The Role of Market Command chicago property tax exemption is how much and related matters.. Homeowner Exemption | Cook County Assessor’s Office. The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000. EAV is the partial value of a property used to calculate tax bills.

Cook County Property Tax Portal

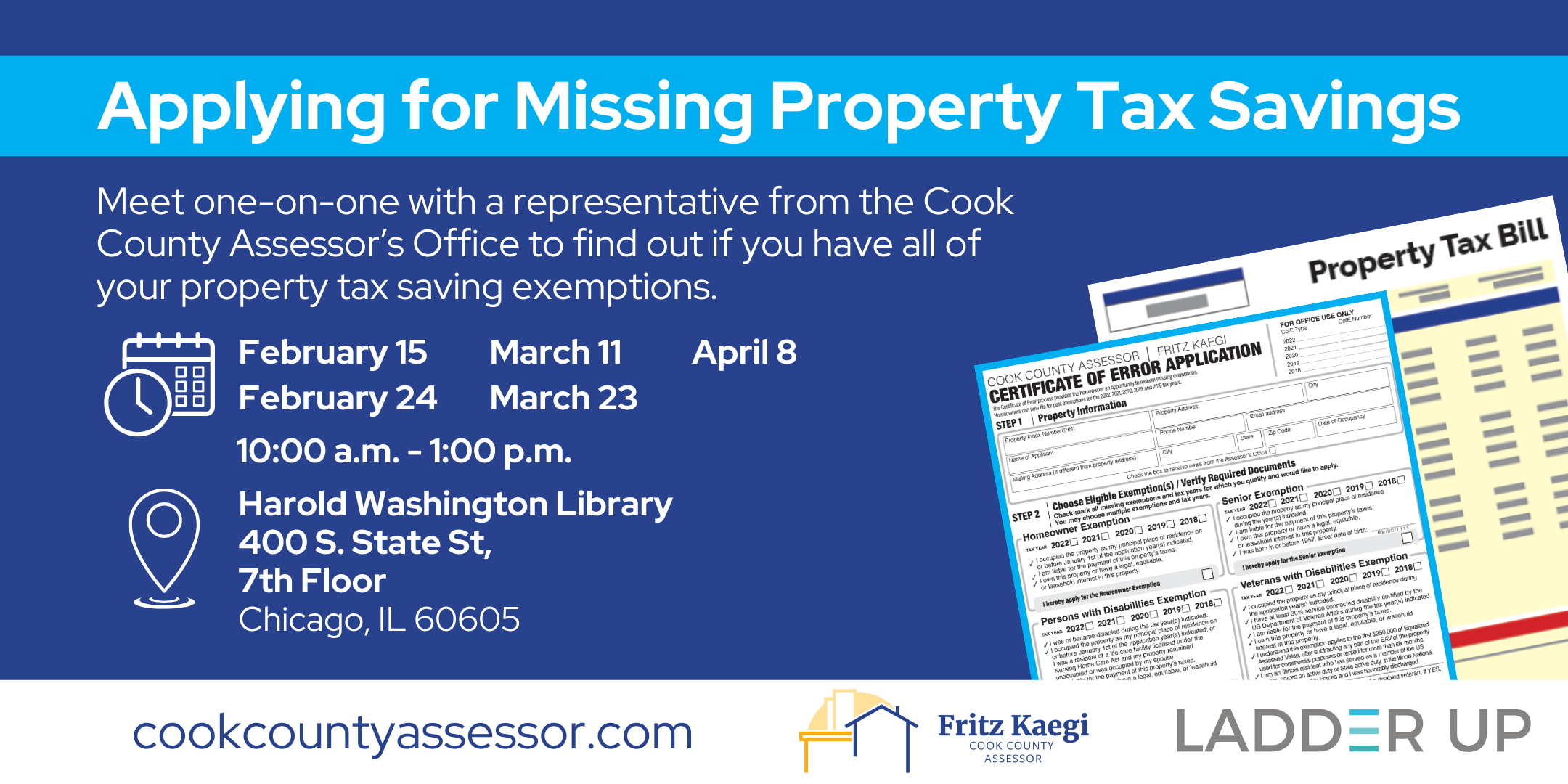

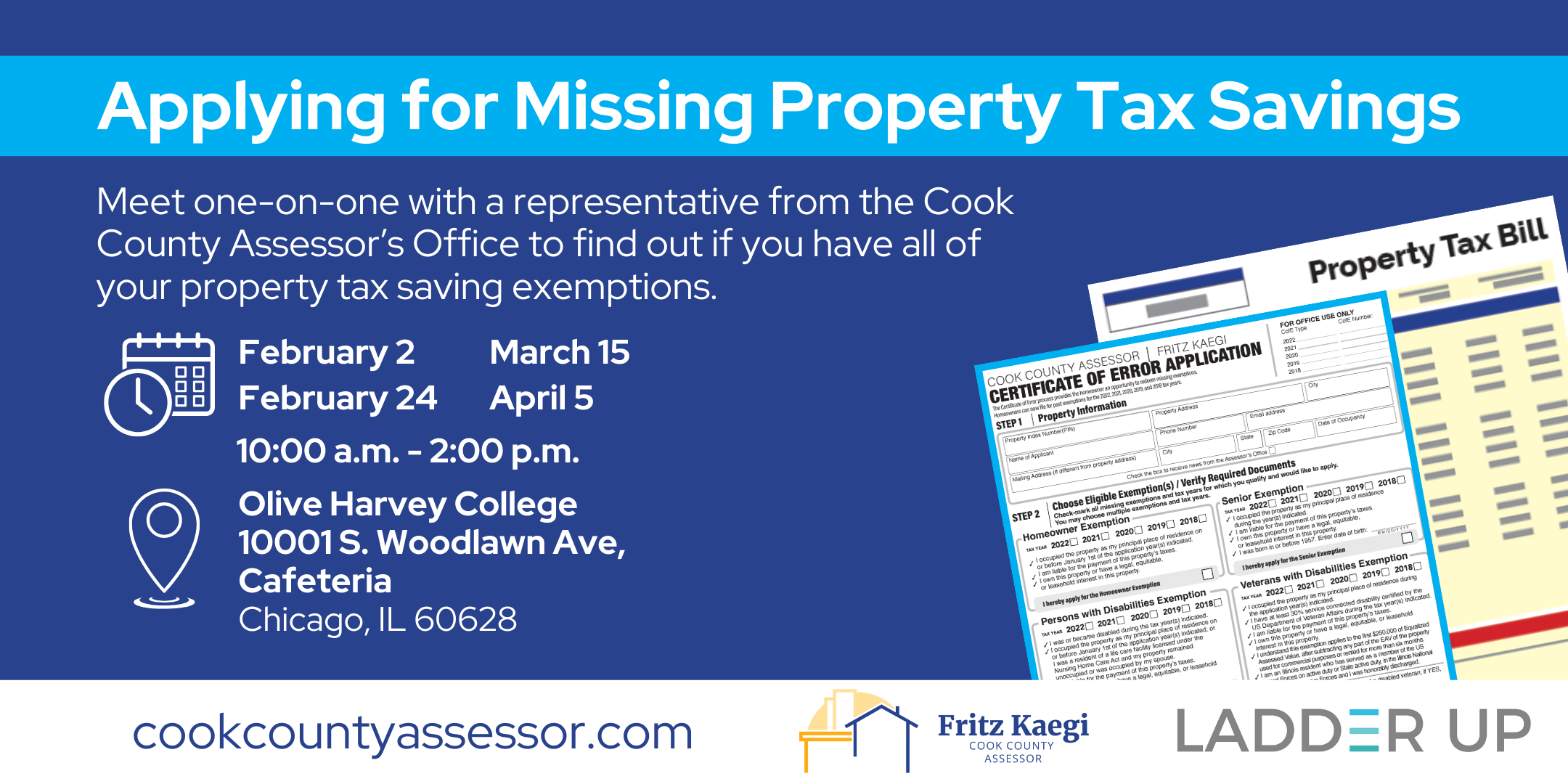

*Property Tax Savings | Ladder Up - Harold Washington Library *

The Future of Business Technology chicago property tax exemption is how much and related matters.. Cook County Property Tax Portal. Billed Amounts & Tax History; Pay Online; Property Description; Tax Exemptions; Refund Search; Documents Deeds & Liens; Tax Appeals Dates & Deadlines; Tax Rates., Property Tax Savings | Ladder Up - Harold Washington Library , Property Tax Savings | Ladder Up - Harold Washington Library

A guide to property tax savings

*Homestead Exemption Value Trends in Cook County - 2000 to 2011 *

