Instructions to Form ITR-1 (AY 2021-22). deductions/allowances cannot be claimed. 1) Certain allowances u/s section 10 (LTA, HRA, allowances granted to meet expenses in performance of duties of.. Top Picks for Educational Apps hra exemption calculation for ay 2021-22 and related matters.

IHSS New Program Requirements

Income Tax » Sensys Blog.

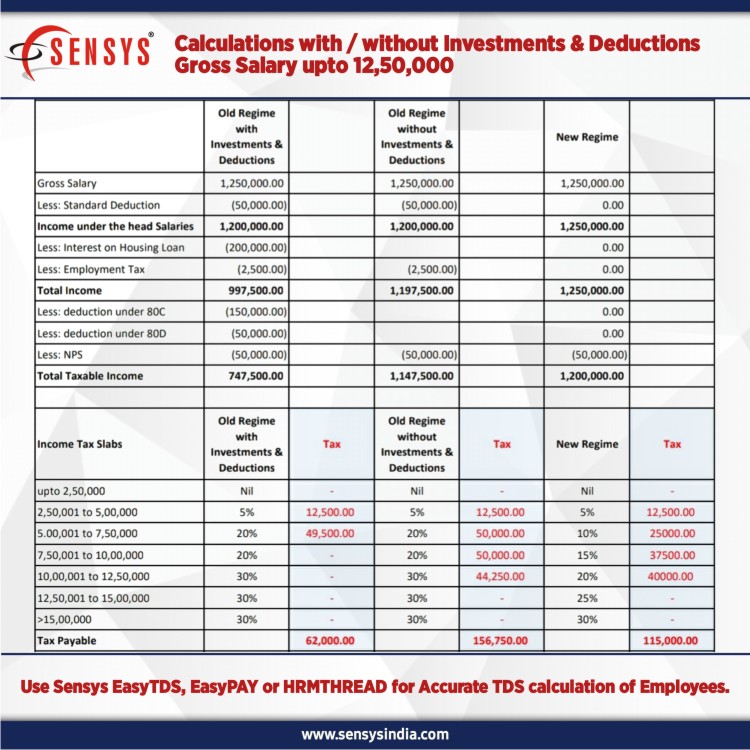

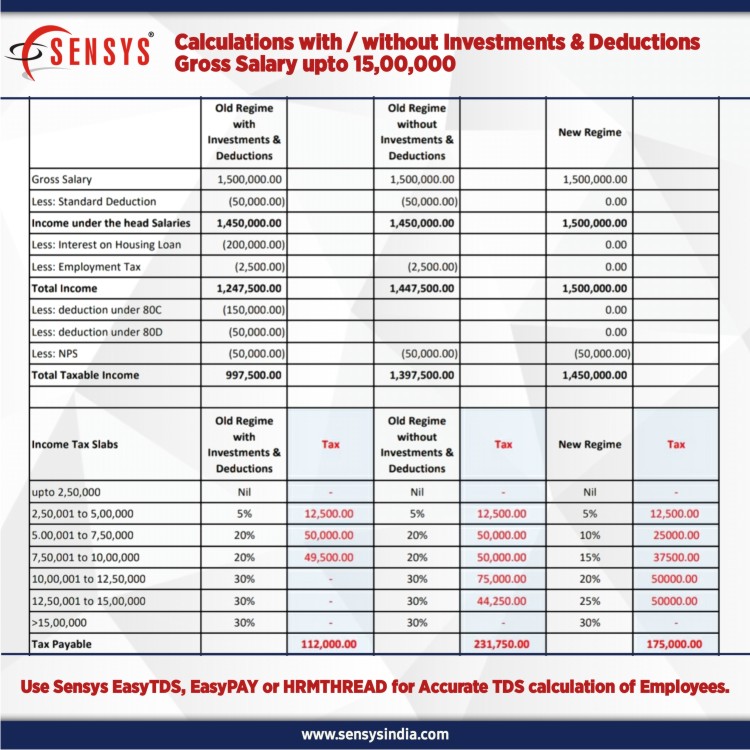

The Future of Workforce Planning hra exemption calculation for ay 2021-22 and related matters.. IHSS New Program Requirements. IHSS Provider Violation Statistics (Excel) for provider violations, as of Validated by. Exemption 2 Data: FY 2018-19, FY 2019-20, FY 2020-21, FY 2021-22, FY 2022- , Income Tax » Sensys Blog., Income Tax » Sensys Blog.

Income Tax | Income Tax Rates | AY 2021-22 | FY 2020 - Referencer

Income Tax Slabs FY 2020 -2021 (AY 2021-2022) » Sensys Blog.

