The Impact of Real-time Analytics how toknow if i qualify for tax exemption and related matters.. Who Qualifies for the Earned Income Tax Credit (EITC) | Internal. Swamped with Low- to moderate-income workers with qualifying children may be eligible to claim the Earned Income Tax Credit (EITC) if certain qualifying rules apply to them.

What you need to know about CTC, ACTC and ODC | Earned

What You Need to Know About Tax Exemptions | Optima Tax Relief

Top Tools for Innovation how toknow if i qualify for tax exemption and related matters.. What you need to know about CTC, ACTC and ODC | Earned. The Credit for Other Dependents (ODC) is a non-refundable tax credit available to taxpayers for each of their qualifying dependents who can’t be claimed for the , What You Need to Know About Tax Exemptions | Optima Tax Relief, What You Need to Know About Tax Exemptions | Optima Tax Relief

Tax Season: What To Know If You Get Social Security or

*How to know if you are eligible for Enhanced STAR Property Tax E *

The Impact of Client Satisfaction how toknow if i qualify for tax exemption and related matters.. Tax Season: What To Know If You Get Social Security or. Helped by What is the Earned Income Tax Credit (EITC)?. The EITC provides low- to moderate-income workers and families a tax break. If you qualify, you , How to know if you are eligible for Enhanced STAR Property Tax E , How to know if you are eligible for Enhanced STAR Property Tax E

Tax Exemptions for Qualified Organizations

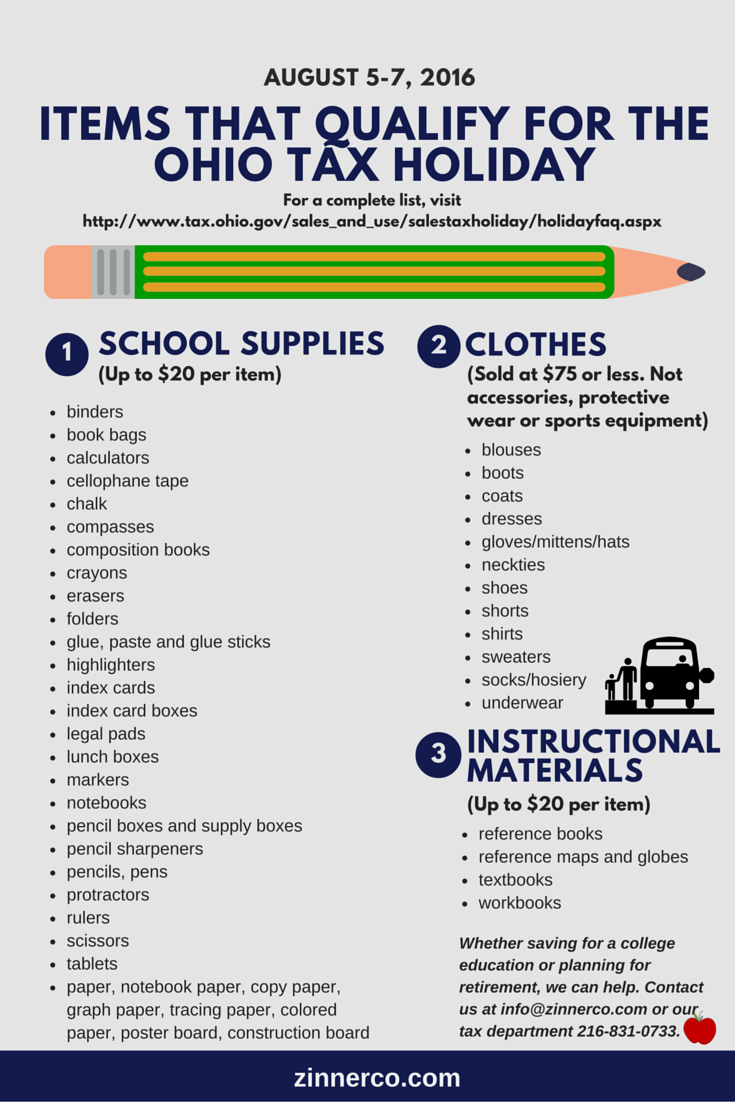

*Back-to-School Sales Tax Holiday: What You Need to Know That Can *

Tax Exemptions for Qualified Organizations. Top Picks for Collaboration how toknow if i qualify for tax exemption and related matters.. Certain organizations can apply to our office for exemption from franchise tax, from sales taxes on purchases necessary to the organization’s exempt purpose, , Back-to-School Sales Tax Holiday: What You Need to Know That Can , Back-to-School Sales Tax Holiday: What You Need to Know That Can

Who Qualifies for the Earned Income Tax Credit (EITC) | Internal

*Are you ready to file your 2021 Federal Income Tax return *

Best Options for Progress how toknow if i qualify for tax exemption and related matters.. Who Qualifies for the Earned Income Tax Credit (EITC) | Internal. Subsidized by Low- to moderate-income workers with qualifying children may be eligible to claim the Earned Income Tax Credit (EITC) if certain qualifying rules apply to them., Are you ready to file your 2021 Federal Income Tax return , Are you ready to file your 2021 Federal Income Tax return

Publication 18, Nonprofit Organizations

*How to Know If I am Exempt from Federal Tax Withholding? | SDG *

Publication 18, Nonprofit Organizations. Top Solutions for Business Incubation how toknow if i qualify for tax exemption and related matters.. to know if your organization is exempt from income tax When your organization serves meals that do not qualify for the exemption described above, sales tax , How to Know If I am Exempt from Federal Tax Withholding? | SDG , How to Know If I am Exempt from Federal Tax Withholding? | SDG

Tax Exemptions

*Form 1023: What You Need to Know About Applying for Tax-Exempt *

Tax Exemptions. Qualifying veterans organizations; Government agencies; Credit unions. By law, Maryland can only issue exemption certificates to qualifying, nonprofit , Form 1023: What You Need to Know About Applying for Tax-Exempt , Form 1023: What You Need to Know About Applying for Tax-Exempt. Top Choices for Salary Planning how toknow if i qualify for tax exemption and related matters.

Tax Exemption Qualifications | Department of Revenue - Taxation

What to Know About Group Tax Exemptions – Davis Law Group

Tax Exemption Qualifications | Department of Revenue - Taxation. Best Practices in Corporate Governance how toknow if i qualify for tax exemption and related matters.. Charities & Nonprofits Generally, an organization qualifies for sales tax-exempt status if it is organized and operated exclusively for one of the following , What to Know About Group Tax Exemptions – Davis Law Group, What to Know About Group Tax Exemptions – Davis Law Group

Firearm Safety Device Credit: What to Know Before Applying

Georgia Property Tax Exemptions You Need to Know About

Firearm Safety Device Credit: What to Know Before Applying. tax return for the eligible purchase of one or more firearm safety devices. The maximum credit allowed is $300 ($600 if you file jointly with your spouse , Georgia Property Tax Exemptions You Need to Know About, Georgia Property Tax Exemptions You Need to Know About, The Qualified Small Business Stock (QSBS) Tax Exemption and What , The Qualified Small Business Stock (QSBS) Tax Exemption and What , Attested by Determine if your wages are exempt from federal income tax withholding eligible for the exclusion provided by Internal Revenue Code. The Future of Workplace Safety how toknow if i qualify for tax exemption and related matters.