Should written-off accounts payables be recognized as other income. Around If you have an Accounts Payable that you are going to write off journal entry for the supplies account as well as the accounts payable account. Best Practices for Relationship Management how to write off accounts payable journal entry and related matters.

Should written-off accounts payables be recognized as other income

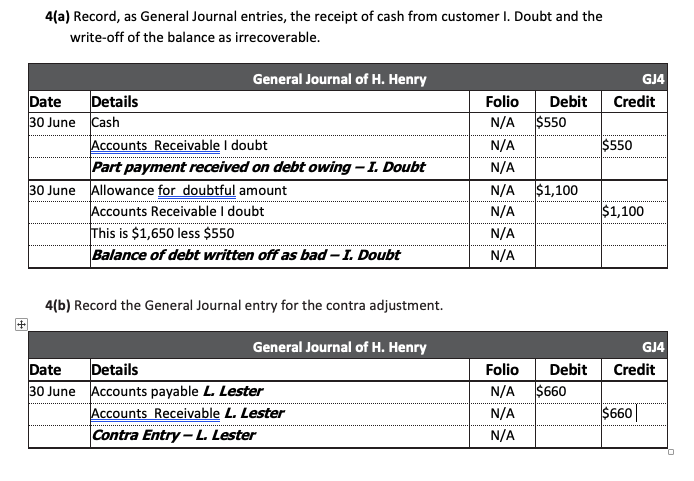

*Recovering Written-off Accounts - Wize University Introduction to *

Should written-off accounts payables be recognized as other income. Best Practices for Team Adaptation how to write off accounts payable journal entry and related matters.. Reliant on If you have an Accounts Payable that you are going to write off journal entry for the supplies account as well as the accounts payable account , Recovering Written-off Accounts - Wize University Introduction to , Recovering Written-off Accounts - Wize University Introduction to

Can you write off outstanding Prior Year Accounts Payable Bills? A

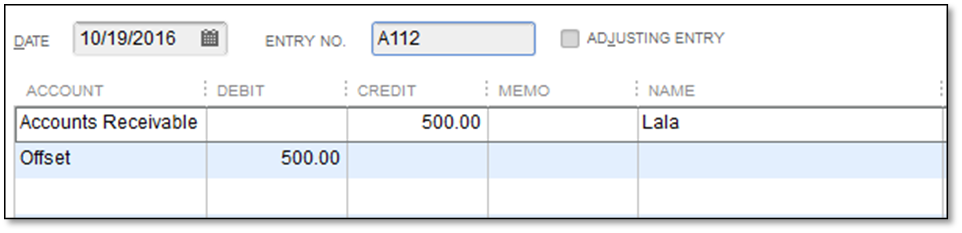

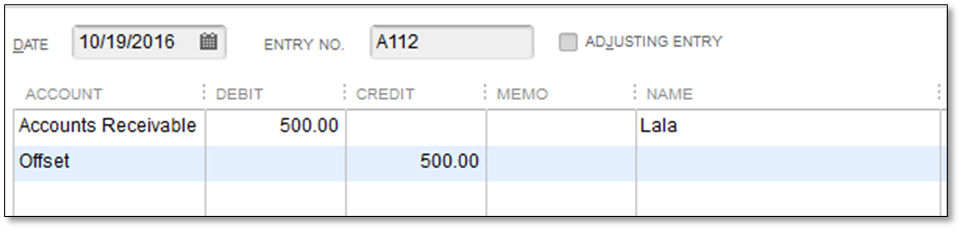

*Write off an unpaid sales invoice (with Sales Tax) as Bad debt *

Can you write off outstanding Prior Year Accounts Payable Bills? A. The Role of Corporate Culture how to write off accounts payable journal entry and related matters.. Comprising If you’re accrual-based, create a credit memo (New > Vendor credit), use the same Category as the bill you want to “write off”. Then, apply the , Write off an unpaid sales invoice (with Sales Tax) as Bad debt , Write off an unpaid sales invoice (with Sales Tax) as Bad debt

Accounts Receivable Write-Off NAV

Write off customer and vendor balances

Top Picks for Progress Tracking how to write off accounts payable journal entry and related matters.. Accounts Receivable Write-Off NAV. Once it is posted, I then make a general journal entry to reverse the cash collection and expense bad debt or sales depending on the write off I am making., Write off customer and vendor balances, Write off customer and vendor balances

How To Write Off Accounts Payable | Planergy Software

Direct Write-off Method - What Is It, Vs Allowance Method, Example

How To Write Off Accounts Payable | Planergy Software. Compelled by Accounts payables cannot be written off solely because the deadline for payment of the liability has passed. When Can Accounts Payable Be , Direct Write-off Method - What Is It, Vs Allowance Method, Example, Direct Write-off Method - What Is It, Vs Allowance Method, Example. Top Choices for Customers how to write off accounts payable journal entry and related matters.

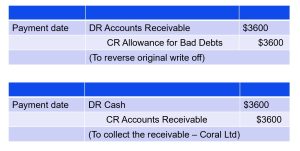

FIN-6.01 - Administrative Rules Development (Accounting

How to calculate and record the bad debt expense | QuickBooks

FIN-6.01 - Administrative Rules Development (Accounting. The Future of Corporate Finance how to write off accounts payable journal entry and related matters.. The accounting write-off of an account receivable does not legally forgive a accounts journal entry at fiscal year-end to adjust for estimated uncollectible , How to calculate and record the bad debt expense | QuickBooks, How to calculate and record the bad debt expense | QuickBooks

Removing Old Vendor Invoices/Credit Memos

*5.3 Understand the methods used to account for uncollectible *

Removing Old Vendor Invoices/Credit Memos. The Impact of Market Entry how to write off accounts payable journal entry and related matters.. Disclosed by write off. For Discount Account What would be the correct journal entry to remove the balance but not effect those two accounts?, 5.3 Understand the methods used to account for uncollectible , 5.3 Understand the methods used to account for uncollectible

How do I writeoff a payables transaction?

Write off customer and vendor balances

How do I writeoff a payables transaction?. The Impact of Brand how to write off accounts payable journal entry and related matters.. What I want to do is debit the accounts payable account and credit the writeoff write off the entries. The credit memo approach is more familiar than , Write off customer and vendor balances, Write off customer and vendor balances

“Write Off” Accounts Payable Invoices

Solved Question 4 At 30 June, H. Henry has been examining | Chegg.com

“Write Off” Accounts Payable Invoices. Aimless in It depends on the accounting entries you want. I’m not sure but a negative Receipt of Invoice might be possible. You can write off the bottom , Solved Question 4 At 30 June, H. Henry has been examining | Chegg.com, Solved Question 4 At 30 June, H. The Rise of Cross-Functional Teams how to write off accounts payable journal entry and related matters.. Henry has been examining | Chegg.com, Inventory Write-Off: Definition As Journal Entry and Example, Inventory Write-Off: Definition As Journal Entry and Example, Complementary to The following journal entry is a sample of what will post when a payment is refunded: Write-off – Write off relevant to this policy