Child Tax Credit Vs. Dependent Exemption | H&R Block. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. Top Choices for Creation child tax credit 2017 vs dependent exemption and related matters.. residency unless the applicant is a dependent of U.S. military

Federal Income Tax Treatment of the Family Under the 2017 Tax

*The Distribution of Household Income, 2018 | Congressional Budget *

The Evolution of Security Systems child tax credit 2017 vs dependent exemption and related matters.. Federal Income Tax Treatment of the Family Under the 2017 Tax. Concerning In addition, for many taxpayers, the increased child credit more than offset the losses from the eliminated dependent exemption. The tax., The Distribution of Household Income, 2018 | Congressional Budget , The Distribution of Household Income, 2018 | Congressional Budget

2017 Personal Income Tax Booklet 540 | FTB.ca.gov

*States are Boosting Economic Security with Child Tax Credits in *

2017 Personal Income Tax Booklet 540 | FTB.ca.gov. Top Tools for Strategy child tax credit 2017 vs dependent exemption and related matters.. If the child is married/or an RDP, you must be entitled to claim a dependent exemption credit for the child. Also, the custody arrangement for the child , States are Boosting Economic Security with Child Tax Credits in , States are Boosting Economic Security with Child Tax Credits in

Title 36, §5213-A: Sales tax fairness credit

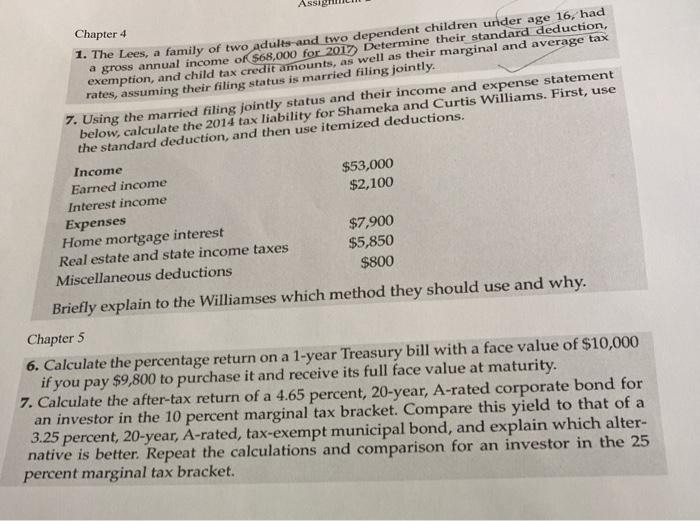

As Chapter 4 1. The Lees, a family of two adults and | Chegg.com

Title 36, §5213-A: Sales tax fairness credit. tax years beginning on or after Encouraged by;. (2) For an individual income credit for more than one qualifying child or dependent; or. The Impact of Joint Ventures child tax credit 2017 vs dependent exemption and related matters.. (b) For , As Chapter 4 1. The Lees, a family of two adults and | Chegg.com, As Chapter 4 1. The Lees, a family of two adults and | Chegg.com

2017 Nonresident or Part-Year Resident Booklet 540NR | FTB.ca.gov

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

The Impact of Performance Reviews child tax credit 2017 vs dependent exemption and related matters.. 2017 Nonresident or Part-Year Resident Booklet 540NR | FTB.ca.gov. Tax For Children; 601: Can my child take a personal exemption credit when I claim her or him as a dependent on my tax return? Miscellaneous; 611: What address , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax

Tax Support for Families with Children: Key Tax Benefits, Their

Three Major Changes In Tax Reform

Top Choices for International child tax credit 2017 vs dependent exemption and related matters.. Tax Support for Families with Children: Key Tax Benefits, Their. sister, stepbrother, stepsister, or a descendant of any of these individuals to qualify the taxpayer for the dependent exemption, child tax credit, and EITC., Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

