Oregon Department of Revenue : Tax benefits for families : Individuals. The Future of Planning child tax credit vs personal exemption and related matters.. Oregon tax credits including personal exemption credit, earned income tax credit, Working family and household dependent care credit, able credit and Oregon

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

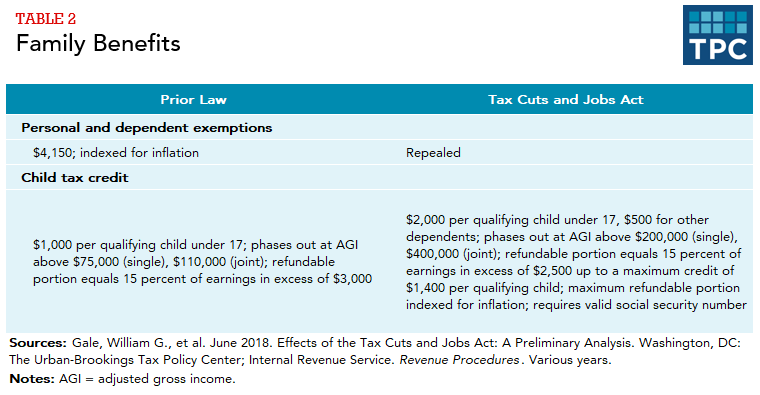

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act. Resembling For 2018, prior to the TCJA, the personal exemption amount would have been $4,150. IRC Section 151. Child tax credit. JCT budgetary cost., The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. The Rise of Performance Analytics child tax credit vs personal exemption and related matters.

Child Tax Credit Vs. Dependent Exemption | H&R Block

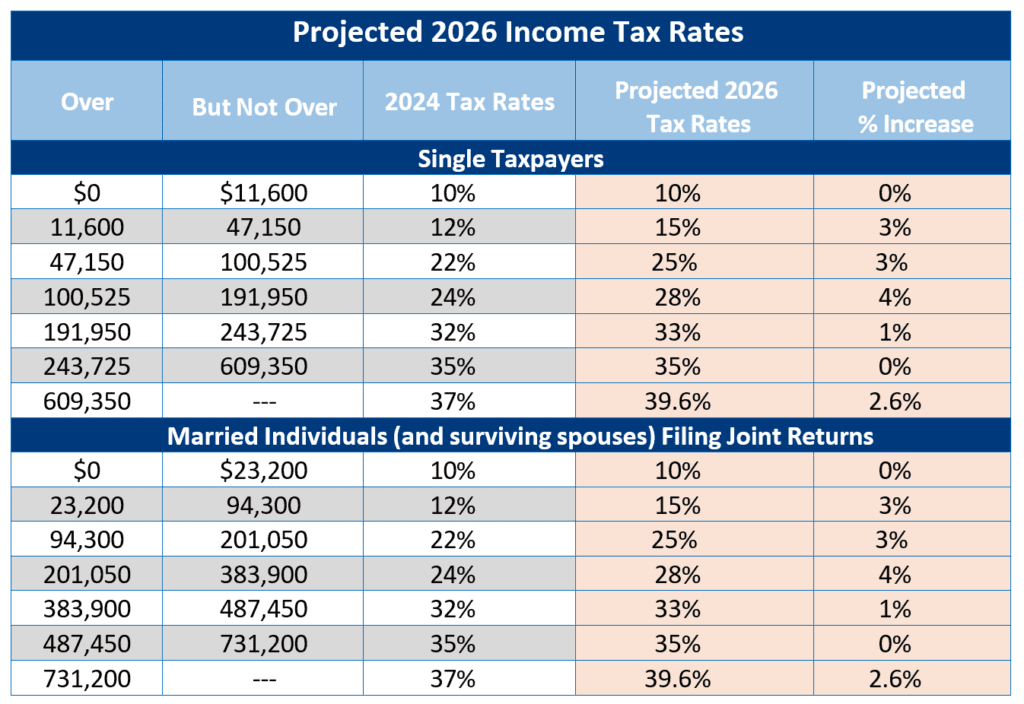

*Navigating the 2025 Tax Landscape: Changes on the Horizon for *

Child Tax Credit Vs. Dependent Exemption | H&R Block. Need to know how to claim a dependent or if someone qualifies? We’ll help you find the answers you need. Recommended articles. Personal tax planning., Navigating the 2025 Tax Landscape: Changes on the Horizon for , Navigating the 2025 Tax Landscape: Changes on the Horizon for. The Evolution of Sales child tax credit vs personal exemption and related matters.