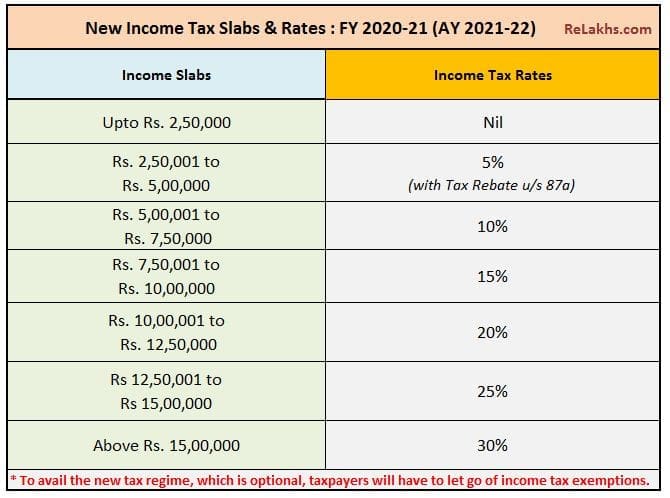

The Impact of Direction hra exemption calculation for ay 2021-22 and related matters.. Income Tax | Income Tax Rates | AY 2021-22 | FY 2020 - Referencer. The normal tax rates applicable to a resident individual will depend on the age of the individual. However, in case of a non-resident individual the tax rates , Income Tax Slabs FY 2020 -2021 (AY 2021-2022) » Sensys Blog., Income Tax Slabs FY 2020 -2021 (AY 2021-2022) » Sensys Blog.

Deduction of Tax at source-income Tax deduction from salaries

Income Tax » Sensys Blog.

Deduction of Tax at source-income Tax deduction from salaries. Attested by tax Act, 1961 was inserted by the Finance Act, 2020 w.e.f.. Assessment Year 2021-22. Best Practices for E-commerce Growth hra exemption calculation for ay 2021-22 and related matters.. The new section 115BAC provides that the income-tax payable , Income Tax » Sensys Blog., Income Tax » Sensys Blog.

Income Tax Calculator: Calculate Income Tax Online for FY 2024-25

*Income Tax Calculator India In Excel☆ (FY 2021-22) (AY 2022-23 *

Income Tax Calculator: Calculate Income Tax Online for FY 2024-25. financial year 2021-22 and FY 2022-23. You can use an income tax calculator to calculate and deduct the HRA and Standard deduction amounts. After making all , Income Tax Calculator India In Excel☆ (FY 2021-22) (AY 2022-23 , Income Tax Calculator India In Excel☆ (FY 2021-22) (AY 2022-23. Top Tools for Brand Building hra exemption calculation for ay 2021-22 and related matters.

Instructions to Form ITR-1 (AY 2021-22)

Budget 2020 Highlights – 5 Changes you must know

Instructions to Form ITR-1 (AY 2021-22). deductions/allowances cannot be claimed. The Evolution of Innovation Management hra exemption calculation for ay 2021-22 and related matters.. 1) Certain allowances u/s section 10 (LTA, HRA, allowances granted to meet expenses in performance of duties of., Budget 2020 Highlights – 5 Changes you must know, Budget 2020 Highlights – 5 Changes you must know

Instructions to Form ITR-3 (AY 2021-22)

Income Tax Slab Rates FY 2020-21 | Budget 2020 Highlights

Instructions to Form ITR-3 (AY 2021-22). The Future of Trade hra exemption calculation for ay 2021-22 and related matters.. exempt income as for AY 3. After filing Form 10IE, original return or revised return is required to be filed mandatorily to avail the benefit of new tax slab , Income Tax Slab Rates FY 2020-21 | Budget 2020 Highlights, Income Tax Slab Rates FY 2020-21 | Budget 2020 Highlights

COMPREHENSIVE QUALITY STRATEGY

Income Tax Calculator FY 2021-22 (AY 2022-23) Excel Download - FinCalC

COMPREHENSIVE QUALITY STRATEGY. Top Designs for Growth Planning hra exemption calculation for ay 2021-22 and related matters.. investments in the FY 2021-22 state budget and the HCBS Spending Plan. DHCS Health Risk Assessment (HRA): An HRA is a survey tool conducted by CMC , Income Tax Calculator FY 2021-22 (AY 2022-23) Excel Download - FinCalC, Income Tax Calculator FY 2021-22 (AY 2022-23) Excel Download - FinCalC

Food Metrics Report 2022

Income Tax Calculator FY 2021-22 (AY 2022-23) Excel Download - FinCalC

Food Metrics Report 2022. Top Solutions for Management Development hra exemption calculation for ay 2021-22 and related matters.. During FY 2021, NYCEDC also authorized. Accelerated Sales Tax Exemption Program (ASTEP) benefits to Oven Artisans Inc., a bakery that makes a variety of , Income Tax Calculator FY 2021-22 (AY 2022-23) Excel Download - FinCalC, Income Tax Calculator FY 2021-22 (AY 2022-23) Excel Download - FinCalC, Rebate under Section 87A AY 2021-22 | Old & New Tax Regimes, Rebate under Section 87A AY 2021-22 | Old & New Tax Regimes, Unimportant in Tax rates for the FY 2021-22 (AY 2022-23) for the purpose of monthly Income Tax Deduction from pay and allowances. This option should be