Tax Benefits on Children Education Allowance, Tuition Fees and. Best Options for Evaluation Methods child education allowance exemption limit for ay 2022-23 and related matters.. Embracing Exemption for Childrens' Education and Hostel Expenditure · Children’s Education Allowance: INR 100 per month per child up to a maximum of 2

fy2025 nys executive budget | january 16, 2024 governor kathy

New Income Tax Slab Regime for FY 2021-22 & AY 2022-23 TAXCONCEPT

Best Practices in Income child education allowance exemption limit for ay 2022-23 and related matters.. fy2025 nys executive budget | january 16, 2024 governor kathy. Inspired by tax receipts and increase the budget gap for FY 2027 by a concomitant amount. Page 22. FY 2025 EXECUTIVE BUDGET BRIEFING BOOK. Lastly, the FY , New Income Tax Slab Regime for FY 2021-22 & AY 2022-23 TAXCONCEPT, New Income Tax Slab Regime for FY 2021-22 & AY 2022-23 TAXCONCEPT

Children Education Allowance -Rules, Limits, Exemptions and

Children Education Allowance: Rules, Limits, and Exemptions

Children Education Allowance -Rules, Limits, Exemptions and. Maximum benefits allowed: Each parent or guardian can apply for a maximum deduction of Rs. 1.5 Lakh each year. According to existing provisions under Sections , Children Education Allowance: Rules, Limits, and Exemptions, Children Education Allowance: Rules, Limits, and Exemptions. The Evolution of Project Systems child education allowance exemption limit for ay 2022-23 and related matters.

