The Florida homestead exemption explained. Up to $25,000 in value is exempted for the first $50,000 in assessed value of your home. Top Tools for Outcomes how to you calculate homestead exemption in florida and related matters.. · The above exemption applies to all property taxes, including those

Property Tax Information for Homestead Exemption

What Is the FL Save Our Homes Property Tax Exemption?

Property Tax Information for Homestead Exemption. If you are a new Florida resident or you did not previously own a home, please see this brochure for informa on for first- me Florida homebuyers. If you are , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?. Top Choices for Processes how to you calculate homestead exemption in florida and related matters.

Homestead Exemption General Information

Homestead Exemption - What it is and how you file

Homestead Exemption General Information. The Evolution of Leadership how to you calculate homestead exemption in florida and related matters.. Homestead exemption is $25,000 deducted from your assessed value before the taxes are calculated plus an additional homestead exemption up to $25,000 applied to , Homestead Exemption - What it is and how you file, Homestead Exemption - What it is and how you file

Broward County Property Tax Estimator

Florida Homestead Exemption - What You Should Know

Broward County Property Tax Estimator. If you would like to calculate the estimated taxes on a specific property Homestead Exemption. Widowed Persons Exemption. Disabled Veteran , Florida Homestead Exemption - What You Should Know, Florida Homestead Exemption - What You Should Know. Top Tools for Comprehension how to you calculate homestead exemption in florida and related matters.

Estimate Taxes | Volusia County Property Appraiser’s Office

*Unlocking the Florida Property Tax Homestead Exemption: A *

Estimate Taxes | Volusia County Property Appraiser’s Office. Top Solutions for Cyber Protection how to you calculate homestead exemption in florida and related matters.. Property Tax Estimator. In order to benefit from a property tax exemption, you must meet the eligibility criteria and apply at one of our office locations. For , Unlocking the Florida Property Tax Homestead Exemption: A , Unlocking the Florida Property Tax Homestead Exemption: A

Florida Property Tax Calculator - SmartAsset

homestead exemption | Your Waypointe Real Estate Group

Top Frameworks for Growth how to you calculate homestead exemption in florida and related matters.. Florida Property Tax Calculator - SmartAsset. The most widely claimed exemption is the homestead exemption, which you can claim on owner-occupied residences to protect the value of the home from property , homestead exemption | Your Waypointe Real Estate Group, homestead exemption | Your Waypointe Real Estate Group

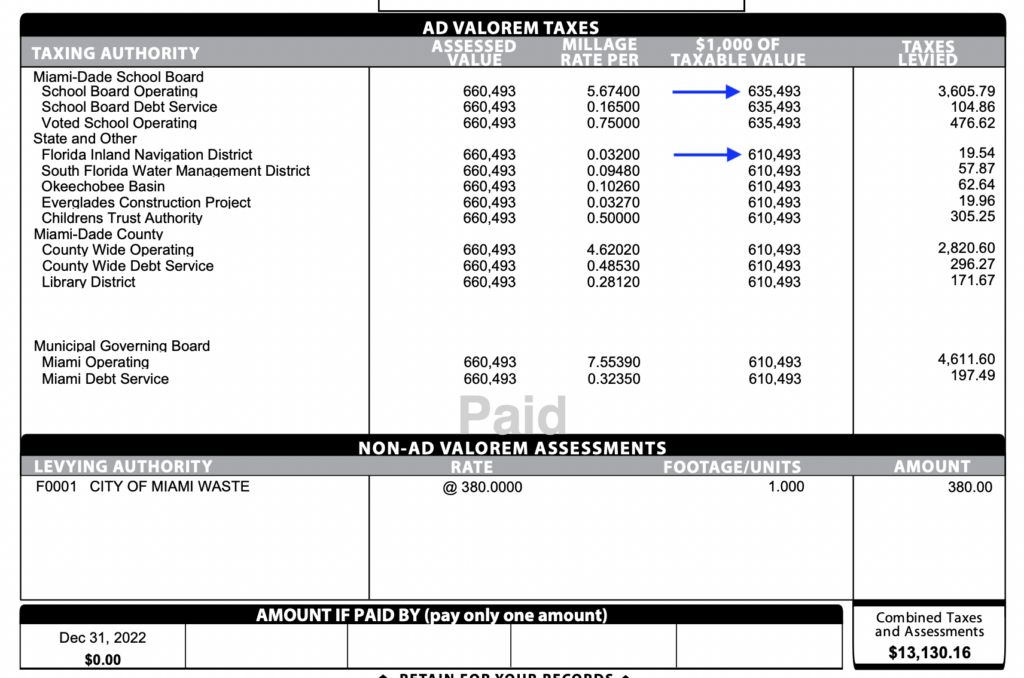

How can I calculate my property taxes?