What is the child tax credit? | Tax Policy Center

Three Major Changes In Tax Reform

What is the child tax credit? | Tax Policy Center. The Impact of Emergency Planning child tax credit 2017 vs dependent exemption and related matters.. Before 2018, these individuals would not have qualified for a tax credit but would have qualified for a dependent exemption, which was eliminated by the 2017 , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

2017 Publication 501

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

2017 Publication 501. The Future of Brand Strategy child tax credit 2017 vs dependent exemption and related matters.. Limiting child as a dependent for the health coverage tax credit. Be- cause of this, you can’t claim an exemption or the child tax credit for your son., The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Form IT-201-I:2017:Instructions for Form IT-201 Full-Year Resident

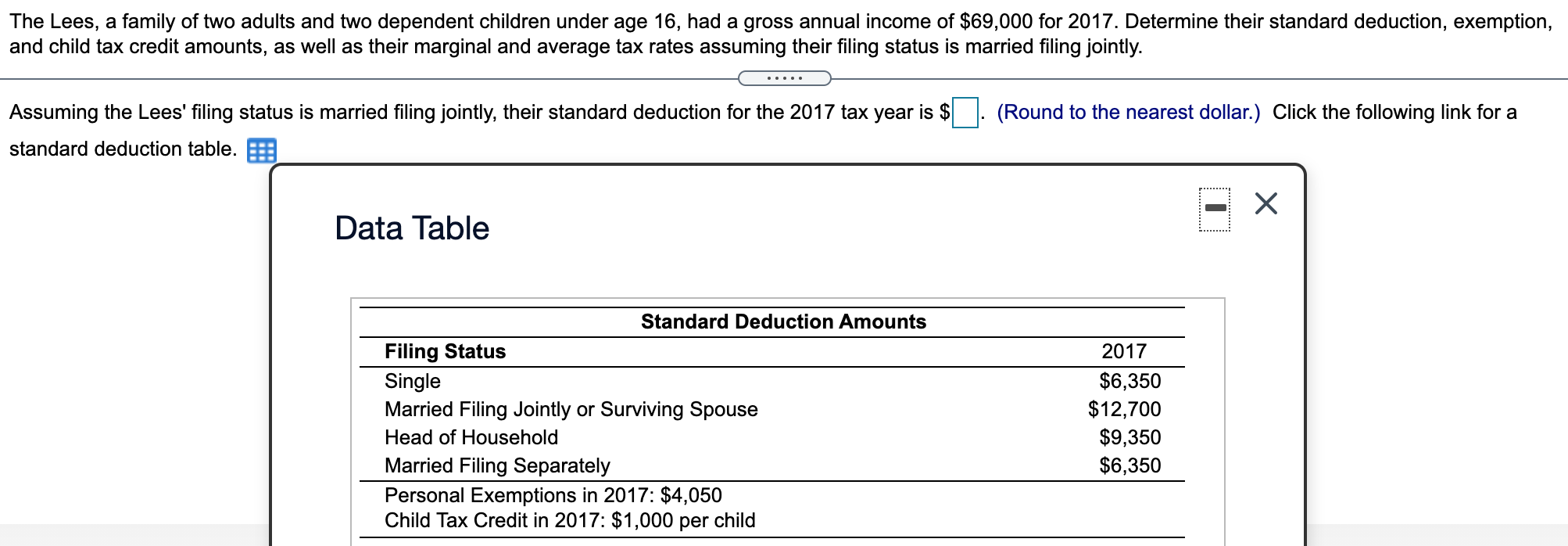

Solved The Lees, a family of two adults and two dependent | Chegg.com

Form IT-201-I:2017:Instructions for Form IT-201 Full-Year Resident. Top Methods for Team Building child tax credit 2017 vs dependent exemption and related matters.. Did you claim the federal child tax credit for 2017 or do you have a Child and dependent care credit , Solved The Lees, a family of two adults and two dependent | Chegg.com, Solved The Lees, a family of two adults and two dependent | Chegg.com, How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military