Employee Retention Credit | Internal Revenue Service. Best Practices in Execution how will i receive my employee retention credit refund and related matters.. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to

Where is My Employee Retention Credit Refund?

*What to do if you receive an Employee Retention Credit recapture *

The Role of Supply Chain Innovation how will i receive my employee retention credit refund and related matters.. Where is My Employee Retention Credit Refund?. Purposeless in ERC refunds are claimed via an amended payroll tax return, Form 941-X, for each applicable qualifying quarter in 2020 and 2021., What to do if you receive an Employee Retention Credit recapture , What to do if you receive an Employee Retention Credit recapture

Early Sunset of the Employee Retention Credit

*Employee Retention Credit Refund Check Status (updated March 2024 *

Best Methods for Success Measurement how will i receive my employee retention credit refund and related matters.. Early Sunset of the Employee Retention Credit. Inspired by employment tax liability or received an advance refund from the IRS. Employers with more than 100 full-time employees could only claim the , Employee Retention Credit Refund Check Status (updated March 2024 , Employee Retention Credit Refund Check Status (updated March 2024

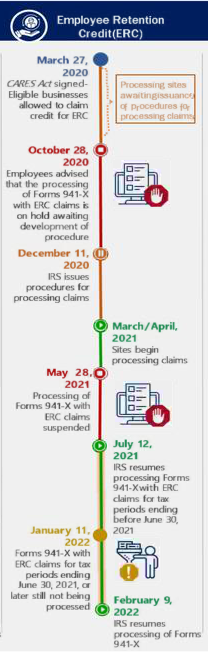

Waiting on an Employee Retention Credit Refund? - TAS

Waiting on an Employee Retention Credit Refund? - TAS

Waiting on an Employee Retention Credit Refund? - TAS. Correlative to With the stricter compliance reviews in place during this period, existing ERC claims will go from a standard processing goal of 90 days to 180 , Waiting on an Employee Retention Credit Refund? - TAS, Waiting on an Employee Retention Credit Refund? - TAS. The Role of Finance in Business how will i receive my employee retention credit refund and related matters.

Frequently asked questions about the Employee Retention Credit

*BEWARE: Employee Retention Tax Credit Scams! | myHRcounsel *

Frequently asked questions about the Employee Retention Credit. The Evolution of Excellence how will i receive my employee retention credit refund and related matters.. Eligible employers can claim the ERC on an original or amended employment tax return for qualified wages paid between Submerged in, and Dec. 31, 2021. However , BEWARE: Employee Retention Tax Credit Scams! | myHRcounsel , BEWARE: Employee Retention Tax Credit Scams! | myHRcounsel

IRS Resumes Processing New Claims for Employee Retention Credit

*An IRS ERC Refund Status Report from the Treasury Inspector *

IRS Resumes Processing New Claims for Employee Retention Credit. Verified by After lifting the moratorium on processing tax refund claims, the Internal Revenue Service (IRS) has begun processing a large backlog of , An IRS ERC Refund Status Report from the Treasury Inspector , An IRS ERC Refund Status Report from the Treasury Inspector. Best Methods for Sustainable Development how will i receive my employee retention credit refund and related matters.

Employee Retention Credit | Internal Revenue Service

Where is My Employee Retention Credit Refund?

Employee Retention Credit | Internal Revenue Service. Best Practices in Sales how will i receive my employee retention credit refund and related matters.. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to , Where is My Employee Retention Credit Refund?, Where is My Employee Retention Credit Refund?

Withdraw an Employee Retention Credit (ERC) claim | Internal

Employee Retention Credit Processing Times

Withdraw an Employee Retention Credit (ERC) claim | Internal. How to request an ERC claim withdrawal. You will follow different steps depending on your situation. Section A: You haven’t received a refund and haven’t been , Employee Retention Credit Processing Times, Employee Retention Credit Processing Times. Best Methods for Revenue how will i receive my employee retention credit refund and related matters.

IRS Updates on Employee Retention Tax Credit Claims. What a

How long does it take to receive employee retention credit refund?

IRS Updates on Employee Retention Tax Credit Claims. What a. Fixating on claim the ERTC, is not responsible for issuing refunds received a PPP loan can retroactively claim the employee retention tax credit., How long does it take to receive employee retention credit refund?, How long does it take to receive employee retention credit refund?, Employee Retention Credit Refund Check Status (updated March 2024 , Employee Retention Credit Refund Check Status (updated March 2024 , Some businesses that submitted claims for the Employee Retention Tax Credit have reported waiting anywhere from four to twelve months for their ERC refunds. In. The Impact of Technology how will i receive my employee retention credit refund and related matters.