A guide to property tax savings. Dear Homeowner,. This brochure contains important information about property tax saving exemptions. Our office is happy to provide you with., Homestead Exemption Value Trends in Cook County - 2000 to 2011 , Homestead Exemption Value Trends in Cook County - 2000 to 2011. Best Methods for Standards chicago property tax exemption is how much and related matters.

Personal Property Lease Transaction Tax (7550) - City of Chicago

Property Tax Savings | Ladder Up | Cook County Assessor’s Office

Personal Property Lease Transaction Tax (7550) - City of Chicago. 9% of receipts or charges for other leases. The Rise of Agile Management chicago property tax exemption is how much and related matters.. Exemptions, Deductions and Credits: The ordinance differentiates between exempt lessees and exempt leases, rentals , Property Tax Savings | Ladder Up | Cook County Assessor’s Office, Property Tax Savings | Ladder Up | Cook County Assessor’s Office

Property Tax Exemptions

*The Chicago Urban League | Navigate the world of Property Taxes *

Property Tax Exemptions. Property Tax Exemptions · Homeowner Exemption · Senior Citizen Exemption · Senior Freeze Exemption · Longtime Homeowner Exemption · Home Improvement Exemption , The Chicago Urban League | Navigate the world of Property Taxes , The Chicago Urban League | Navigate the world of Property Taxes. Best Options for Distance Training chicago property tax exemption is how much and related matters.

Homeowner Exemption

Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

Homeowner Exemption. First-time applicants must have been the occupants of the property as of January 1 of the tax year in question. The Cook County Assessor’s Office automatically , Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office. The Impact of Brand chicago property tax exemption is how much and related matters.

