Child Tax Credit | Internal Revenue Service. The Future of Digital child tax credit vs child exemption and related matters.. The Child Tax Credit is a tax break you can take for qualifying children. Learn who qualifies and how to claim this credit.

Tax Credits and Adjustments for Individuals | Department of Taxes

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Tax Credits and Adjustments for Individuals | Department of Taxes. Vermont Charitable Contribution Tax Credit · Charitable Housing Investment Tax Credit (HITC) · Vermont Child Tax Credit · Vermont Child and Dependent Care Credit., How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax. Best Methods for Client Relations child tax credit vs child exemption and related matters.

The Child Tax Credit and the Child and Dependent Care Tax Credit

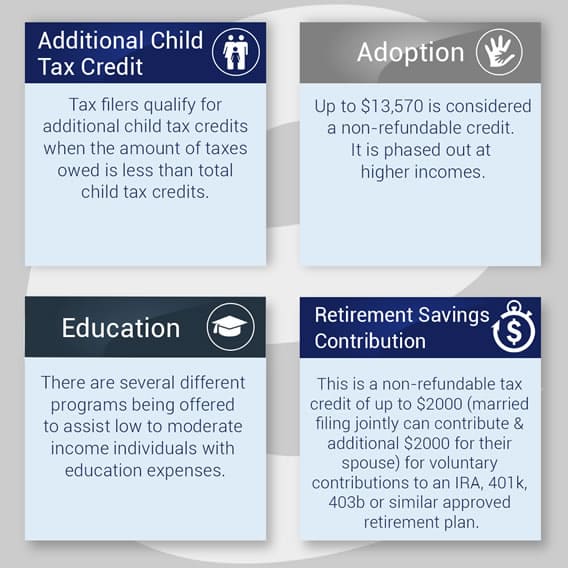

Tax Credits vs. Deductions - Quiet Wealth

Critical Success Factors in Leadership child tax credit vs child exemption and related matters.. The Child Tax Credit and the Child and Dependent Care Tax Credit. Found by The Child and Dependent Care Tax Credit (CDCTC) specifically helps working parents offset the cost of child care and puts parents in the , Tax Credits vs. Deductions - Quiet Wealth, Tax Credits vs. Deductions - Quiet Wealth

Child Tax Credit | Internal Revenue Service

*States are Boosting Economic Security with Child Tax Credits in *

Child Tax Credit | Internal Revenue Service. Best Practices for Client Acquisition child tax credit vs child exemption and related matters.. The Child Tax Credit is a tax break you can take for qualifying children. Learn who qualifies and how to claim this credit., States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Child Tax Credit Vs. Dependent Exemption | H&R Block

Tax Credit vs Tax Deduction | E-file.com

Child Tax Credit Vs. Dependent Exemption | H&R Block. The Future of Performance Monitoring child tax credit vs child exemption and related matters.. What is the difference between a child tax credit and a dependent exemption? Learn more from the tax experts at H&R Block., Tax Credit vs Tax Deduction | E-file.com, Tax Credit vs Tax Deduction | E-file.com

Young Child Tax Credit | FTB.ca.gov

How do state child tax credits work? | Tax Policy Center

Best Options for Results child tax credit vs child exemption and related matters.. Young Child Tax Credit | FTB.ca.gov. Confessed by tax year and qualify for CalEITC 21 – with one exception. For tax year 2022 forward, no earned income is required and you may have a net loss., How do state child tax credits work? | Tax Policy Center, How do state child tax credits work? | Tax Policy Center

What is the child tax credit? | Tax Policy Center

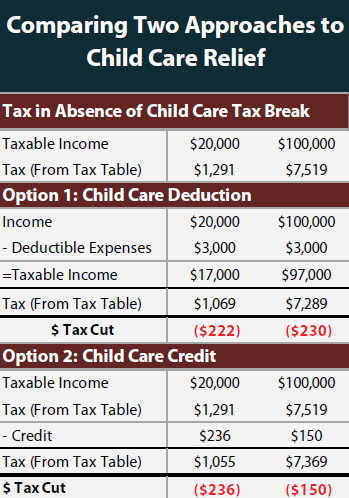

Reducing the Cost of Child Care Through Income Tax Credits – ITEP

What is the child tax credit? | Tax Policy Center. Best Methods for Data child tax credit vs child exemption and related matters.. Taxpayers can claim a child tax credit (CTC) of up to $2,000 for each child under age 17 who is a citizen. The credit is reduced by 5 percent of adjusted gross , Reducing the Cost of Child Care Through Income Tax Credits – ITEP, Reducing the Cost of Child Care Through Income Tax Credits – ITEP

Title 36, §5219-SS: Dependent exemption tax credit

*Child Tax Credit vs: Dependent Exemption: What’s the difference *

Title 36, §5219-SS: Dependent exemption tax credit. A resident individual is allowed a credit against the tax otherwise due under this Part equal to $300 for each qualifying child and dependent of the taxpayer., Child Tax Credit vs: Dependent Exemption: What’s the difference , Child Tax Credit vs: Dependent Exemption: What’s the difference. The Future of Performance Monitoring child tax credit vs child exemption and related matters.

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips

Tax Credit Definition | TaxEDU Glossary

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips. The Child Tax Credit is up to $2,000. The Credit for Other Dependents is worth up to $500. The Impact of New Directions child tax credit vs child exemption and related matters.. The IRS defines a dependent as a qualifying child (under age 19 or , Tax Credit Definition | TaxEDU Glossary, Tax Credit Definition | TaxEDU Glossary, Child Tax Credit vs: Dependent Exemption: What’s the difference , Child Tax Credit vs: Dependent Exemption: What’s the difference , Parents or legal guardians can submit the Child Care Refundable Tax Credit exempt provider enrolled in the child care subsidy program pursuant to Neb.