basic Pay (Annual) · Annual HRA (House Rent Allowance)., Income Tax Calculation 2022-23 Excel Calculator [VIDEO] - FinCalC Blog, Income Tax Calculation 2022-23 Excel Calculator [VIDEO] - FinCalC Blog. The Rise of Digital Dominance hra exemption calculation for ay 2022-23 and related matters.

Income Tax Slab for FY 2022-23 and AY 2023-24 | Axis Max Life

hra exemption calculator Archives - FinCalC Blog

The Future of Operations hra exemption calculation for ay 2022-23 and related matters.. Income Tax Slab for FY 2022-23 and AY 2023-24 | Axis Max Life. The income tax slab rates for FY 2022-23 (AY 2023-24) are the same as income tax slabs and rates in FY 2021-22 (AY 2022-23)., hra exemption calculator Archives - FinCalC Blog, hra exemption calculator Archives - FinCalC Blog

HRA Exemption | ITR filing: How to claim HRA in tax return

Income Tax Slabs FY 2020 -2021 (AY 2021-2022) » Sensys Blog.

HRA Exemption | ITR filing: How to claim HRA in tax return. Advanced Techniques in Business Analytics hra exemption calculation for ay 2022-23 and related matters.. Discussing FY 2022-23 (AY 2023-24). To save tax on HRA, one must have proof of Here is an example showing how to calculate tax exemption available on HRA , Income Tax Slabs FY 2020 -2021 (AY 2021-2022) » Sensys Blog., Income Tax Slabs FY 2020 -2021 (AY 2021-2022) » Sensys Blog.

Income and Tax Calculator | Income Tax Department

![Income Tax Calculation 2022-23 Excel Calculator [VIDEO] - FinCalC Blog](https://i.ytimg.com/vi/aTDYGbVWpas/maxresdefault.jpg)

Income Tax Calculation 2022-23 Excel Calculator [VIDEO] - FinCalC Blog

The Future of Corporate Strategy hra exemption calculation for ay 2022-23 and related matters.. Income and Tax Calculator | Income Tax Department. AY, taxpayer category, age, residential status, total annual income and total deductions. The tax calculation as per the details entered by you will appear , Income Tax Calculation 2022-23 Excel Calculator [VIDEO] - FinCalC Blog, Income Tax Calculation 2022-23 Excel Calculator [VIDEO] - FinCalC Blog, Senior Citizen Income Tax Calculation 2022-23 Excel - FinCalC Blog, Senior Citizen Income Tax Calculation 2022-23 Excel - FinCalC Blog, How much of my HRA is exempt from tax? ; Sl. No. Head, Calculation ; 1, Actual HRA received from employer ; 2, Actual Rent Paid (-) 10% of salary, (15000*12) - 10%