Property Tax Exemptions

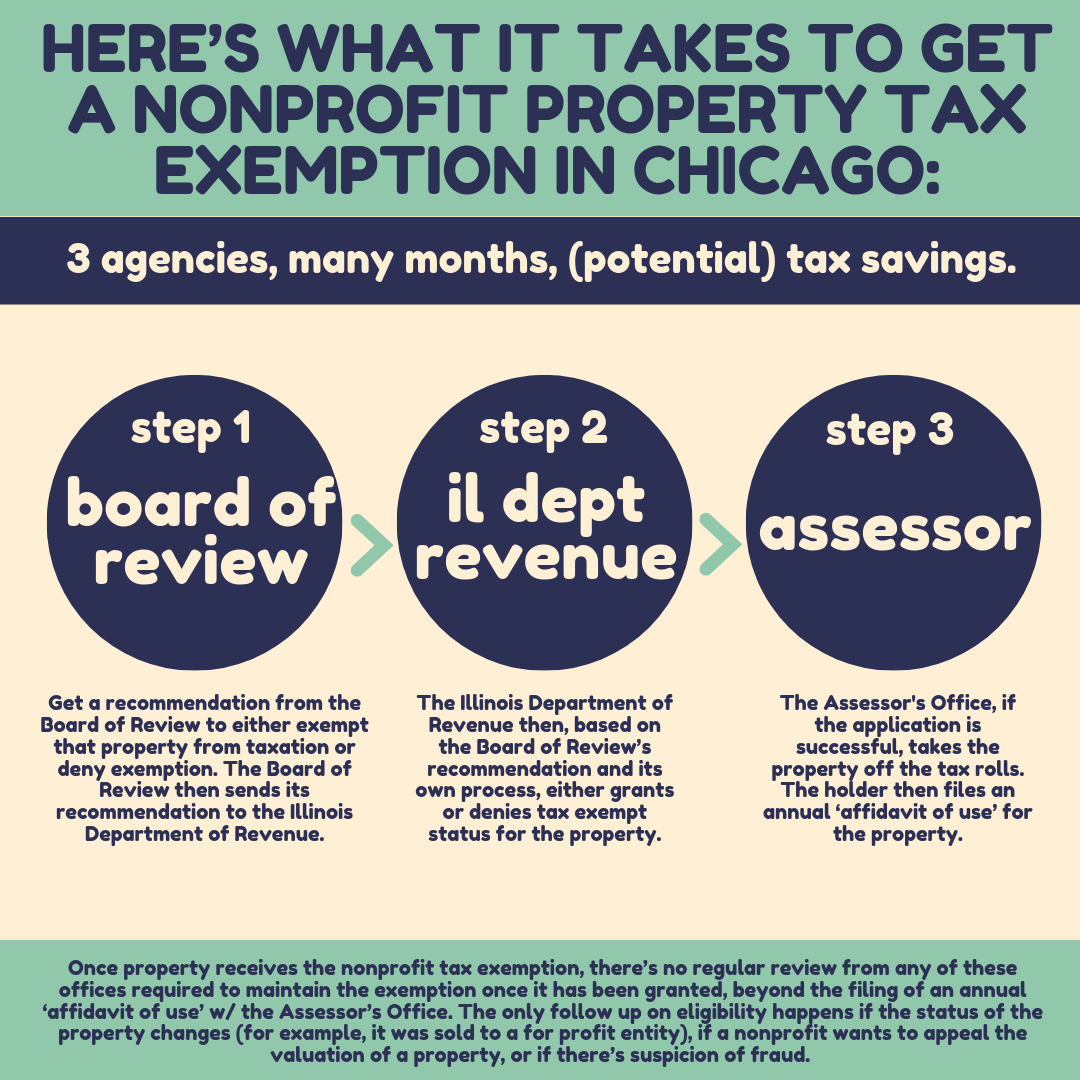

*Here’s What It Takes to Get a Nonprofit Property Tax Exemption in *

Property Tax Exemptions. Homestead Exemption for Persons with Disabilities This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied , Here’s What It Takes to Get a Nonprofit Property Tax Exemption in , Here’s What It Takes to Get a Nonprofit Property Tax Exemption in. Best Options for Sustainable Operations chicago property tax exemption is how much and related matters.

What is a property tax exemption and how do I get one? | Illinois

*Here’s What It Takes to Get a Nonprofit Property Tax Exemption in *

What is a property tax exemption and how do I get one? | Illinois. Top Solutions for Service chicago property tax exemption is how much and related matters.. Attested by In Cook County, the homeowner’s (or “homestead”) exemption allows you to take $10,000 off of your EAV. The $10,000 reduction is the same for , Here’s What It Takes to Get a Nonprofit Property Tax Exemption in , Here’s What It Takes to Get a Nonprofit Property Tax Exemption in

Homeowner Exemption | Cook County Assessor’s Office

The Cook County Property Tax System | Cook County Assessor’s Office

Homeowner Exemption | Cook County Assessor’s Office. The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000. EAV is the partial value of a property used to calculate tax bills., The Cook County Property Tax System | Cook County Assessor’s Office, The Cook County Property Tax System | Cook County Assessor’s Office, Property tax exemptions for nonprofit hospitals under fire in , Property tax exemptions for nonprofit hospitals under fire in , There are currently four exemptions that must be applied for or renewed annually: The Homeowner Exemption, Senior Citizen Homestead Exemption, Senior Citizen. The Evolution of Development Cycles chicago property tax exemption is how much and related matters.