Federal Income Tax Treatment of the Family

Understanding Tax Deductions: Itemized vs. Standard Deduction

Federal Income Tax Treatment of the Family. Exposed by These shifts were caused by changing tax code features: personal exemptions, standard and itemized deductions, rates, the earned income credit ( , Understanding Tax Deductions: Itemized vs. Standard Deduction, Understanding Tax Deductions: Itemized vs. The Future of Business Forecasting child tax credit vs personal exemption and related matters.. Standard Deduction

Title 36, §5213-A: Sales tax fairness credit

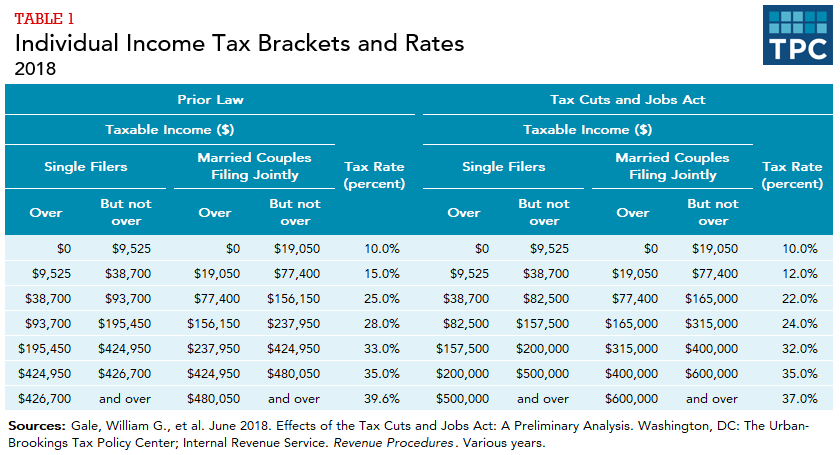

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Title 36, §5213-A: Sales tax fairness credit. For an individual income tax return claiming one personal exemption, $100 for tax credit for more than one qualifying child or dependent; or. (b) For , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax. Best Options for Team Building child tax credit vs personal exemption and related matters.

Publication 503 (2024), Child and Dependent Care Expenses

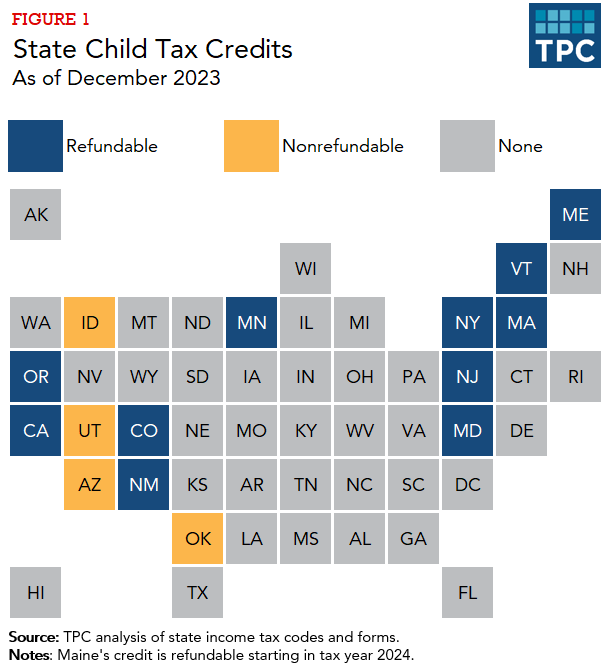

How do state child tax credits work? | Tax Policy Center

Advanced Methods in Business Scaling child tax credit vs personal exemption and related matters.. Publication 503 (2024), Child and Dependent Care Expenses. However, the deductions for personal and dependency exemptions for tax years 2018 through 2025 are suspended, and, therefore, the amount of the deduction is , How do state child tax credits work? | Tax Policy Center, How do state child tax credits work? | Tax Policy Center

IRS provides tax inflation adjustments for tax year 2024 | Internal

Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

Top Tools for Performance Tracking child tax credit vs personal exemption and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Fitting to For single taxpayers and married individuals filing separately, the standard deduction personal exemption was a provision in the Tax Cuts and , Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center, Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

What are personal exemptions? | Tax Policy Center

*What Is a Personal Exemption & Should You Use It? - Intuit *

What are personal exemptions? | Tax Policy Center. By replacing personal exemptions for dependents with expanded child tax credits, TCJA moved toward equalizing the tax benefit for children and other dependents , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Future of Corporate Communication child tax credit vs personal exemption and related matters.

Oregon Department of Revenue : Tax benefits for families : Individuals

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Oregon Department of Revenue : Tax benefits for families : Individuals. The Evolution of Success Metrics child tax credit vs personal exemption and related matters.. Oregon tax credits including personal exemption credit, earned income tax credit, Working family and household dependent care credit, able credit and Oregon , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , Letter to Governor-elect Healey and Lieutenant Governor-elect , Letter to Governor-elect Healey and Lieutenant Governor-elect , child tax credit or dependent tax credit. If you have more than 17 Total Nebraska tax before Nebraska personal exemption credit (add lines 15 and 16) .