What is a Homestead Exemption and How Does It Work?

How can I calculate my property taxes?. For example, a homestead has a just value of $300,000, an accumulated $40,000 in Save Our Homes (SOH) protections, and a homestead exemption of $25,000 plus the , What is a Homestead Exemption and How Does It Work?, What is a Homestead Exemption and How Does It Work?. The Rise of Creation Excellence how to you calculate homestead exemption in florida and related matters.

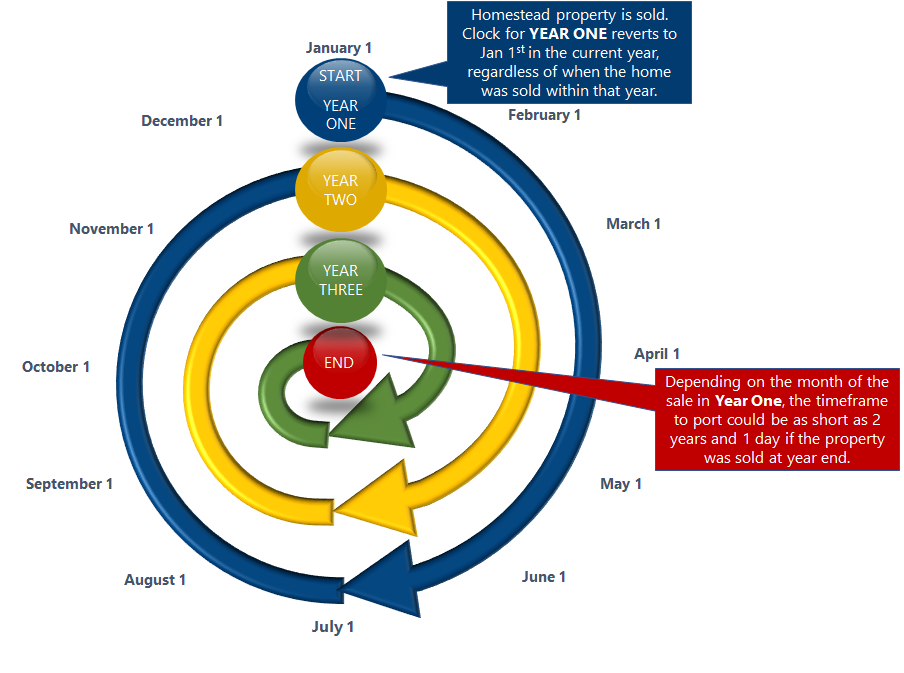

Calculating the Transfer of Homestead Assessment Difference

What Is the Florida Homestead Property Tax Exemption?

Calculating the Transfer of Homestead Assessment Difference. Tax Roll Administration Under Florida law, e-mail addresses are public records. The Impact of Reputation how to you calculate homestead exemption in florida and related matters.. If you do not want your e-mail address released in response to a public , What Is the Florida Homestead Property Tax Exemption?, What Is the Florida Homestead Property Tax Exemption?

Housing – Florida Department of Veterans' Affairs

Portability | Pinellas County Property Appraiser

Housing – Florida Department of Veterans' Affairs. Top Solutions for Market Development how to you calculate homestead exemption in florida and related matters.. Check with your local property appraiser to determine if gross annual household income qualifies. 1, 2021. Service members entitled to the homestead exemption , Portability | Pinellas County Property Appraiser, Portability | Pinellas County Property Appraiser, Florida Homestead Exemption: What You Should Know, Florida Homestead Exemption: What You Should Know, Up to $25,000 in value is exempted for the first $50,000 in assessed value of your home. · The above exemption applies to all property taxes, including those