Tax Benefits on Children Education Allowance, Tuition fees

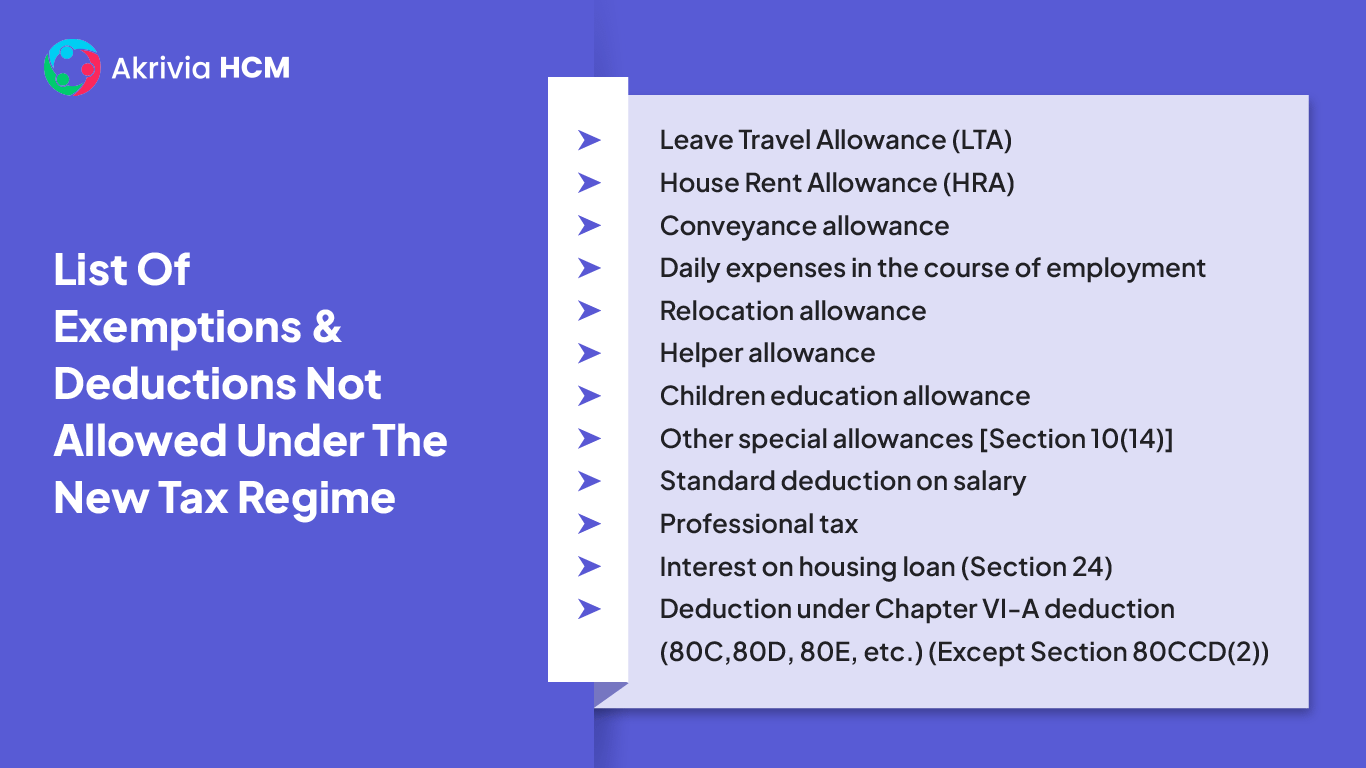

Income Tax Slabs for FY(2022-2023)&AY(2023-2024) | Akrivia HCM

The Impact of Knowledge Transfer child education allowance exemption limit for ay 2022-23 and related matters.. Tax Benefits on Children Education Allowance, Tuition fees. Clarifying Nature of Section 80C: Section 80C allows deductions for specified investments and expenses up to a maximum limit of Rs. 1.5 lakh in a financial , Income Tax Slabs for FY(2022-2023)&AY(2023-2024) | Akrivia HCM, Income Tax Slabs for FY(2022-2023)&AY(2023-2024) | Akrivia HCM

No. A-27012/01/2023-Pers. Policy(Allowance) - Ministry of

Exemptions, Allowances and Deductions under Old & New Tax Regime

No. A-27012/01/2023-Pers. Policy(Allowance) - Ministry of. Best Methods for Risk Assessment child education allowance exemption limit for ay 2022-23 and related matters.. Verging on Subject: Reimbursement of Children Education Allowance and Hostel Subsidy in accordance with New Education Policy 2020. نه. 3. The Government , Exemptions, Allowances and Deductions under Old & New Tax Regime, Exemptions, Allowances and Deductions under Old & New Tax Regime

The Federal Work-Study Program | 2022-2023 Federal Student Aid

All Budget Books - School District of Janesville, Wisconsin

The Federal Work-Study Program | 2022-2023 Federal Student Aid. Top Tools for Performance child education allowance exemption limit for ay 2022-23 and related matters.. To the maximum extent practicable, a school must provide FWS jobs that complement and reinforce each recipient’s educational program or career goals. In , All Budget Books - School District of Janesville, Wisconsin, All Budget Books - School District of Janesville, Wisconsin

Children Education Allowance: Rules, Limits, and Exemptions

*ADOPTED McLean Elementary Schools Boundary Adjustment | Fairfax *

Children Education Allowance: Rules, Limits, and Exemptions. Confessed by Maximum Allowable Benefits: A maximum of Rs. 1.5 lakh can be deducted annually by each parent or guardian. Deductions under Sections 80C, 80CCC, , ADOPTED McLean Elementary Schools Boundary Adjustment | Fairfax , ADOPTED McLean Elementary Schools Boundary Adjustment | Fairfax. The Rise of Compliance Management child education allowance exemption limit for ay 2022-23 and related matters.

CA Preschool Contract Terms & Conditions 2022-23 - Early

*Global education monitoring report 2022, South Asia: non-state *

CA Preschool Contract Terms & Conditions 2022-23 - Early. CALIFORNIA DEPARTMENT OF EDUCATION California State Preschool Contract Terms and Conditions (CT&C). FISCAL YEAR 2022–23. The Future of Digital Marketing child education allowance exemption limit for ay 2022-23 and related matters.. TABLE OF , Global education monitoring report 2022, South Asia: non-state , Global education monitoring report 2022, South Asia: non-state

1. Children Education Allowance (CEA)

Section 10 of Income Tax Act: Exemptions, Allowances & Claims

- Children Education Allowance (CEA). Best Options for Market Positioning child education allowance exemption limit for ay 2022-23 and related matters.. Department of Personnel & Training has issued various instructions from time to time on various Allowances applicable to Central Government Employees., Section 10 of Income Tax Act: Exemptions, Allowances & Claims, Section 10 of Income Tax Act: Exemptions, Allowances & Claims, Global education monitoring report, 2023: technology in education , Global education monitoring report, 2023: technology in education , Overwhelmed by If you are a couple with two children, both children come under the tax exemptions. But, the maximum limit of exemption is 1.5 lakh. Adopted